Spike in funding costs to hurt banks’ profitability

Weak banks in Bangladesh with small holdings of government securities, which are used to mobilise funds either from the central bank or peers, may become more vulnerable in the days to come, Moody's Investors Service warned yesterday.

"In the worst-case scenario, they could require extraordinary support from the BB to fulfill their obligations, which would shatter customer confidence and lead to deposit losses, further worsening their liquidity stress in a vicious cycle," the global credit ratings agency said in a report.

The lenders will be forced to slow lending, it said.

The warning from Moody's came at a time when banks in Bangladesh are facing tight liquidity conditions after a spike in imports and declines in remittance inflows significantly tightened the US dollar supply, while high inflation is hindering deposit inflows.

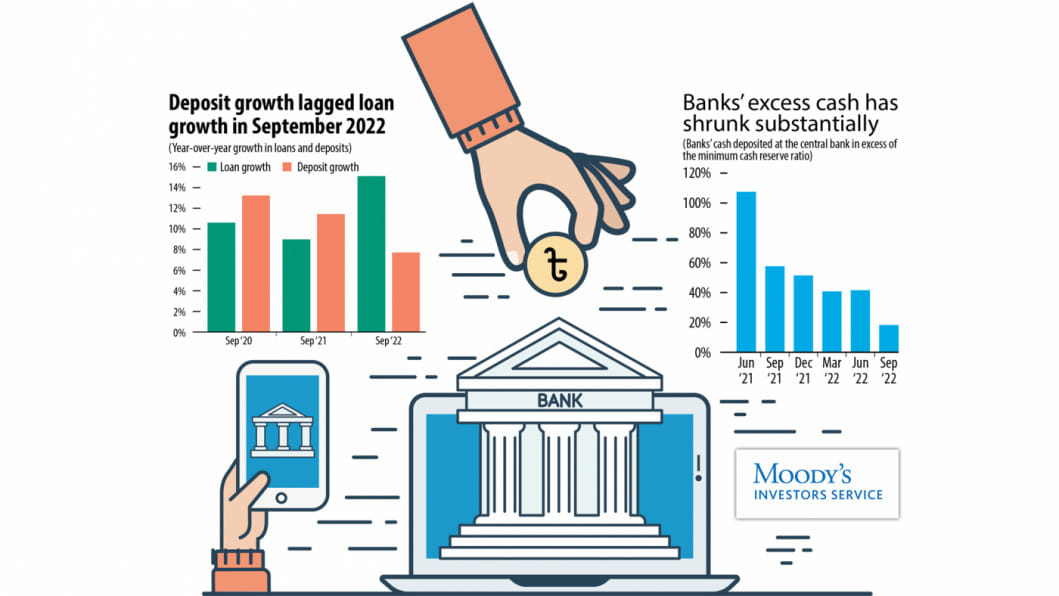

In fact, liquidity in the banking system began to tighten in June 2021 after banks were forced to buy more US dollars to plug a shortfall of the American greenback that resulted from a jump in demand for letters of credit among importers. As a result, banks' excess cash deposited at the central bank has decreased substantially since June 2021.

Banks usually buy treasury bills and bonds from the government. They keep the securities as collateral when they borrow funds from their peers and the central bank.

Banks that hold sufficient government securities as well as those that have stable funding sources will be able to withstand the ongoing liquidity stress.

To plug liquidity shortfalls, banks can borrow from the interbank market or use the central bank's repurchase agreement (repo) facility. But the costs of such funding have increased materially, which will pressure the profitability of banks, said Moody's.

The report highlighted the recent vulnerability in Bangladesh's banking sector.

A slower-than-expected flow of remittances, the cheapest source of US dollars for Bangladesh, has become a headache for the banking sector.

Inflows of remittances through banks decreased by 15 per cent in the fourth quarter of 2022 from the preceding three months because exchange rates offered by illegal or unregistered establishments were more favourable to senders.

Banks previously were able to offer competitive rates but their prices are now capped by a ceiling that the central bank implemented in September 2022 to maintain stability in the foreign exchange market.

On the other hand, jumps in expenses amid high inflation, which has strained households' capacity to save, have resulted in a slowdown in the expansion of deposits, the main source of funding for banks.

Deposits increased 8 per cent year-on-year in the three months to September, down from 11 per cent a year earlier.

The pressure on liquidity may not fully abate in 2023 as high inflation will keep a lid on deposit growth, while economic uncertainty may lead to reductions in exporters' earnings, the ratings agency said.

It expects inflation in Bangladesh to be 7-8 per cent this year, higher than pre-pandemic levels of 5.5-6 per cent.

Islamic banks are more vulnerable to tightened liquidity conditions because they have smaller liquidity buffers and weaker profitability, the agency said.

Some Shariah-based lenders have recently faced a wide range of scams, hitting depositors' confidence. This forced the central bank to come up with extraordinary liquidity support to help them tackle the ongoing crisis.

"Islamic banks are more vulnerable to the tightening of liquidity than conventional banks because they have smaller liquidity buffers," the report said.

One reason that Islamic banks have weaker liquidity cushions is that the central bank has more relaxed liquidity requirements for them to support the growth of the sector.

Another reason is that Islamic banks are prohibited from holding conventional interest-bearing government bonds, and there is a limited amount of liquid Shariah-compliant instruments.

The profitability of Islamic banks has already become weaker than that of conventional banks because they are more reliant on term deposits, which results in a narrower spread between financing yields and deposit costs than the systemwide level.

In addition, in the first three quarters of 2022, Islamic banks' deposit growth lagged that of conventional banks, while the financing growth of the former continued to outpace the loan growth of the latter.

"The funding cost in the entire banking sector will jump, which may hurt the profitability of banks," said the report.

Although banks can fill liquidity shortfalls through borrowing from the interbank market or the central bank, the costs of such funding have increased materially as demand has grown and the central bank has started tightening monetary policy to curb inflation.

"This will pressure banks' net interest margin and their profitability," said Moody's.

The weighted average of interbank repo rates jumped to 8.1 per cent at the end of 2022 from 1.4 per cent at the start of the year, while the weighted average of interbank overnight rates rose to 5.8 per cent from 2.7 per cent, the highest since 2015.

The central bank raised the repo rate, the rate at which it lends to banks, to 6 per cent in January this year from 4.75 per cent at the beginning of 2022.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments