Bangladesh, India to launch trade in rupee today

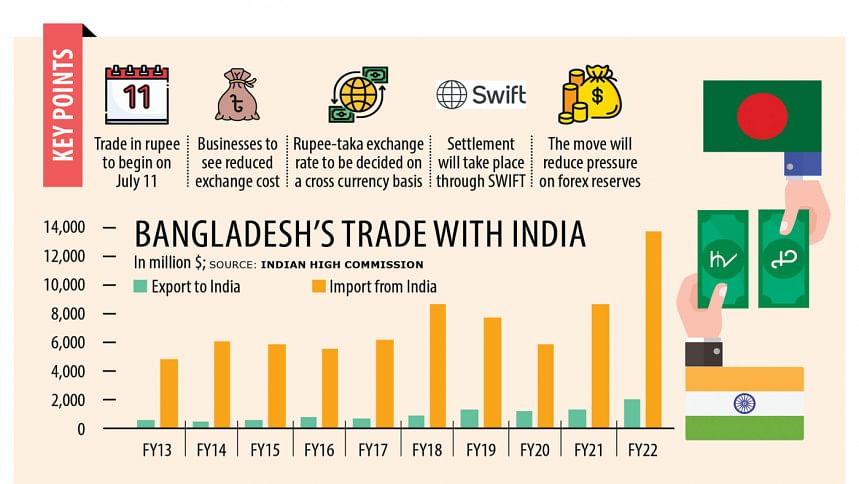

Bangladesh and India are set to launch settlement of bilateral trade in Indian rupee (INR) today in an effort to cut over-dependence on the US dollar for transaction.

The move is likely give some respite to the importers since they will be able to open letters of credit in rupee to source a portion of the products from the neighbouring country, thus cutting the use of the US dollar to some extent.

The government has toughened import rules due to the shortage of the American greenback, driven by higher import bills, with a view to stopping further depletion of Bangladesh's foreign currency reserve, which has fallen by nearly 30 per cent from a year ago.

Both the Bangladesh Bank and the Indian High Commission are expected to announce the move towards the Indian currency at an event at Le Méridien Hotel in Dhaka on Today.

The BB has already given permission to three banks – Sonali Bank, Eastern Bank and State Bank of India (SBI) in Bangladesh – to open nostro accounts with their counterparts in the neighbouring country.

The Reserve Bank of India has also granted permission to local banks to open accounts in India to facilitate settlement of a portion of nearly $16 billion bilateral trade between the two nations.

The move comes as Bangladesh's foreign exchange reserves have been falling since the amount of external payment continued to outpace receipts from exports and remittance.

Bangladeshi taka lost value significantly over the last one-and-a-half years and the deprecation continues.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments