Remittance keeps falling as hundi gains upper hand

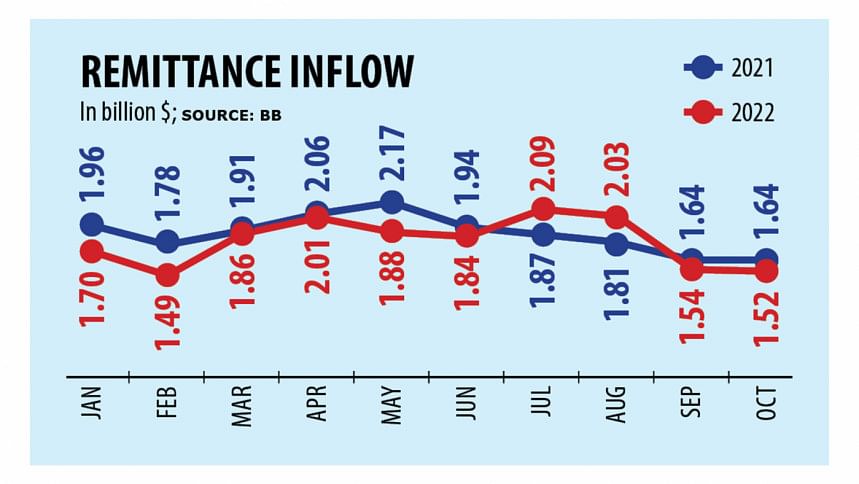

Despite a surge in the outflow of migrant workers, remittances to Bangladesh declined 7.4 per cent year-on-year to $1.52 billion in October, an unpromising development that may deepen the volatility in the economy.

Last month, the receipts of remittances – the money sent from citizens working abroad to families back home – were the lowest in eight months.

Experts blame the hundi cartel for the slide in remittance, saying the exchange rate gap between the formal and informal channels has encouraged remitters to send money through the cross-border illegal financial transaction system.

Last month, the commoners bought each dollar at Tk 112-Tk 113 from the kerb market, a largely unregulated platform where foreign exchanges are bought and sold. Beneficiaries of remittances might have received almost the same rate from the hundi cartel.

On the other hand, banks in Bangladesh pay Tk 107 to remittance recipients for each dollar.

October's receipts were also 1 per cent lower than in the preceding month.

Remittance dropped 2.03 per cent year-on-year to $7.19 billion in the first four months of the current fiscal year, data from the Bangladesh Bank showed yesterday.

The poor show in the remittance sector came despite 8.75 lakh migrant workers leaving the country for jobs in the first nine months of 2022. The figure was 6.17 lakh in 2021 and 2.17 lakh in 2020.

Zaidi Sattar, chairman of the Policy Research Institute of Bangladesh (PRI), said: "A record number of migrant workers have left the country for jobs abroad this year, so there is no scope for remittances to fall."

Besides, the majority of migrant workers are working in the Middle East, a region that is now witnessing vibrant economic activities riding on a boom in oil prices, he said.

"But the expatriates might have preferred the hundi channel to the formal transfer system for a better exchange rate."

Even before the pandemic and the latest volatility in the foreign exchange market, only 51 per cent of the remittances used to flow to Bangladesh through formal ways and the rest through hundi.

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), warns that the fall in remittance may deepen the ongoing instability in the foreign exchange market.

"This may create a vicious circle in the economy."

Falling remittances mean the country's foreign exchange reserves, which have been declining for several months owing to escalated import bills, may come under further strain.

The reserves stood at $35.85 billion on October 26, down more than 22 per cent in contrast to $46.49 billion a year earlier.

A further fall in reserves could force imports to fall, which will ultimately bring down exports since businesses rely on external sources for industrial raw materials to manufacture goods for international markets.

"The ongoing stress facing the economy will broaden if exports fall," said Fahmida.

October's export figure has not been published. In September, shipment slipped 6.25 per cent year-on-year, driven by the slowing orders for garments amid higher inflation and concerns of recession in the major destinations.

"The economic uncertainties may widen due to the decrease in remittances," said Ahsan H Mansur, executive director of the PRI.

Under such a situation, capital flight may receive a boost as both individuals and businesses will lose confidence in the economy and may move to other countries or relocate businesses, he said.

He suggested the government reduce the exchange rate gap between the formal and informal channels.

According to the former economist of the International Monetary Fund, if the government can secure credit support from the multilateral lenders, the local currency's fall against the US dollar may come to a stop.

"Otherwise, the taka will keep falling against the American greenback," Mansur said.

The exchange rate of the taka stood at Tk 104.34 against the dollar on October 31, down 22 per cent from a year earlier.

Mustafizur Rahman, a distinguished fellow at the CPD, urged the government to take initiatives to stop capital flight as it plays a key role in slowing down the flow of remittances.

As per the Bangladesh Financial Intelligence Unit, many businesses have avoided import duty through under-invoicing, which takes place when the price of a good on an invoice is less than the price paid.

"The vested quarter usually pays the cost of imported goods to foreign exporters with the help of the hundi cartel," Rahman said, urging the authorities to take strict measures against money launderers.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says banks are under pressure to some extent to clear import bills due to the downward trend of remittances.

He, however, hopes that the pressure may ease after three to four months as the opening of letters of credit (LCs) declined in the first quarter of the current fiscal year.

LC opening stood at $18.58 billion between July and September, down 8.6 per cent year-on-year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments