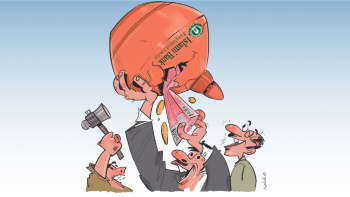

The never-ending crisis in our banking sector

A few weeks ago, we woke up to the news of yet another case of irregular lending activity. According to news reports, a powerful business group took out loans of Tk 30,000 crore from the Islami Bank Bangladesh Limited (IBBL), which the group owns. The amount of loans given to the group violates a single borrower's exposure limit. This happened amid the financial challenges the country has already been grappling with. Over the past decade, our banking sector has faced loan frauds by many business groups and individuals who misappropriated thousands of crores of taka from banks, such as BASIC Bank, Sonali Bank, Janata Bank, and Farmers Bank. That money is yet to be recovered, may never be recovered, and has probably been laundered out of the country.

Unfortunately, such lending irregularities are not unknown to the authorities. Such a huge volume of loans cannot be decided and disbursed by any credit officer of a bank without directives from the high authority. Loans are granted to the so-called business groups and individuals bypassing rules and regulations and under the instructions of powerful people. Since there is no accountability for loan defaulters and their fraudulent activities, honest borrowers are demoralised and frustrated. Undue privileges are for large borrowers only. Small borrowers such as farmers are put in jail for defaulting on only a Tk 25,000 loan.

Small borrowers also face many hurdles to receive bank loans. Poor disbursement of loans under stimulus packages during the pandemic to small and powerless enterprises is testament to banks' unwillingness to give loans to them. But they cannot take any measure against large unlawful lending as those borrowers are either owners of said banks or have strong backing. Thus, our banking sector has set examples of monopolisation that has resulted in deterioration in the sector's governance. It has also created crony capitalism where banks are used for extraction.

Bangladesh Bank, which is supposed to oversee the governance of the country's financial institutions, has rather supported these irregular activities through its policies and actions. For example, an observer was appointed in 2010 for IBBL to monitor any loan irregularities. In 2020, the observer was withdrawn by the central bank, without any explanation.

There have also been serious policy amendments by the Bangladesh Bank to favour certain groups and individuals. Amendment to the provisions of the Bank Company Act, 1991 is a major regressive and harmful step. Through the Bank Company (Amendment) Act, 2018, the tenure of private bank directors was increased from six years to nine years. and the number of members of the same family in a private bank's board was increased from two to four.

One may recall that, before the 2018 election, the present ruling party made several pledges towards improving the economic discipline in the country, including the banking and financial sector. One of the pledges was, "Bank frauds including loan defaulters will be subdued and all the involved bank officials, loan receivers and culprits will be brought to trial and punished."

How much the ruling party has been successful in fulfilling its pledge is evident from the existing fragile banking sector that is saddled with scams and irregularities. These incidents indicate an inertia of the authorities to fix the problem and bring discipline to the sector. The increasing trend of defaulted loans and continued embezzlement of bank funds don't indicate any urgency on the government's part to address the problem. To put things into perspective, as per the Bangladesh Bank's annual reports, in 2009, the amount of non-performing loans (NPL) in our banking sector was Tk 22,480 crore; that amount swelled to Tk 93,911 crore in 2018 and to Tk 134,396 crore as of September 2022. The actual amount of NPLs could be much more if the amounts of write-offs, money stuck in Money Loan Court and rescheduling of special mention accounts are taken into consideration.

Unfortunately, governments in Bangladesh have always shied away from reforms of the financial sector. The sector showed better performance in the past due to some reforms. In the 1980s, the government started the liberalisation process through denationalising the nationalised commercial banks. The reform process continued during the 1990s and the 2000s. Ironically, these reforms happened under the directions of the World Bank and the IMF, not spontaneously initiated by the government.

Additionally, the National Commission on Money, Banking and Credit was constituted in 1984. A banking commission was set up in 1996 and a banking reform committee was formed in 2002. Following this, the Central Bank Strengthening Project was implemented in 2003 to have a strong and effective banking regulatory and supervisory system. The Bangladesh Bank (Amendment) Act, 2003 was passed in parliament, through which the central bank received autonomy to operate on its own. Sadly, it has lost its independence and become weakened day by day, despite such a mandate.

The practice of the government coming forward to rescue not only the state-owned banks but the private commercial banks, too, encouraged other banks to care less about their governance and performance. To improve the balance sheet of the weak state-owned banks, the government provided generous support. However, such recapitalisation has not improved their health. The NPL rate in state-owned banks is more than double the banking sector's average NPL rate. The government also came forward to rescue troubled private banks by extending flexibilities and support without any visible success.

The Centre for Policy Dialogue (CPD) has been urging for forming a banking commission for at least a decade now. CPD spelt out that the objective of this banking commission should be critically assessing the overall situation of the sector, establishing transparency regarding data and information on the sector, detecting root causes of the problem and possible future challenges, identifying groups and institutions responsible for crises in the sector, and making meaningful and specific suggestions on administrative, regulatory, and structural reforms for the short and medium terms. The duration of the commission will be time-bound.

The current finance minister also mentioned reform in the banking sector during his budget speech for FY 2019-20, saying he would examine the possibility of forming a banking commission. This promise is yet to be fulfilled. Indeed, there is a serious lack of political commitment in reforming our financial sector. Until that is done, governance in Bangladesh's financial sector will remain a far cry.

Dr Fahmida Khatun is executive director at the Centre for Policy Dialogue (CPD). Views expressed in this article are the author's own.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments