Govt borrows nearly Tk 98,000cr from Bangladesh Bank in FY23

The government took around Tk 98,000 crore in loans from Bangladesh Bank (BB) in 2022-23 fiscal year, which was nearly 73 per cent of the borrowing from banks and non-banking sources and may contribute to stoking inflationary pressures.

"This will create demand as the central bank is printing money to lend to the government. This fresh money is coming to the market. This will stoke inflation," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

If the government borrowed from banks, there would not have much effect on inflation, he said.

According to the economist, there is concern about the composition of debts.

"And the concern remains the same for the new fiscal year as the government keeps borrowing. The main reason is the failure to collect required amount of revenue. We are already seeing the consequence of that."

For the 11th consecutive year, the National Board of Revenue missed its tax target in FY23 in the face of slowing growth of collections amidst economic slowdowns and ambitious goals set by the government. The collection grew only 8 per cent in the year.

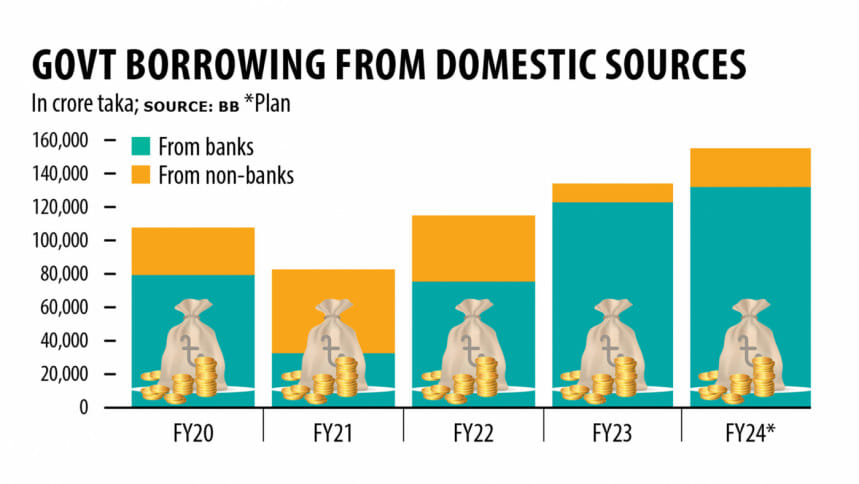

The government planned to borrow Tk 140,425 crore from domestic sources in FY23. And it managed to could keep debts within the plan although borrowing from the banking system exceeded its projection by 7 per cent year-on-year, according to the Bangladesh Bank data.

The government's borrowing from domestic sources in 2022-23 was Tk 133,800 crore, excluding the net sales of national savings certificates. It was Tk 115,216 crore in 2021-22.

The government's debt from banks stood at around Tk 123,000 crore, up from Tk 115,425 crore. And in the first four days of the new fiscal year, it took Tk 3,538 crore as loans from banks.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, said the continued borrowing shows that the government's fiscal space is shrinking.

Fiscal space refers to the financial resources available to a government for policy initiatives through the budget and related decisions.

"The government's fiscal position is strained and it appears that it has no alternative but to borrow," she said, adding that the government would require an increased amount of fund in 2023-24 since the size of the national budget has increased.

The government plans to borrow about Tk 258,000 crore from local and foreign sources in FY24 to implement the Tk 761,785 crore national budget.

Of the amount, it wants to secure 60 per cent from domestic sources, mainly banks.

Fahmida said banks are already in liquidity stress and high borrowing from the sector might affect the credit flow to the private sector and investments.

Mansur, also a former economist at the International Monetary Fund, said the government might borrow a higher amount from the central bank to finance the budget in order to avoid increased debt servicing.

"By borrowing from the central bank, it will pay a low interest rate. And ultimately, the cost of loan will be zero as the earnings of the central bank will go to the state coffer."

On the other hand, if the government borrows from banks, it would require to pay a higher interest rate and the overall interest rate in the market would go up that would affect businesses.

"It appears that the government is not willing to dishearten businesses. But the irony is that it is the common people who will pay for higher inflation."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments