Walton’s earnings dip amid inflation, increased cost of dollar

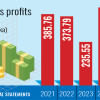

Walton Hi-Tech Industries PLs, the country's largest consumer electronics manufacturer, recorded a massive slump in its earnings in the October-December quarter, worsening overall profitability in the first half of the financial year 2022-23.

The company said its earnings declined to Tk 2 per share in October-December, down 63 per cent from Tk 5.45 in the same period a year ago.

With the second quarter earnings, Walton's net profit in the July-December period fell to Tk 0.47 per share from Tk 14.73 in the first half of 2021-22, said the electronics and home appliance maker in a filing on the Dhaka Stock Exchange (DSE).

Shares of Walton remained unchanged at Tk 1047.70 at 11:50 am.

The company blamed the Russia-Ukraine war, higher inflation, and tightening of the global financing conditions for the drop in its earnings per share.

Besides, the price hike of raw materials and freight cost, vulnerable global market conditions and the devaluation of Bangladesh's currency against foreign currencies as a post-pandemic effect increased the material cost drastically, which brought down overall profitability, said Walton.

In addition, VAT has been imposed on the supply of refrigerator products.

The net operating cash flow per share (NOCFPS) surged to Tk 61.07 in July-December of FY23 against a negative Tk 16.78 in the first half of FY22.

The NOCFPS increased significantly due to control over inventories, improvement of receivables, and close monitoring and control over expenses and utilisation of resources, said Walton.

In addition, payments to suppliers and others decreased in a similar way from its working capital which contributed to achieving a healthy NOCFPS, it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments