Capital base up for state-run banks, down for private lenders

The capital base of state-owned commercial banks rose while it fell for private lenders at the end of the fourth quarter of 2022-23, Bangladesh Bank data showed.

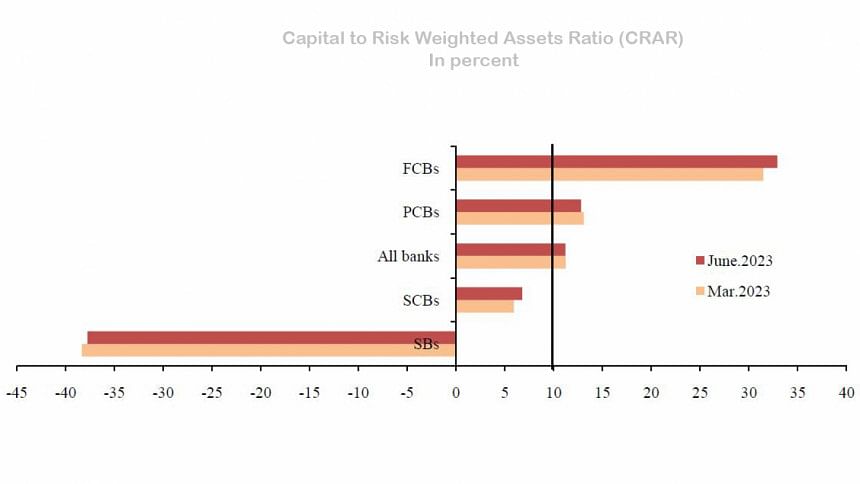

The overall capital-to-risk-weighted assets ratio (CRAR) of private commercial banks stood at 12.82 percent in April-June, down from 13.08 percent in the previous quarter.

The ratio assesses a bank's financial stability by measuring its available capital as a percentage of its risk-weighted credit exposure.

The capital adequacy ratio of state-owned commercial banks climbed to 6.76 percent in the fourth quarter from 5.90 percent in the third quarter.

BB data also showed that the banking sector's capital base remained stable at the end of the July-September quarter of the current financial year as the overall CRAR was almost unchanged at 11.2 percent.

Banks are required to keep at least 11.817 percent CRAR as per a roadmap set by the central bank to implement Basel III.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments