Candy, noodles top export items alongside biscuits

Candy, which did not attract the attention of exporters even a decade ago, has become one of the top five items in Bangladesh's processed food export basket, highlighting the much-needed value-addition brought on by manufacturers.

Noodles, another popular food, has also become one of the major items shipped from the country.

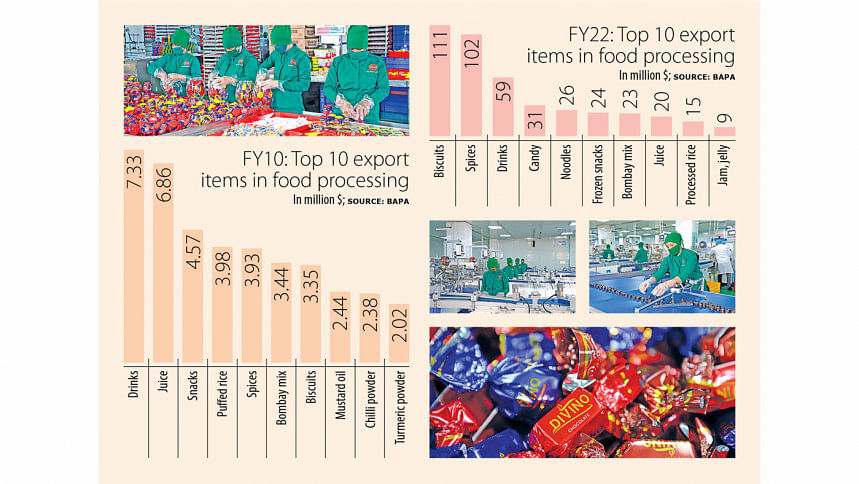

Biscuit and bakery items, which ranked seventh on the list of top 10 export products in 2009-10, have become the No.1 item in the processed food category, replacing drinks, according to data compiled by the Bangladesh Agro-Processors Association (BAPA).

The data points to the changing composition of the processed food export basket.

"Bangladesh had factories to make candies a decade ago, but we did not try to find out the potential for confectionery items in the overseas markets. We have been exploring the international market for the last five years," said Eleash Mridha, managing director at Pran Group, the biggest food processor and exporter.

BAPA figures showed that exporters fetched $30 million from candy shipments in 2021-22. The product was the fourth-largest earner in the processed foods category in the year.

Biscuits and bakery items topped the list and spices and drinks came second and third respectively in FY22.

Md Parvez Saiful Islam, chief operating officer of Square Food & Beverage Ltd, said the demand for its spice is growing abroad.

Bangladesh earned $458 million from shipping of foods in FY22, with the top 10 items accounting for 91 percent of the receipts, according to the BAPA.

The association is yet to compile data on product-wise export receipts for the last financial year of 2022-23.

Mridha said local exporters initially focused on the Bangladeshis working mainly in the Middle East and other regions.

"Over the years, we have expanded our reach as we have added more value-added items to our export basket targeting non-Bangladeshi consumers too," he said, adding that Arabs also purchase confectioneries and biscuits shipped from Bangladesh.

He said they identified the prospect of confectionery in the Middle East after finding out that the candies available there came from Turkey and they were expensive.

"So, we tried to catch the market and have done well," said the official of Pran, which has a confectionery plant.

The firm is growing cassava through contract farming in order to make liquid glucose for confectionery items. It has included value-added drinks to the basket and its export has risen.

"We are selling confectioneries in the Middle East and the Asean region. We are also shipping a good number of candy items to Australia," Mridha said.

"In the past, our focus was on the Bangladeshi consumers. Now, we have entered the global market in a real sense."

According to Mridha, the growing shipment of confectionery items also points to value-addition, investments, and job creation in the processed food segment, contributing to the country's diversification efforts.

Bangladesh's noodles are going to Europe and the Middle East.

Nazim Uddin, head of Olympic Industries Ltd, said the company initially targeted the Middle East to sell biscuits and confectionery items as the region employs a large number of Bangladeshi migrant workers.

Eventually, the largest biscuit maker increased export earnings.

"Our biscuits and dry cakes are popular among non-Bangladeshi consumers, including Arabs, as well," he said.

Bangladesh's export earnings from processed foods grew more than seven times since 2009-10.

Saudi Arabia is home to nearly a fourth of one crore Bangladeshis living and working abroad. Thus, it is the biggest destination for processed foods and is expected to retain its position in the years to come.

"Local firms are making quality biscuits," said Khurshid Ahmad Farhad, general manager for export at Bombay Sweets & Company Ltd.

He said the Malaysian market will expand in the coming years as many migrant workers went to the Southeast Asian country for jobs.

Debasish Singha, head of business (export) at Danish Foods Ltd, owned by Partex Star Group, says the global processed foods market is large and offers a lot of opportunity.

"Local entrepreneurs need to make investments and focus on gaining more market share."

Data from the Export Promotion Bureau showed that sugar confectionery exports declined to $24 million in FY23 from $29 million the previous year.

However, the shipment of items such as noodles and pasta surged 45 percent to $35 million.

Pran's Mridha said Bangladesh's exports will grow if the government inks a free trade deal with the Asean region, which comprises 10 Southeast Asian nations representing more than 68 crore population and about 6.5 percent of global GDP.

He said the market for basic spices is shrinking and the demand for mixed spices is growing.

He urged the government to provide duty-free import opportunities for cinnamon and cumin seeds so that they could make mixed spices for the international market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments