Adani power purchase against ‘public policy’: How could such a deal be signed?

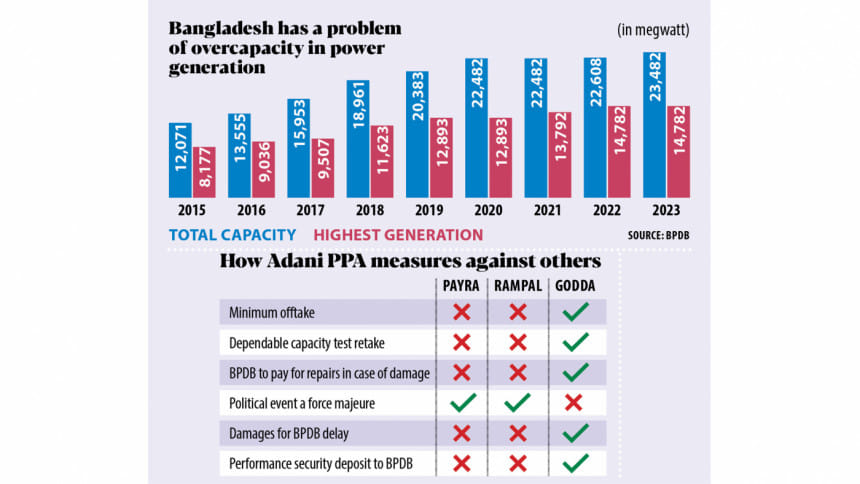

In 2015, with a flurry of power deals in the bag and overcapacity in existing production capacity, did Bangladesh need to sign another landmark deal? Statistics suggest no.

Perhaps, the raw exuberance surrounding the Bangladesh growth story then could justify the deal struck with Adani Power under the 2011 Indo-Bangla Framework Agreement for Cooperation on August 11, 2015 -- about two months after Indian Prime Minister Narendra Modi's maiden visit to Bangladesh.

"It is a punishable offence to sign such a contract -- we believe that our agencies have the ability to identify the corruption in this deal." M Shamsul Alam vice-chairman Consumers Association of Bangladesh

But nothing explains the government's rationale for signing the power purchase agreement for the deal two years later: three legal and energy experts at home and abroad who reviewed the contract at The Daily Star's request found it to be exceptionally expensive, overtly favouring Adani Power and ironclad.

"The way I would put it is heads Adani wins, tails you lose. The contract is so biased against the interests of Bangladesh to the point that one has to wonder why any sensible person would sign it on behalf of the Bangladeshi government," said Tim Buckley, an energy economist and founder of Sydney-based Climate Energy Finance Australasia.

The Daily Star contacted Mina Masud Uzzaman, who signed the deal in his capacity as the secretary of the Bangladesh Power Development Board then, on November 5, 2017 to learn of the government process in the lead-up to agreeing to the deal.

"I don't remember anything. It came through the chairman. I was the last step," said Mina Masud, who is now an additional inspector general at the Department of Inspection for Factories and Establishments.

Khaled Mahmood, who was the BPDB chairman from August 2016 to December 2019, declined to speak on the matter.

"I am not interested in talking about this. You realise that everything is vulnerable now," said Mahmood, who is now an independent director at Baraka Power.

What is unfortunate is there is virtually no scope for BPDB to get out of this contract for power purchase from the plant, which was built at an estimated cost of Rs 14,816 crore on 'unconditional and irrevocable' sovereign guarantee from the Bangladesh government that it would purchase the entire power generated for 25 years.

"If there is a material breach, you cannot terminate the contract. You have to seek remedy and that description has to be in reasonable detail. And you have to give them time for remedy in all termination events," said a top corporate lawyer in Bangladesh, who specialises in drafting infrastructure contracts.

And even in the case of dispute resolution, the government has conceded ground: it waived off sovereign immunity, which would have given it an upper hand.

"It's a plain unfair contract. This is an agreement against public policy," said the lawyer on the condition of anonymity to speak candidly on the issue.

But it is not that the government did not have experience negotiating big PPAs before this: at The Daily Star's request, the experts also reviewed the Payra and Rampal deals and found those to be not ideal either but are much less predatory.

In so doing, Adani Power passed on the entire risks associated with its fixed and variable costs of the power plant, which was set up on a 68:32 debt-to-equity ratio, to BPDB and also line its pockets along the way.

In fact, this is the only PPA of Adani Power in which all variable costs are pass-through, making it a largely low-risk venture for India's largest private power company.

Major predatory aspects of the PPA with Adani Power, whose chairman Gautam Adani has longstanding ties with Modi, can be found in the pricing of coal and capacity charge.

Coal that would fire the 1,600 megawatt ultra-supercritical power plant located in the Indian eastern state of Jharkhand's Godda district would be calculated based on the average prices of benchmark coal with an energy value of 6,332 kilocalories per kg (kcal/kg) at the Indonesian coal index and the Australian Newcastle index for the relevant month.

"That means if Adani purchased coal from countries other than Indonesia and Australia at a lower cost, they would be able to charge extra," said M Shamsul Alam, an energy expert who reviewed the 163-page document for The Daily Star.

While the PPA mentions that BPDB would be charged for 4,600 kcal/kg, there are significant gains to be made by Adani Power for deciding to arrive at the price based on the rates for higher-grade coal.

The 4,600 kcal/kg coal is of inferior grade and trades at a fraction of the price of 6,332 kcal/kg coal.

"If you tie it to an index that is unrelated to the quality of coal Adani is using, how is that fair? It's probably the most generous coal PPA I have ever seen in the world in my decades of energy analysis," Buckley said.

While there is a provision in the Adani PPA to change the index based on which coal would be billed, it is almost impossible to explore that option, according to the lawyer.

"It can be deployed if any of the indexes is withdrawn, unavailable or inappropriate. But we do not know what constitutes inappropriate," he said.

Coincidentally, Adani Power's sister concern Adani Enterprises is India's biggest coal trader and owns mines in Indonesia and Australia -- and the coal for the Godda plant will most likely be supplied by that vendor.

The entire transportation and logistics-related costs for coal are linked to the relevant global indices: Baltic Exchange Dry Index and Platts Oilgram Bunkerwire Singapore.

BPDB would also have to pay for the transport and logistics of the coal for the Payra and Rampal power plants, but this cost would be baked into the final price of the coal procured through the open tender. Subsequently, a competitive rate is expected that is immune from the vagaries of the indices.

The coal for the plant -- located in an Indian village about 100 kilometres from the Bangladesh border -- would be delivered to Odisha's Dhamra port, which is owned by another sister concern, Adani Ports and Special Economic Zone.

Dhamra Port Company has been tasked with port handling including coal unloading, storage, loading onto railway wagons and port-related documentation. From there, coal would travel 695 kilometres in wagons of Indian Railways to the power plant.

It is not known whether arm's length pricing would be used for this leg of coal's journey.

Arm's length pricing is the price at which a willing buyer and a willing unrelated seller would freely agree to transact or a trade between related parties that is conducted as if they were unrelated, so that there is no conflict of interest in the transaction.

For Payra and Rampal, separate coal purchase agreements are signed through an open tender and with BPDB's vetting and provisions for discounts.

Their coal purchases would be based on the year-ahead notification given by BPDB about its electricity purchase schedule. But the invoice would be as per the dispatch to BPDB.

If the coal purchase agreements have a minimum offtake guarantee and BPDB's dispatch is below that, there would be an additional invoice to make up the difference.

In the Adani PPA, BPDB must take and pay for at least 34 percent of the power generated by the plant every year. Failure to do so would entail reimbursing all the penalty, damages or compensation paid or incurred by Adani Power to its coal supplier, coal transporter and port operators.

There is no minimum offtake requirement for Payra and Rampal.

Another major point of difference between the Adani PPA with the other two is in the calculation of capacity payment, which, in essence, is the rent paid to the power plant for the contracted years regardless of how many hours the boiler, the turbine and the generator are run to generate electricity.

Where Payra and Rampal's authorities arrived at the sum using a formula based on the capital cost, return of equity, the interest on debt, depreciation, interest on working capital and so on, Adani Power arbitrability slapped on a sum. In addition, it will factor in the US Consumer Price Index for the capacity payment calculations for the 25-year contract duration.

Subsequently, the electricity that would be purchased from the Adani Godda plant, which was built with a Rs 10,075 crore loan from Indian state-run lender Power Finance Corp. and its unit REC at a subsidised rate, will end up costing more than the others for BPDB.

However, the government could have landed a windfall had it approached this PPA with more gumption.

A little over a year after the PPA was signed, India's ministry of commerce and industry designated the 425 hectares of land on which the state-of-the-art power plant was emerging as a special economic zone. This meant Adani Power got tax and levy exemptions.

Naturally, the capacity payment, energy tariff and coal invoices would come down as those were originally calculated factoring in the taxes and levies.

But a clause in the PPA states that Adani Power is obliged to make adjustments only in the cases of taxes or levies or costs going up, in yet another example of the one-sided nature of the contract.

"This proposition is absurd. It is a clear example of duress. No sane person agrees to such clauses," the lawyer said.

The SEZ designation is saving Adani Power upwards of $1 billion, according to Buckley.

Where in the other two PPAs, a political event like a strike or war or change in law is a force majeure, in the Adani PPA it is not.

If Adani Power is unable to supply power for a political event, it is not obliged to pay any liquidated damage to BPDB. But the converse is not true, in yet another instance of the one-sided nature of the contract.

"You cannot catch him [Adani] for his failure to deliver for political events. However, if he invokes a political event, you have to continue to pay the capacity payment, energy payment and the other dues," the lawyer said.

A political event should be force majeure and as per law, during force majeure, both sides are exempted from each party's obligations.

"He will take money by doing nothing. This is another robbery. This is absolutely an illegal clause. It's hard to stay in the right mood after seeing such clauses," he said.

If the plant gets damaged for a political event, Adani Power would bill BPDB for repair works and restoration of normal service, in another unfair inclusion in the PPA.

This supplemental tariff, which was not used in the other two PPAs, can also be invoked in the case of costs going up for Adani Power.

Another favourable clause for Adani is the option to take a second test to check the dependable capacity -- which is the total electricity the plant can supply to the grid -- should it fail the first one.

As is standard practice in PPAs, the test is carried just once and that result is valid for 300 months. If the plant fails the test, it has to pay a penalty.

Should the Godda plant fail the test, Adani Power could carry out another test at its own cost.

If it gets the expected reading this time, it will supersede the previous one and the compensation paid by Adani Power to BPDB until then would be adjusted with future invoices.

"In every layer, there is a loophole -- they are giving with one hand and taking it back with the other hand," the lawyer said.

Nasrul Hamid, the state minister for power, energy and mineral resources since 2014, and Tawfiq-e-Elahi Choudhury, the prime minister's energy adviser since 2009, declined The Daily Star's request for comment.

"It is a punishable offence to sign such a contract -- we believe that our agencies have the ability to identify the corruption in this deal," said Alam, also the vice-chairman of the Consumers Association of Bangladesh.

And cancelling the agreement will not solve matters. "We need to bring to book those who made such agreements."

It is highly unlikely that Bangladesh would be able to consume the 1,496 megawatts of electricity that would be produced by the Godda plant.

The dedicated transmission line from Godda would bring power to the northern part of Bangladesh, which is not an industries-dense region and hence the demand for electricity is not that much. "We will need to keep the power plant unutilised and keep spending dollars as capacity charges," Alam added.

"The whole contract is a gift by the Bangladesh government to the [previously] richest man in Asia," Buckley said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments