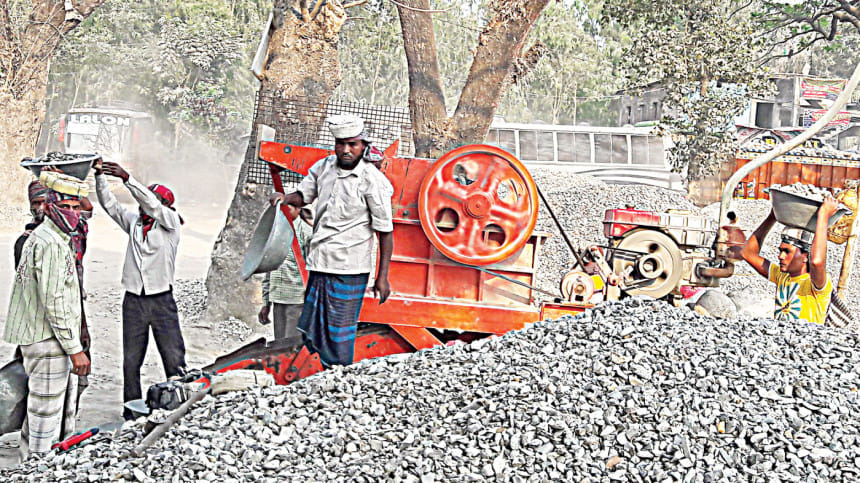

Construction aggregate market grows sevenfold in a decade

The sale of construction aggregates is growing steadily in Bangladesh in tune with increasing infrastructure development and economic activities, according to industry insiders.

Aggregates are a broad category of coarse particulate material including sand, gravel, crushed stone, slag, recycled concrete and geo-synthetic aggregates commonly used in construction projects for various purposes such as concrete production, road construction, and building foundations.

The country is fully dependent on the import of aggregates from Nepal, India, Bhutan, Indonesia and the Middle East.

According to the industry insiders, the country currently needs around seven crore tonnes of aggregates per year worth around Tk 35,000 crore.

It was at best Tk 5,000 crore prior to 2010, they said. This has prompted big corporations to entering what was mostly an informal market.

Use of natural aggregates increased last year and demand is mostly met with imports from Oman and Dubai, said Md Shamsul Hoque, physical infrastructure specialist and a civil engineering professor at the Bangladesh University of Engineering Technology.

Previously the demand was low and met with stone extracted locally, including from Sylhet and Chittagong Hill Tracts, he added.

"The lifecycle benefit of natural aggregate is higher than artificial one which people of Bangladesh can quite understand," he said.

According to him, the longevity of infrastructure made with natural aggregates is around 100 years whereas artificial aggregates only provide a temporary solution.

During the past decade, a huge amount of deployment work has been carried out which created a demand for natural aggregates as a part of a shift towards sustainable development, he said.

"Aggregates are more sustainable than the traditional brick chips because of their strength, durability and workability," said Thuhidul Islam, head of communications, LafargeHolcim Bangladesh Ltd.

"The demand for aggregates is on the rise as developers and individual house builders are now focusing on the longevity of their buildings and other construction," he said.

LafargeHolcim commenced its aggregates business in 2021, he said.

Crown Cement PLC started supplying stone chips for government projects and the private sector around two years ago, said the company secretary, Md Mozharul Islam.

Use of stone chips has diversified from road and bridge construction such as for the construction of buildings for the need for sustainability, he said.

According to him, the demand of aggregates is increasing with economic growth and heightened awareness about the environment and longevity of infrastructure.

Meanwhile, Shah Cement Industries Limited plans to enter the business next year, said a senior official.

"We just started using aggregates for construction of buildings and other infrastructure while developed countries started using aggregates a long time ago," said FR Khan, managing director of bti, one of the top developers in the country.

"For this reason, the demand for aggregates is increasing," he said.

As Bangladesh is prone to heavy rains during the monsoons, it is better to use stone chips rather than those of bricks, at least for the roof of buildings, he said.

Buildings built using stone chips on low-lying land do not suffer any damage from water inundation, he said.

In spite of the price difference, stone chips provide long-term benefits for being a natural product, he added.

Demand for stone chips has been increasing by around 8 per cent to 10 per cent annually over the past decade as people want their buildings to last longer, said Khandoker Kingshuk Hossain, chief marketing officer of Bashundhara Cement.

The company supplies stone chips through a ready-mix concrete, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments