Local firms equally dissatisfied with business climate

Like Japanese and Chinese companies operating in Bangladesh, domestic firms as well as those from other countries are not happy with the overall business climate in the country, said a number of entrepreneurs, heads of chambers and experts.

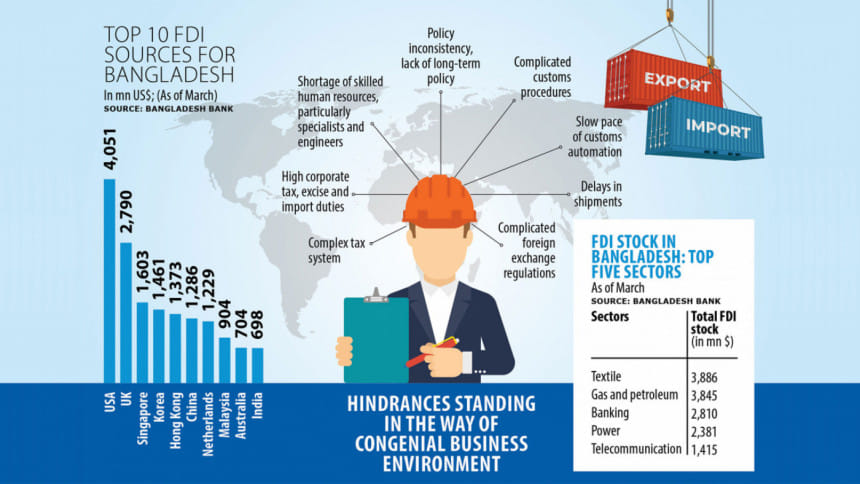

Policy inconsistency, complicated customs procedures, shipment delays, lack of service-oriented attitudes among government officials, and prevalence of informal payments aimed at ensuring quick services from regulators and facilitating agencies are all blamed for the poor business environment.

Their concerns, which have lingered for a long time, reflected the challenges recently cited by Japanese and Chinese businesses that have a presence in Bangladesh.

For example, a survey of the Japan External Trade Organisation (Jetro) released on August 30 said 71 percent of Japanese companies are dissatisfied with the general business environment in the country.

On Saturday, Chinese investors pointed to the challenges they face while doing business, starting from difficulties in securing visas and work permits to opening and settling of letters of credit (LCs). They sought improved services alongside remedies to the hurdles.

The challenges faced by Japanese and Chinese investors are also applicable to all domestic and foreign companies, said Md Sameer Sattar, president of the Dhaka Chamber of Commerce and Industry.

He said due to slower-than-expected clearance of customs, importers are sometimes compelled to pay more in demurrages and imported raw materials and goods might even be found to be damaged.

As a result, entrepreneurs face cost consequences at home as well as challenges in the international market from a competitive perspective.

Businesses have to wait 11 days and six hours to have their cargo released after their arrival at seaports, according to the Time Release Study 2022 of the National Board of Revenue.

Nihad Kabir, chairperson of the Business Initiative Leading Development, a think-tank, said it is true to some extent that Japanese companies and some domestic and foreign companies don't receive government incentives because of inefficiencies and red-tapism.

She said automation in customs procedures is not fully in place and the NBR needs to complete the process as soon as possible.

"Businesses want transparency, accountability and predictability in the regulatory framework."

Nihad said there has to be a relentless drive to carry out required regulatory reforms in a bid to reduce the burden on businesses so that Bangladesh can attract a higher volume of foreign direct investments and domestic businesses can contribute more to the economic growth.

"A more efficient customs process will lead to an improved country branding for Bangladesh."

Citing the Jetro survey, Md Saiful Islam, president of the Metropolitan Chamber of Commerce and Industry, Dhaka, said although there is dissatisfaction over the business environment, 66 percent of existing Japanese companies showed interest in expanding their operations in Bangladesh.

"Japanese investors stressed faster customs clearance and faster settlement of LCs."

Mohammed Amirul Haque, managing director of Premier Cement, cited bureaucratic complexity and unfavourable policies as the main obstacles standing in the way of attracting a higher volume of FDIs.

He added inefficient port handling and complicated procedure of customs lead to slower clearance of raw materials, inflicting losses on investors.

Haque, however, lauded the intention of the government aimed at securing more FDIs and making it easier to do business in a bid to accelerate economic growth.

"We need long-term policies on tax and benefits for investors, irrespective of local or foreigners."

Fahmida Khatun, executive director of the Centre for Policy Dialogue, says Japanese investors are very particular and have high work ethics.

"So, they want an enabling environment where they can work smoothly without facing any bureaucratic complexities."

M Masrur Reaz, chairman of the Policy Exchange Bangladesh, says obviously there are some reasons to be dissatisfied with the business environment in Bangladesh.

According to him, the challenges are time-consuming clearance at ports, taxation complexity, a higher tax burden and import duty, poor logistics system, and an absence of modern trade financing.

Despite conducive investment policies in Bangladesh, Japanese investors are unhappy due to some reasons such as policy inconsistency, incongruous business environment, complex repatriation processes, complicated customs procedures, delays in shipments, lack of skilled professionals, and complicated foreign exchange regulations, said Yuji Ando, country representative of the Jetro.

"However, there is a potential to improve the situation by getting rid of these bottlenecks."

Shinichi Nagata, country general manager of Sumitomo Corporation Asia and Oceania Pte Ltd, said investors move to the countries that offer benefits and tax incentives to foreign firms.

Tetsuro Kano, president of the Japanese Commerce and Industry Association in Dhaka, said the import duty of raw materials is much higher in Bangladesh than in other countries and this increases the cost of production.

He, however, said the labour cost is cheaper and this is helpful for investors.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments