IMF’s $4.5b loan coming

The government yesterday reached a preliminary agreement with the International Monetary Fund over a $4.5 billion loan programme, putting to bed all suspense on whether a deal would be struck with the multilateral lender at all.

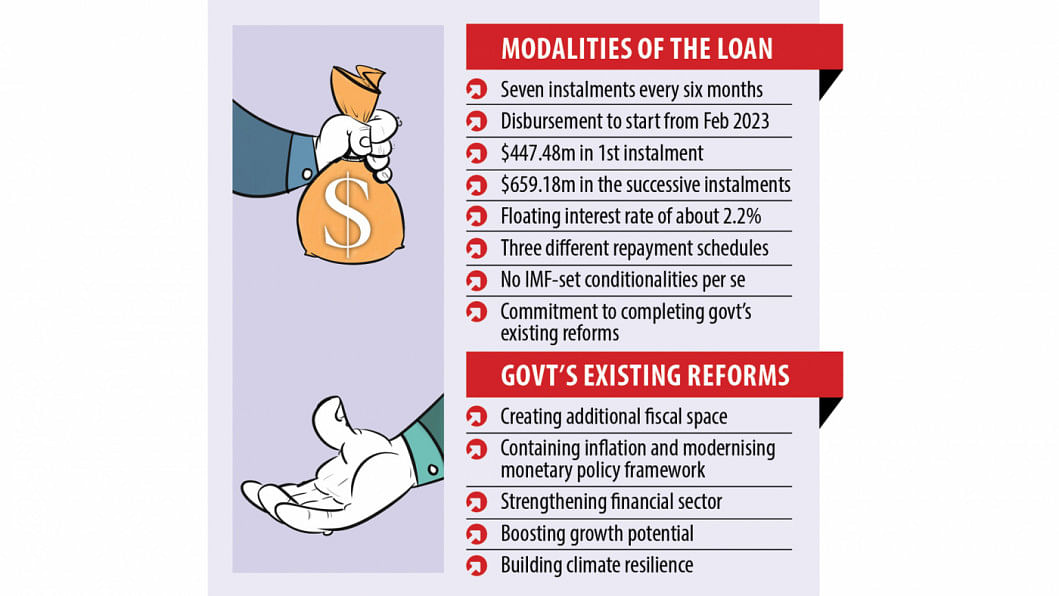

The amount would be disbursed over a 42-month period, with the first instalment expected in February next year, Finance Minister AHM Mustafa Kamal told reporters after wrapping up his engagements with the visiting IMF staff mission.

The first instalment would be $447.8 million, followed by six equal instalments of $659.18 million.

The interest rate would be about 2.2 percent. Of the $4.5 billion, $1.3 billion can be repaid over a 20-year horizon with a grace period of ten years. The remaining amount must be paid back within ten years; the grace period for a portion of the sum is 3.5 years and for another portion 5.5 years.

This would be Bangladesh's 13th loan from the Washington-based multilateral lender, with the last package taken in 2012.

In exchange for its loan, the IMF typically insists governments do what they find most difficult: reduce public spending, raise taxes and implement reforms designed to lower their debt-to-GDP ratios, such as cutting subsidies for fuel or food.

But Bangladesh is fortunate: this time, the IMF mission did not come to Dhaka with a reform plan; rather, it wants to make sure that the government executes its own existing reform agenda.

"We got what we wanted -- we are getting the loan at terms that we wanted," Kamal said, adding that the loan programme holds greater value than its monetary amount.

This fiscal year alone, the Bangladesh Bank has supplied more than $4.5 billion to the market to support the exchange rate, while the import bill averages $6 billion a month, so the loan amount, which would come over a three-year period, would not ease the pressure on the foreign exchange reserves.

Creditors -- whether commercial banks or foreign governments -- often consider a prior arrangement with the IMF as a sign of a country's creditworthiness.

"We are using the IMF. If IMF, after duly completing the audit of the books and accounts of the country, says Bangladesh is doing fine, nobody else will say no to us," Kamal said.

The agreed loan programme will now need to be approved by the IMF's top management and the executive board, which is expected in the coming weeks.

"This was the need of the hour," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

He went on to express hope that the programme would have sufficient core elements of reforms and that the government will implement those "sincerely, forcefully and timely".

"This is a programme of the authorities -- the authorities own the programme and the IMF is supporting the authorities as its trusted advisor," said Rahul Anand, who led the ten-member IMF mission, in a press briefing yesterday.

The IMF though did not articulate the specifics of the programme.

Kamal said reforms include raising the tax-GDP ratio, implementing the VAT law and setting up an asset management company to dispose of soured loans.

Bringing down the banking sector's default loans to within 10 percent and raising the capital adequacy ratio to the BASEL 3 requirement of 12.5 percent, periodically adjusting the fuel price, implementing the climate-related proposals made in the budget and on various international conferences and increasing remittance receipts through the formal channels are also on the task list, according to BB Governor Abdur Rouf Talukder.

Increasing social spending and better targeted social safety net programmes, increased exchange rate flexibility, developing the capital and bond market, expanding and diversifying exports and modernising the monetary policy framework are the other agreed reforms.

Withdrawing the interest rate cap or cutting back on fertiliser subsidy and tax exemption were off the table, Kamal said.

The reforms will shore up the foreign currency reserves in the short-term and create the fiscal space for higher social spending and mitigating the effects of climate change in the medium- to long-term.

The immediate task at hand is to stabilise the macroeconomic situation by rebuilding the reserve buffer, Anand said.

"During the pandemic, reserves went up to $48 million but that was a one-off. Exports rebounded very quickly because of the stimulus package but also trade diversion from China, Vietnam and Myanmar, while imports were very low. That led to an artificial build-up of reserves."

Imports started to pick up as the economy rebounded, but then the war happened and the commodity prices went up considerably.

This started depleting the reserves fast.

The import bills are expected to stay high and the balance of payment to remain under pressure.

As of November 2, net foreign currency reserves stand at about $27.7 billion -- which is enough for three-and-a-half months' import bills.

"Whether three months' reserves are high or low is difficult to say in the current situation because the global economy is in such turmoil. There is so much uncertainty -- nobody knows how this war will play out and what would be the spill-over effects."

More reserves are needed going forward and the IMF programme will catalyse additional financing from other developmental and bilateral partners, which will prop up the dollar stockpile.

Anand dismissed any concerns of Bangladesh heading the way of Sri Lanka.

"We don't expect Bangladesh's debt will suddenly become unsustainable -- it is a slow-moving target. With fiscally prudent policies, fiscal deficits have always been kept in check. And that has led to debt sustainability."

Asked if the IMF has factored in the forthcoming national elections in its decision-making, Anand said: "We have no such concerns. Bangladesh has never defaulted and the election cycle will not change anything on this front."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments