Tax calculation: know your numbers

Today, Abdul Karim will complete the second part of the first page of the tax return form.

The headline of this part is "statement of income during the income year ended on 30/06/2022". He is filing returns for the income year July 1, 2021, to June 30, 2022.

Today, he will require two figures: one is taxable income under salaries and another is tax leviable amount, which shall be written in serial 1 and 5 respectively. He is ready with a blank page and a calculator to get these two numbers.

He is very careful now because he knows if there are any mistakes then his taxable income calculation will be wrong. Based on the salary breakdown in the first step, he is going to start the calculations.

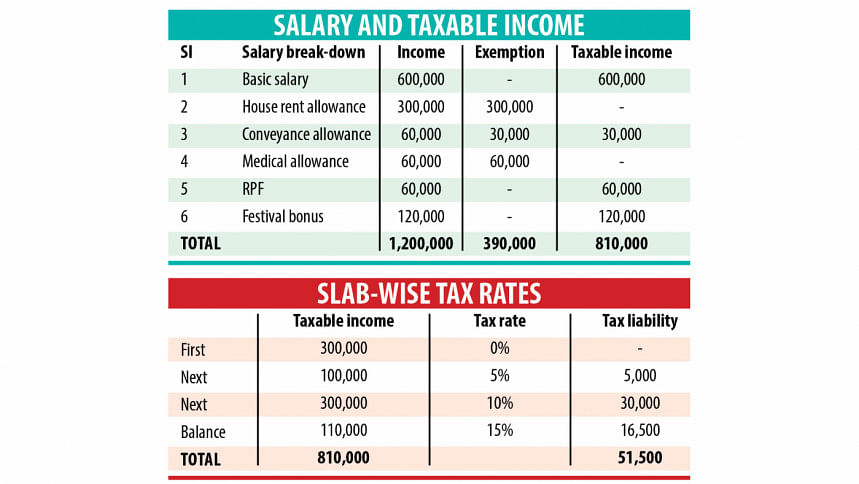

First, he writes the full basic salary as his taxable income by multiplying it by 12 months as he is getting salary on a monthly basis. So, his total taxable income is Tk 600,000 (Tk 50,000X12 months). There is no exemption for basic salary. So, he writes the total amount.

The monthly house rent allowance of Tk 25,000 or 50 per cent of basic salary or whichever is lower, shall be exempted as per tax rules.

Abdul Karim is receiving Tk 25,000 per month from his company which is 50 per cent of his basic salary. The amount is also equivalent to Tk 25,000. So, he got the full exemption. So, no amount shall be included with taxable income.

An annual conveyance bill of Tk 30,000 exempted. He is receiving Tk 60,000 over the 12 months (Tk 5,000X12 months). So, his taxable income shall be Tk 30,000 after deducting the exempted amount.

According to tax rules, 10 per cent of the basic salary, or yearly Tk 120,000, whichever is lower, shall be excluded. A 10 per cent of the basic salary is Tk 60,000 which is the lower amount. He is receiving the same amount. So, he is getting the full exemption.

In addition to the salary income, his company is contributing monthly Tk 5,000 to the Recognised Provident Fund. The total amount for 12 months was Tk 60,000 and it shall be included as taxable income. And two festival bonuses equivalent to a monthly basic salary each, Tk 120,000 (Tk 60,000X2) shall also be included with taxable income. No exemption for these two incomes.

Karim earned a total of Tk 12 lakh. Out of this income, he gets an exemption of Tk 3.90 lakh. Finally, his taxable income is Tk 8.10 lakh on which he has to pay tax and it shall be written in serial 01. If this taxable income was below Tk 3 lakh then he shall not be eligible to pay any tax.

Now he will calculate the tax liability. His total tax liability comes at Tk 51,500, which shall be written in serial 5. Is it big?

No worries, in the third step, he will learn how to minimise this tax and maximise wealth!

The author is lead consultant of Taxpert, an online tax training centre.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments