Pubali Bank aims to be a lifelong partner of clients

Riding on the reputation it has earned over the decades, Pubali Bank Ltd, one of the oldest banks in Bangladesh, is investing to build a robust digital infrastructure with a view to providing all financial services at the fingertips of customers and their doorsteps.

The private commercial bank also plans to expand its physical network through the establishment of sub-branches across the country to onboard more customers.

In doing so, it wants to be the lifelong partner of every customer, said its top executive.

"We are putting in place all kinds of infrastructures to provide a good experience to our customers," said Mohammad Ali, managing director and chief executive officer of Pubali Bank, in an interview with The Daily Star recently.

"Usually, a customer does not leave us once they become a client. Now, we want to provide a life-long experience to them."

The top executive, a computer science graduate from Bangladesh University of Engineering and Technology, shared this as it restructures its human resources and invests in building digital infrastructure to get today's tech-savvy customers on board.

"We are embracing modern technologies so that we can satisfy all the digital needs of customers. We also want to create a perception among people that the capacity and integrity of our employees is unparalleled."

Established as Eastern Mercantile Bank Ltd in 1959 in then East Pakistan, it was renamed Pubali Bank after the independence of Bangladesh.

Today, it is one of the largest private banks in terms of branches. It has 500 branches, 151 sub-branches and 17 Islamic banking windows.

It has the largest real-time centralised online banking network.

"We are trying to create an environment so that customers do not have to come to us. Rather, we will meet them where they are. They can open letters of credit in the comfort of their offices," Ali said.

Speaking about the expansion of fintech such as mobile financial services, the Pubali Bank CEO said one of the limitations of MFS providers is that they charge customers high.

"But the fees for the money transferred through banks and other services are minimal. We are integrating all these into our platform to meet the requirement of customers."

The bank is developing a mobile app to provide banking services digitally.

Despite an increased focus on boosting the digital infrastructure, Pubali Bank will expand its footprints through the setting up of sub-branches, particularly in suburban areas.

Ali thinks there are about 10,000 bazaars in Bangladesh and people will have more confidence if there is a sub-branch in these bustling business centres.

Since its inception, Pubali Bank has garnered goodwill through its services. And it continues to see growth in deposits whereas many of its competitors struggle to attract savers.

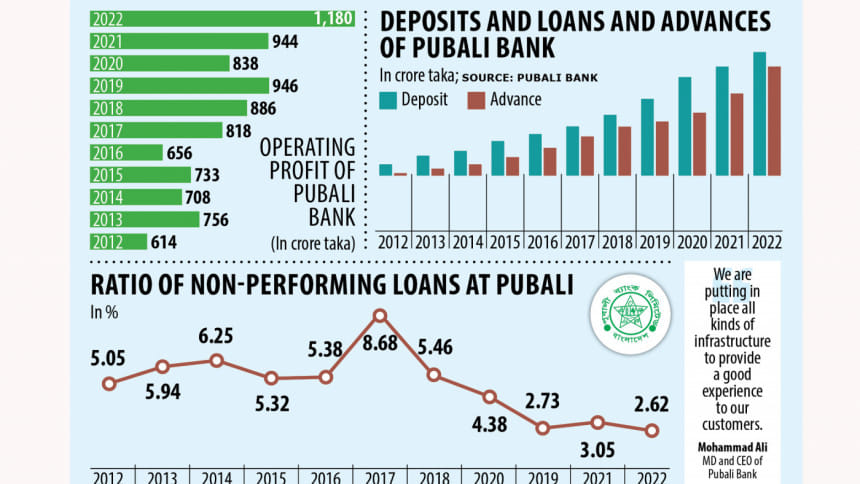

At the end of 2022, the private bank posted a 10 per cent year-on-year growth in deposits, touching Tk 50,935 crore. It was Tk 46,240 crore a year ago.

"An elevated level of public trust has contributed to the increased flow of deposits," said Ali, who holds a master's degree in development studies and an executive MBA from the Institute of Business Administration, both at the University of Dhaka.

"Our customers continue to enjoy our services and share their positive experiences with others. The brand value has spread by word of mouth. Providing and ensuring a beautiful environment is one of our core competencies."

Pubali Bank also recorded an increase in the growth of loans and advances: in 2022, loans and advances jumped 23 per cent to Tk 46,275 crore from Tk 37,665 crore a year ago.

"We made a record profit in 2022," Ali said.

The operating profit was Tk 1,180 crore last year and the profit after tax grew to Tk 564.8 crore from Tk 435 crore.

Ali credited the bank's performance in keeping non-performing loans in check for the higher profit.

In the last calendar year, the NPL fell to 2.62 per cent, the lowest since 2012 and much lower than the industry average of 8.16 per cent.

"We select borrowers meticulously before the disbursement of depositors' money. We ensure a two-layer visit to see the potential of a borrower's capacity to repay: one is done by our branch office and the other is by the head office," said Ali.

"Besides, we assess the balance sheets of loan-seekers and corporate governance and look at their buyers and work orders. We also see whether their factories are operational."

So, fraudulent companies don't come to the bank, he said, adding that the loans that have been sanctioned in the last five years have not become classified.

Although Pubali Bank selects borrowers through a rigorous process, it ensures the quickest disbursement of loans so that customers can reap benefits.

"Regular meetings of the board allow us to approve loans without delays," the CEO said.

In order to ensure balanced growth, the private bank looks to focus equally on retail, cottage, micro, small and medium enterprises and continue to serve corporate clients.

Pubali Bank is establishing a card division and aims to expand its business in consumer credit and lease finance in the coming days.

"At the same time, we will keep our focus on green and environment-friendly lending," Ali said.

The bank has financed the establishment of solar power plants, effluent treatment plants, recycling plants and green buildings.

In order to keep the morale of the employees high, it has set up a retired employees welfare fund so that they benefit after their retirement.

In the case of the death of an employee, it provides employment opportunities to the spouse of the departed.

"We want to be a socially responsible bank," added Ali.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments