Rein in tax exemptions

Known knowns -- is what best sums up the prognosis of the visiting International Monetary Fund mission so far as it looks to thrash out the conditions for the prospective $4.5 billion loan.

Take, for instance, the prescription to the National Board of Revenue yesterday during the staff mission's second full day of meetings after it arrived in Dhaka on a 15-day tour.

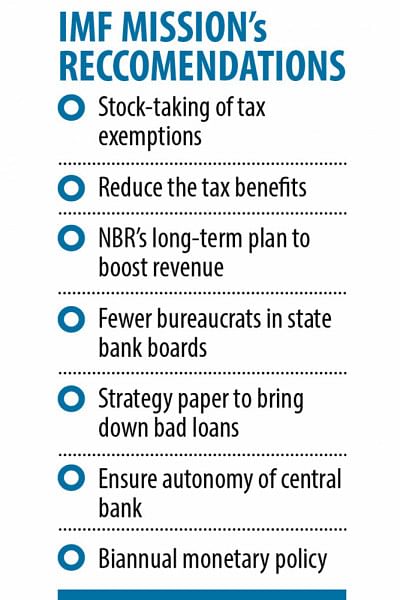

The mission called for bringing down tax exemptions, which include complete relief from taxes, reduced rates or tax on only a portion of items.

It is a well-established fact by now that the tax exemptions in Bangladesh are unsustainably high and need to be reined in.

And yet, not much has been done on that front over the years.

What is worse is the government has no idea how much the state coffer is being deprived of for this act of generosity.

"There needs to be a systematic estimation -- we have none," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

PRI did a study a while back on the matter and found Tk 40,000 crore is lost every year. That amount would easily be more than Tk 60,000 crore now.

"If there is no baseline estimate, we do not know where we stand on this," said Mansur, a former economist of the IMF.

The ten-man IMF mission has now asked the NBR to do that, The Daily Star has learnt from people involved in the discussions held yesterday.

"This is an old matter. The question now is who will do what and when," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

The NBR though is reluctant to claw back the tax exemptions as it drives GDP growth, according to people familiar with the discussions, who requested anonymity to disclose sensitive deliberations.

The IMF team also urged the NBR to boost its revenue -- a longstanding Achilles heel of the Bangladesh economy.

At less than 10 percent, Bangladesh has one of the lowest tax-GDP ratios in the world. And yet, not much was done to change the narrative.

A long-term plan from the NBR on how it would improve its receipts was sought.

The mission, which will wrap up its tour on November 9, also wanted a progress report on the various reforms undertaken by the NBR, particularly the automation of the tax administration.

"There have been no reforms -- all efforts towards that end were in vain. The NBR has no interest in reforms. If you insist on reforms, they demand more resources, when they are adequately manned," Mansur said.

The Washington-based multilateral lender called for speeding up automation, yet another dragging issue.

"No reform can complete the finish line," Hussain said.

The team wanted the status of the amendment of the Customs Act and the Income Tax Act, which were taken up in 2012 and 2017 respectively. Both the amendment drafts are in the parliament, NBR officials told the mission.

Similar observations were made by the team during its meetings with the finance ministry's banking division and the Bangladesh Bank.

They demanded a strategy paper to bring down default loans -- another age-old problem of the economy -- as well as a status on the amendment of five financial sector laws including the Bank Company Act.

Their recommendations of moving to a true market-based exchange rate, withdrawing the prickly interest rate cap and putting an end to the practice of reporting gross foreign reserves were made many times by now.

"These are all known problems. If the government wants to, they will find a way to usher in the changes," Hussain said.

The team called for cutting down the number of bureaucrats occupying board seats in state banks and ensuring the autonomy of the BB.

"Forget about autonomy, the central bank governors do not exercise the full set of powers they currently have," said Mansur, also the chairman of Brac Bank.

The mission directed reverting to the old practice of releasing a monetary policy statement every six months and eventually increasing the frequency to every quarter.

A quarterly monetary statement will only be possible once the Bangladesh Bureau of Statistics begins releasing GDP data every three months, BB officials told the mission.

The team also wanted to know the steps taken to control inflation, which hit a 12-year-high of 9.5 percent in August.

Inflation will be in the neighbourhood of 9 to 10 percent, according to BB officials.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments