Forex reserves keep falling amid dollar selling spree

The central bank has kept injecting a hefty volume of US dollars into the market to help banks clear import bills, eroding the Bangladesh's foreign exchange reserves.

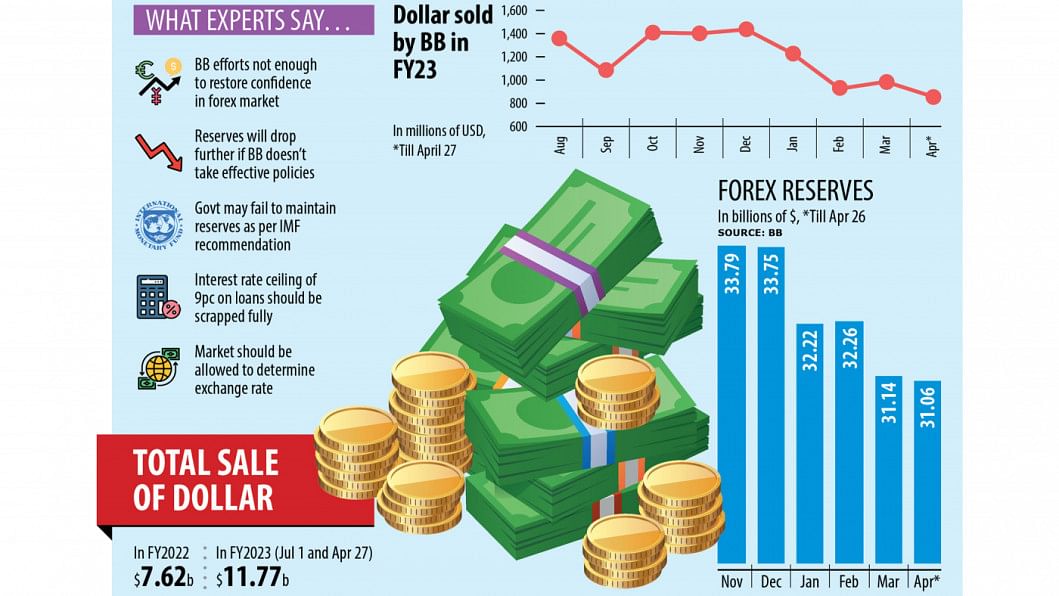

Between July 1 and April 27 of the ongoing financial year, the central bank supplied a record $11.79 billion to banks in contrast to $7.62 billion provided in the entire fiscal year of 2021-22, data from the Bangladesh Bank showed.

Persistently higher imports, driven by a spike in global commodity prices amid the Russia-Ukraine war and the dragging impacts of the coronavirus pandemic, have been contributing to the decline in the reserves for nearly a year.

Although import bills fell 10.27 per cent to $48.79 billion in the first eight months of 2022-23, it was not enough to stop the depletion of the international currency reserves as earnings from exports and remittance, the two biggest sources of US dollars for Bangladesh, were inadequate to bring stability in the foreign exchange regime.

Export receipts stood at $34.97 billion in July-February, up 9.45 per cent year-on-year, while money transferred by migrant workers rose 4.27 per cent to $14.01 billion, BB data showed.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says that banks are still facing a shortage of dollars as the inflow of the greenback is not adequate given the demand.

"We want to help businesses by providing the required dollars, but we are unable to do so. This has put a negative impact on the industrial sector."

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, says that the central bank has not taken any effective policy measure to restore confidence in the foreign exchange market, which has been facing volatility since the war broke out in February last year.

"So, the reserves are falling continuously. And it will further deteriorate in the days ahead if the BB follows its ongoing stances," he said.

The reserves stood at $31.06 billion yesterday compared to $44.01 billion on April 30 last year, a year-on-year decrease of about 30 per cent.

Although the BB has loosened its control over the foreign exchange rate in the face of an unprecedented hike in the US dollar rate, the taka has still been under pressure owing to the dragging crunch of the American greenback.

Another sticking point is the 9 per cent ceiling on loans.

The central bank has recently said it would implement a market-based interest rate from July 1, scrapping the ceiling that has been put in place since April 2020.

But Mansur said: "The implementation of the floating exchange rate will not be possible if the 9 per cent ceiling of interest rate on loans is not scrapped."

"There is no scope to stop the decrease in reserves if the BB does not take effective measures."

And Mansur and Zahid Hussain, a former lead economist of the World Bank's Dhaka office, have long urged the central bank to withdraw the cap with a view to encouraging foreign investors to invest money in Bangladesh.

"If foreigners invest in the country, the erosion of the reserves will be tackled," Mansur said.

Foreign investors' reluctance to invest in Bangladesh was evidenced from the fast deterioration of the financial account of the balance of payments.

A financial account covers claims or liabilities to non-residents concerning financial assets. Its components include foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investment, and reserve assets.

Between July and February, the financial account registered a deficit of $1.53 billion in contrast to a surplus of $11.9 billion a year ago, data from the BB showed.

Historically the financial account of Bangladesh has experienced a surplus almost every year.

For example, it was $944 million in FY16, $4.25 billion in FY17, $9.01 billion in FY18, $5.13 billion in FY19, $7.54 billion in FY20, $14.07 billion in FY21, and $13.67 billion in FY22, according to the World Bank data.

Mansur thinks the government may not be able to fulfill the International Monetary Fund's target of keeping the net reserves at $24.46 billion by June if the ongoing erosion of the reserves continues.

If the IMF's calculation is taken into account, the net reserves are now less than $22 billion, he said.

This is because while calculating the reserves level, the IMF excludes the central bank's US dollar investments through the Export Development Fund (EDF) and other windows.

For example, the central bank has lent more than $5 billion to exporters through banks under the EDF.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments