Demand for loans falls to 12-month low

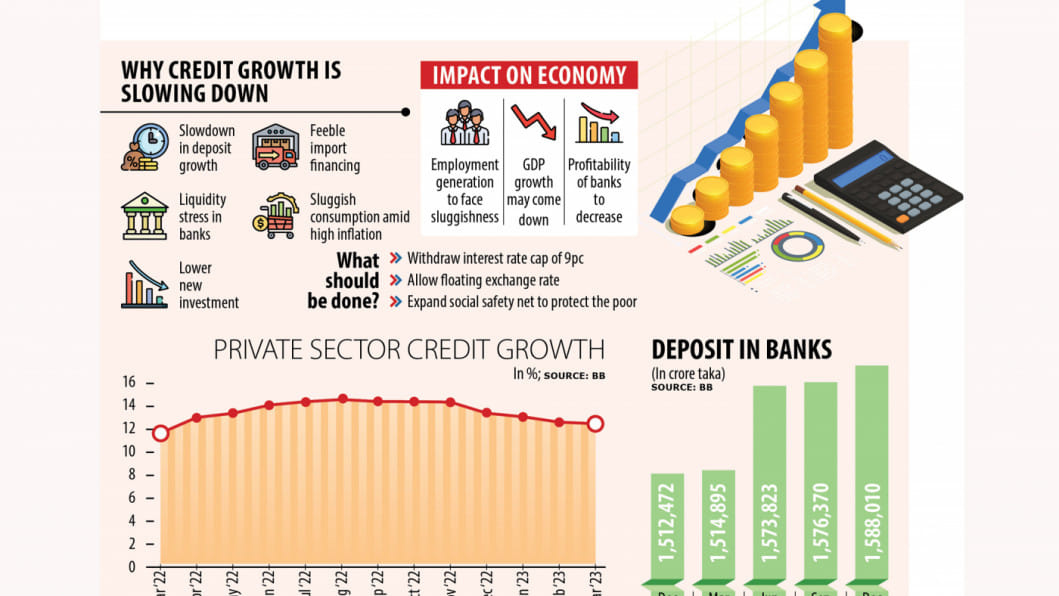

Private sector credit growth in Bangladesh slipped to a 12-month low of 12.03 per cent in March, a development that may hurt GDP growth and job creation.

This was the fourth consecutive monthly decline, data from the Bangladesh Bank showed. The credit growth stood at 12.14 per cent in February.

Bankers blamed the liquidity stress in the banking system and banks' cautious approach in disbursing loans amid rising non-performing loans for the deceleration in credit growth.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says a majority of banks are now facing liquidity stress. "So, they are struggling to give out loans."

"In addition, non-performing loans in banks are on the rise, so banks are cautious about disbursing loans. This has affected the credit growth."

Default loans in the banking sector increased 16.8 per cent year-on-year to Tk 120,656 crore last year.

A mid-level official of a private commercial bank employed in Jamalpur says his bank has been following a go-slow policy since the beginning of 2022.

"We are witnessing that some customers are failing to make instalments regularly after one or two months of securing loans. The number of borrowers belonging to this group is going up. So, we have become careful in giving out loans," he said.

Since the country's foreign exchange market is facing a shortage of US dollars amid persistently higher import costs against lower-than-expected export and remittance earnings, banks are opening a lower number of letters of credit. This is expected to bring down the post-import financing of banks.

Import payments stood at $48.79 billion in the first eight months of the ongoing financial year, down 10.27 per cent from a year ago.

The foreign exchange reserves stood at $31.02 billion yesterday compared to $44.01 billion a year ago, a decrease of about 30 per cent.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, says if banks want to expedite their credit growth, they would have to mobilise more deposits amid the tightening of the liquidity.

"The growth of deposits has been experiencing a weak trend for several months due to the lower interest rate and the volatility in the foreign exchange regime."

The deposit growth rose 5 per cent year-on-year to Tk 15,12,472 crore last year, according to the central bank.

"The lower deposit growth indicates that the credit growth will decrease more in the coming days," said Mansur, also a former official of the International Monetary Fund.

Besides, the inflow of the US dollar has faced a sluggish trend in recent months, hitting the liquidity level of banks as well, he said.

For instance, if the inflow of remittances and export earnings increases, the central bank will release more taka in the market in exchange for the US dollar.

When the inflow of US dollars goes up, the central bank purchases the surplus greenbacks from the market. But the central bank has been selling the US currency for months to help banks clear import bills, which has dried up the liquidity base of lenders.

Between July 1 and April 27 of the ongoing financial year, the central bank supplied a record $11.79 billion to banks in contrast to $7.62 billion provided in the entire 2021-22.

Mansur warned that the slower credit growth would squeeze the GDP growth of the country and put an adverse impact on employment generation.

The dragging impacts of the coronavirus pandemic and the severe fallout of the Russia-Ukraine war have already taken their toll on the country's economy.

The International Monetary Fund maintained that growth would be at best 5.5 per cent in 2023 and 6.5 per cent next year. The government says the economy will expand by 6.5 per cent this fiscal year, down from 7.1 per cent in 2021-22.

Mohammad Ali, managing director of Pubali Bank, says that government borrowing from banking sources has recently increased.

"So, it has created some difficulty for banks to disburse loans to the clients in the private sector."

The government's domestic borrowing climbed 72.3 per cent year-on-year to Tk 42,717 crore in the July-January period of the current fiscal year of 2022-23, with a major portion coming from the banking system.

This has prompted the central bank to urge the government to borrow more from non-banking sources to finance its expenditures.

According to Ali, banks are also feeling encouraged to invest in treasury bills and bonds as the investment tools are risk-free.

He also said if banks disburse more loans now, the rate of default loans may go up further due to the business slowdown.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, says that the central bank should align the lending rate and the foreign exchange rate in line with demand and supply in a bid to bring back discipline to the financial sector.

According to the economist, the purchasing power of people has decreased to a large extent owing to an elevated level of higher inflation for nearly a year, which has lowered the demand and thus production.

"New investments are not taking place to a large extent. So, new jobs are not being created much. Under such a situation, the government should expand the social safety net programmes for the underprivileged people."

He urged the government to take initiatives to reduce the cost of doing business so that businesses can invest to expand.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments