Inflation climbs to 12-year high

Average inflation in Bangladesh surpassed the government's target for the just-concluded fiscal year by a large margin as higher prices of goods and services continue to linger for the economic crisis at home and abroad.

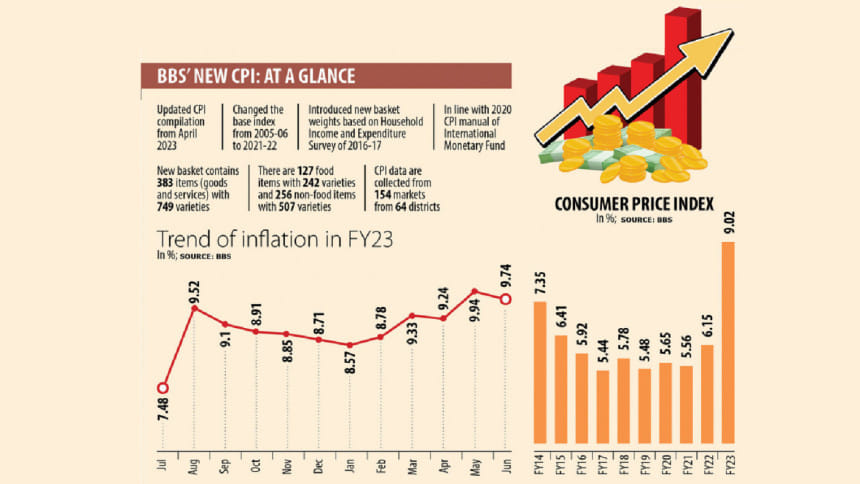

The Consumer Price Index (CPI) rose 9.02 per cent in 2022-23 against the government's revised target of 7.5 per cent. This was the highest average inflation rate in 12 years, according to the Bangladesh Bureau of Statistics (BBS).

This was much higher than the 5-6 per cent average inflation seen in the decade before the Russia-Ukraine war. General inflation was 6.15 per cent in 2021-22.

The Consumer Price Index rose 9.02 per cent in 2022-23 against the government's revised target of 7.5 per cent

At the beginning of FY23, the government had aimed to limit the inflation to 5.6 per cent.

The goal was later revised upwards first to 6.5 per cent and then to 7.5 per cent since the war rages and the slide in the foreign currency reserve, the weakening of the taka against the US dollar, and the energy crisis continues.

In FY23, average inflation stayed above 9 per cent for six months, above 8 per cent for five months and more than 7 per cent in one month, data from the national statistical agency showed.

In June, general inflation fell 20 basis points to 9.74 per cent compared to a month ago. This was down from an 11-year high of 9.94 per cent in May.

Food inflation rose 49 basis points to 9.73 per cent in the last month of the fiscal year, highlighting the persisting pains confronting the poor and the low-income groups. Non-food inflation declined 36 basis points to 9.6 per cent.

At the end, food inflation averaged 8.71 per cent, the highest in 12 years. Non-food inflation stood at 9.39 per cent, an 11-year high.

Economists blame inadequate measures on the part of the government and the central bank for the surge in consumer prices.

They argue that although the central bank has raised the policy rate five times in the past one year, it has not been able to rein in the rocketing inflation owing to the lending rate cap on loans and the largely administered exchange rate.

Recently, Sadiq Ahmed, vice-chairman of the Policy Research Institute of Bangladesh, a think-tank, said the government's responses to inflation reduction comprised of control over the exchange rate and the use of subsidies to prevent a pass-through of global energy price increases.

"Contrary to lowering demand, the government policy sought to boost demand by increasing domestic credit through controls over interest rates and a higher fiscal deficit. These policies further added to inflationary pressures."

"Evidence shows that countries that adopted demand reduction policies through hikes in interest rates have all succeeded in reducing inflation substantially."

The central bank has blamed several factors for the elevated domestic commodity prices and inflation, including higher prices of imported items and a larger depreciation of the taka, which fell around 25 per cent against the US dollar in the past one year.

The upward adjustments in fuel and energy prices have also significantly contributed to the inflationary pressure, it said.

"All these factors have collectively contributed to the overall increase in domestic commodity prices. The lack of a competitive environment, along with market syndication, could have also contributed to the current CPI inflation."

The BB said the elevated level of inflation across the globe has declined due to the easing of supply-side conditions, and lower food and energy prices.

"The adjustments have not been reflected equally in Bangladesh's economy mainly due to the domestic price rigidity, lack of adequate market competition and large depreciation of the domestic currency."

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said headline inflation declined somewhat primarily due to a decline in non-food inflation in both rural and urban markets.

"It appears that the decline in the purchasing power of consumers has started to pinch demand for non-food items in which consumers have some discretion."

He said both monetary and fiscal policies have so far not made any significant move to combat inflation or to make it bearable for those who live hand to mouth.

"The family card programme is one exception, but it is beset with irregularities."

The government hopes that due to the decrease in the prices of fuel, food, and fertiliser in the global market, along with the adjustment of fuel prices in the domestic market and government initiatives to keep the food and supply systems normal, inflation will remain much controlled in FY24.

Thus, it has targeted to limit it to around 6 per cent in the new fiscal year. The World Bank forecasts inflation to average 6.5 per cent in FY24 before falling to 5.7 per cent in FY25.

The IMF, however, predicts that inflation will likely exceed targets in most countries in 2024, but the rate is expected to approach targets in 2025 as global commodity prices trend lowers and oil prices decline.

The BBS said it has been updating its CPI compilation method in line with the 2020 CPI manual of the IMF from April 2023.

It has changed the base index from 2005-06 to 2021-22 and introduced the new basket weights based on the Household Income and Expenditure Survey of 2016-17.

The new basket contains 383 items (goods and services) with 749 varieties, including 127 food items with 242 varieties and 256 non-food items with 507 varieties.

CPI data are collected from 154 markets from 64 districts, according to the BBS.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments