What modern states can learn from Ancient Rome

"Those who cannot remember the past are condemned to repeat it." – George Santayana, The Life of Reason

Many economists today believe we are committing one of the biggest economic blunders, which has brought ruin to countless past societies. Since 1971, when the world moved to a pure fiat money standard for the first time in recent history, many central banks around the world have been printing money at a faster and faster rate. This practice has been put on steroids since the 2008 financial crisis, particularly in more advanced countries such as the US and its allies; needless to say, the global impact of greater numbers of US dollars being printed is obviously more profound, given its status as the world reserve currency.

A sustained increase in the money supply of a country, when it is not commensurate with other fundamental economic factors, always leads to monetary inflation. In his book, "Immoderate Greatness: Why Civilisations fail," American political scientist and author Patrick Ophuls wrote: "No matter how modest or benign it may seem at first, an inflationary policy is… always [fatal] in the long run. It has been tried many times and has always failed. It does not solve the problems of the society; it aggravates them and leads inexorably on toward self-destruction."

If we go back in time and look at the history of the Roman Empire, after its defeat at the hands of the Germans in 9 AD, Emperor Augustus decided to end the Roman expansion policy, which put a dent in its supply of foreign wealth acquired from conquering new lands. Augustus and the emperors who followed thus faced the problem of insufficient revenues. Taxes could only be increased upto a certain point before it angered the masses. "To counter this problem, Nero began in 64 AD a policy that subsequent emperors found increasingly irresistible," writes American historian Joseph Tainter in his book, "The collapse of complex societies."

This policy involved debasing the value of the standard Roman silver coin by mixing it with cheap metals such as copper and reducing the size of gold and silver coins. The surplus precious metal obtained was then used to create more coins, which it used to cover its debts and expenses, and fill the pockets of statesmen and political insiders.

By the year 280 AD, the Roman denarius was debased of 50 percent of its original silver content, and the rising prices that followed became impossible to ignore. "By the latter part of the third century, the currency was so worthless that the State resorted to forced labour," as well as collecting "its taxes in the form of supplies directly usable by the military and other branches of government, or in bullion to avoid having to accept its own worthless coins," writes Tainter.

Between 235-284 AD, the breakdown of the social order of ancient Rome due to high inflation became increasingly evident as groups of military deserters whom the state was unable to pay roamed the countryside, pillaging small towns and farms. The average reign for an emperor came down to a few months, civil wars became common, the population declined and lawlessness prevailed.

In the first half of the 4th century, hyper-inflation kicked in due to the state's protracted inflationary policy. As Tainter writes, "In the second century a modius of wheat, during normal times, had sold for 1/2 denarius… the same modius of wheat sold in 335 AD for over 6,000 denarii, and in 338 for over 10,000." Whatever savings ordinary people held in denarii were practically wiped out. By the 5th century, the peasantry was decimated from prolonged predation, so much so that they became "apathetic about the dissolution of Roman rule," as "the empire could no longer afford the problem of its own existence."

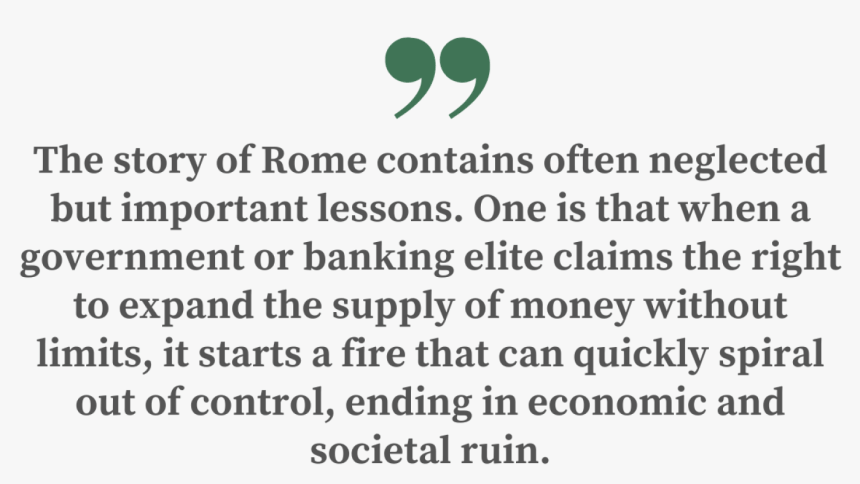

The story of Rome contains often neglected but important lessons. One is that when a government or banking elite claims the right to expand the supply of money without limits, it starts a fire that can quickly spiral out of control, ending in economic and societal ruin. Hence why, for more than 2,000 years, we have seen every fiat currency whose supply became unrestrained lose their value (or go extinct) and states ultimately returning to the gold standard (where a country's currency has a value directly linked to gold).

While many developed countries seem to have forgotten this lesson and gotten away with such policies up until now, it is clear that not all economies can afford the same because not all of them are on the same footing. That is why it is particularly concerning that in a time of elevated inflation, the Bangladesh government has started to borrow heavily from the Bangladesh Bank to meet its budget deficit. Between July 1 and November 3 this year, the government borrowed Tk 28,378 crore from the central bank, according to the bank's data. Whereas, in all of the last fiscal year, it borrowed Tk 31,403 crore from the bank.

According to Ahsan Mansur, executive director of the Policy Research Institute, "Borrowing from the central bank means printed money is being injected into the market," which will further fuel inflation. This form of money can multiply as much as five times in Bangladesh through fractional reserve banking, a system in which only a fraction of bank deposits is backed by actual cash on hand and available for withdrawal. So, the Tk 28,378 crore borrowed by the government may end up being Tk 141,890 crore eventually.

Historically, we have seen government elites, particularly the more corrupt ones, lose control once they started the practice of printing more money, until such a policy ruined the state's economy. As the famous economist Ludwig von Mises wrote, "Just as when you start to use certain drugs you don't know when to stop nor how to stop, it is the same with [inflationary monetary policy], the governments don't know when nor how to stop." That is why, during these challenging times, it is so important for us to "remember the past", so that we too are not "condemned to repeat it."

Eresh Omar Jamal is an assistant editor at The Daily Star. His Twitter handle is: @EreshOmarJamal

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments