Tax evasion costs Bangladesh up to Tk 223,000cr a year: CPD

Bangladesh is losing potential taxes from as low as Tk 41,800 crore to as high as Tk 223,000 crore every year because of tax evasion committed by individuals and corporates, said the Centre for Policy Dialogue (CPD) yesterday.

The amount of tax losses rises when tax avoidance is taken into consideration.

The think-tank said overall potential tax losses would be between Tk 55,800 crore and Tk 292,500 crore annually and this needs to be cut so that the country can meet its expenditures aimed at economic development and public welfare.

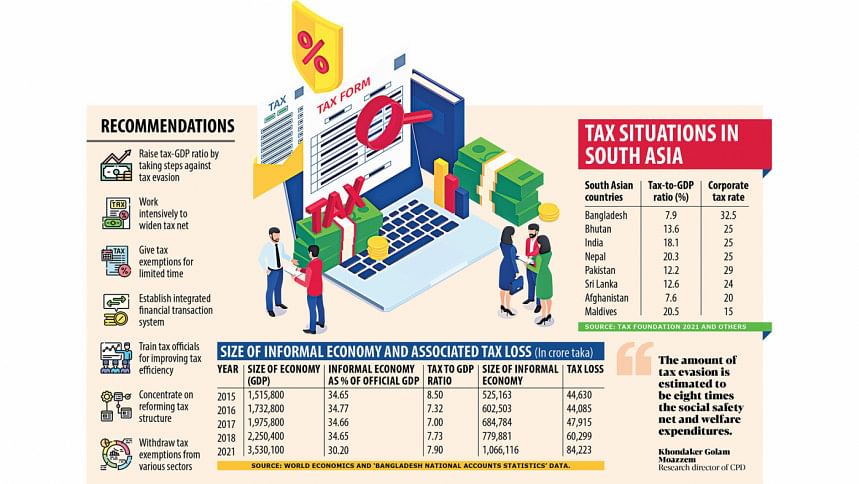

"The amount of tax evasion is estimated to be eight times social safety net and welfare expenditures," said CPD Research Director Khondaker Golam Moazzem while presenting a paper on "Tax Transparency in the Corporate Sector: Impact on Public Revenue of the National Budget" at a media briefing.

The CPD and the Christian Aid organised the briefing at the former's office in Dhaka to share the findings of a study.

"This is happening in multiple ways such as showing lower incomes, unethical support from tax practitioners, claiming more investment allowances, individuals reporting lower incomes, and higher informal or cash-based transactions," said Moazzem.

The amount of tax avoidance is 200 per cent of the public health expenditure, he added.

The revelation of tax losses comes at a time when Bangladesh's fiscal space has been facing persisting strain for lower revenue generation against elevated expenses.

What is more, Bangladesh has one of the lowest tax-to-gross domestic product (GDP) ratios in South Asia, prompting economists and multilateral lenders to suggest increasing revenue collection to enhance the country's capacity to bankroll expenditures.

Bangladesh's current tax-to-GDP ratio stands at 7.9 per cent, way behind the ideal benchmark of 15 per cent. So, the country needs to collect an additional tax revenue of Tk 145,000 crore to lift the ratio to 12 per cent and an additional Tk 250,600 crore to raise it to 15 per cent.

The number of taxpayers who file income tax returns regularly is very low in a country of around 17 crore people.

Moazzem cited CPD's previous study, which found that 68 per cent of the people did not pay income tax even though they had taxable incomes.

"This is a major reason why the tax-GDP ratio is not increasing," he said. "The tax net is very narrow and it needs to be broadened."

Citing data from the Registrar of Joint Stock Companies and Firms and the National Board of Revenue, the economist said 45,000 out of 2,13,000 registered companies and firms filed returns.

"This implies that the corporate income tax compliance rate is 21 per cent. In other words, one in five registered businesses pays tax," said the CPD.

The CPD conducted key informant interviews for the study, blaming tax avoidance for the 5 and 25 per cent of tax losses and evasion for 15-80 per cent of unrealised tax collection.

Other reasons for the tax losses are exemptions.

The research organisation said eight types of industries, including jute, textile and knitwear, are enjoying reduced tax benefits of 3 per cent to 15 per cent.

The size of the informal economy is one of the key reasons for tax losses for the economy, said the CPD, adding that Bangladesh suffered an estimated loss of Tk 84,200 crore in 2021 due to the dominance of informal activities.

The size of the informal economy was 30.2 per cent of GDP in 2021, said Moazzem.

In his paper, the economist blamed corruption, lack of efficient manpower and inadequate infrastructure for the lower tax-to-GDP ratio and higher tax evasion.

"In order to overcome the challenges, corruption needs to be addressed," he said.

The CPD suggested Bangladesh work intensively to widen the tax net and bring businesses that are out of the tax net.

According to the think-tank, tax exemptions and related incentives should be offered for a limited time.

Moazzem recommended promoting cashless transactions, saying digitalisation should take place under the integrated financial transaction system.

"As the corruption of tax officials is claimed to be the major cause of tax evasion, this needs to be addressed."

He urged the government to set an annual target on reducing tax avoidance through the gradual phasing out of tax incentives, tax breaks and other concessions for the established sectors.

"The national budget should withdraw all kinds of non-transparent tax-related provisions, including provision for whitening black money since they contradict tax transparency efforts."

"The government has allowed the legalisation of black money and it is against tax fairness and tax transparency. Such opportunity should be cancelled in the upcoming budget," he said.

CPD Executive Director Fahmida Khatun said, "If the tax management can be made better, modern, transparent, logical and fair, the fiscal imbalance in the financial sector can be reduced to a large extent."

"The government needs to put in place a plan for the next five years, outlining where it wants to go in terms of raising revenue."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments