Capital machinery import slumps, a sign of slowing investment, economy

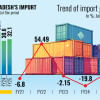

Bangladesh's import of capital machinery and intermediate goods, which are used to make finished products for both local and export markets, declined in the last fiscal year, reflecting a slowdown in private investment and the economy.

The persistent dollar crisis, which began at the beginning of 2022-23, and higher inflation at home and abroad for a fall in the purchasing capacity of consumers are all to blame for the drop.

Of late, businesses have become cautious when it comes to investments as political uncertainty is deepening ahead of the parliamentary election due early next year.

Subsequently, the import of capital machinery fell 11 percent year-on-year to $4.84 billion in FY23, according to the import data compiled by the Bangladesh Bank based on customs records.

Other capital goods import dipped 20 percent.

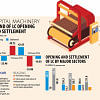

"The lack of availability of foreign currencies affected the import of capital machinery. Banks had been slow in opening letters of credit," said Md Saiful Islam, president of the Metropolitan Chamber of Commerce and Industry.

"Besides, traditionally, investors go slow while making investments during an election year. It seems that existing investors are cautious while new investors are not coming forward to make fresh investments now."

The import of intermediate goods also suffered as well.

For example, the overall import of intermediate goods used in the garment industry, the largest exporting sector, plunged 22 percent to $17.31 billion in FY23.

The sharpest slump was registered by yarn, followed by textile articles and dyeing and tanning materials.

Yarn import plummeted nearly 47 percent to $2.79 billion in the last fiscal year. Raw cotton import declined marginally.

"Sales have dropped everywhere because of higher inflation. The sales situation is not good in the domestic market as well," said Anwar-ul Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, attributes the fall in prices in the international market for the decline in the import of intermediate goods.

"It seems that the import of raw materials has not fallen in terms of volume. Had it fallen volume-wise, garments exports would not have grown."

The economist thinks the price fall alone can't explain the significant drop in the capital machinery import.

"Business faced difficulties in opening LCs due to the dollar shortage. High inflation and political uncertainty have affected investment decision."

Rahman said the slowing private investment will affect job creation and impact economic growth in the mid-term.

"All are taking a wait-and-see approach," said Parvez, citing factors such as the increased cost of production, the shortage of dollar and the spike in the interest rate.

He thinks the sluggishness in investment is temporary and it will be over after the elections.

Mohammad Ali, managing director of Pubali Bank, says investors usually embrace a go-slow approach during elections year.

"Besides, the export growth has slowed. So, investors who expanded their capacity in 2021-22 could not utilise their production facility fully. They will expand once they can make the most of their current capacity."

Selim Raihan, a professor of economics at the University of Dhaka, said the decline in the capital machinery import means that investment is going to fall and the economic growth is going to decelerate.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments