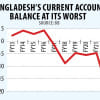

Current account balance turns positive

The country's current account balance stood in positive territory in the first quarter of the current fiscal year due to a sharp slowdown in imports.

A country's current account represents its imports and exports of goods and services, payments made to foreign investors, and transfers such as foreign aid, according to investopedia.com.

In the July-September period of fiscal year 2023-24, the current account balance stood at $892 million whereas it was $3.67 billion in the negative in the previous fiscal year, as per the latest data of Bangladesh Bank.

Current account balance has turn around, which is good news but it was in the positive because of a sharp fall in imports, said Zahid Hussain, former lead economist at the World Bank's Dhaka office.

Exports were up 9.85 percent year-on-year to reach $12.93 billion during the quarter while imports dropped 23.77 percent to $14.74 billion.

Import payments have fallen mainly due to austerity measures put in place by the government and the central bank to stop the depletion of the forex reserve, which has fallen by about 25 percent in the last one year.

A shortage of US dollars and a lingering gas crisis have also prompted many businesses and industries to slash imports and put their investment and expansion plans on hold.

In the July-September period of this fiscal year, the trade deficit narrowed to $1.81 billion from $7.57 billion in the same period of last fiscal year.

The imports of Bangladesh are related to production and investment and so any fall was a cause for concern, said the economist.

However, the central bank explained that they reduced overinvoicing by checking prices which was why value of imports declined, he said, adding that the imports did not fall solely for the reduction in overinvoicing.

There is no doubt that the real import has declined, as per the economist.

During the July-September period this fiscal year, the financial account stood at $3.92 billion in the negative whereas it was $839 million in the positive in the same period of previous fiscal year.

The financial account is a key component of a country's balance of payments.

It covers claims or liabilities to non-residents concerning financial assets and its components include foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investment and reserve assets.

The overall balance of payments (BoP) was $2.85 billion in the negative in the July-September quarter, down from $3.31 billion in the negative in the same period of the previous year.

The BoP represents the sum of balances of the current account and the non-reserve portion of the capital and financial account, plus net errors and omissions.

Although the balance of payments had reduced, it was still in the negative, which means that external pressure continues to persist, said Zahid Hussain.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments