Actual investment far lower than proposed

Actual investments at six government-owned economic zones have remained at a far lower level compared to the proposals put forward by both foreign and local investors owing largely to inadequate facilities, official figures showed.

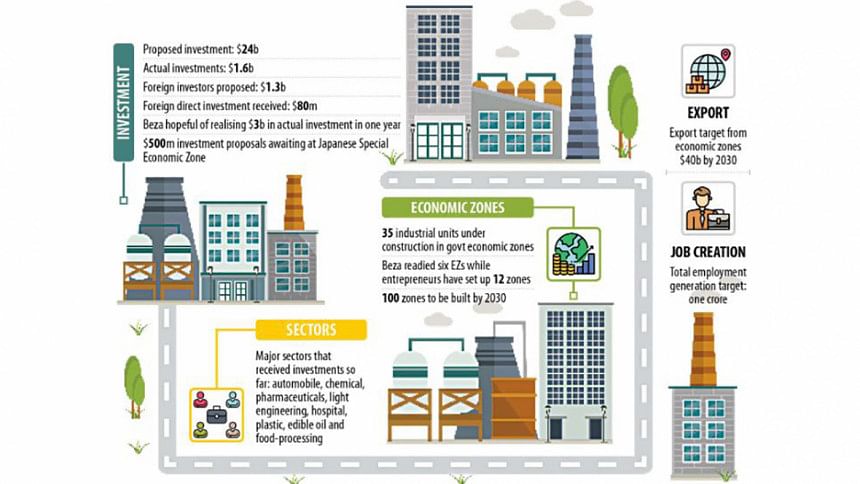

Local and foreign investors have promised to invest $24 billion in the industrial enclaves in the last three and a half years. But the actual investments stand at $1.6 billion, according to the Bangladesh Economic Zones Authority (Beza).

Of the realised investment, $80 million came from foreign investors, which is again much lower than the inflows initially pledged.

An analyst has termed the amount disappointing.

Of the units, 23 are being set up at the Bangabandhu Sheikh Mujib Shilpa Nagar in Chattogram, two in Moheshkhali Economic Zone of Cox's Bazar, six in Sreehatta Economic Zone of Moulvibazar, and five units in Jamalpur Economic Zone, said Beza Executive Chairman Shaikh Yusuf Harun.

"Some investors have had to develop land on their own and they have taken more time. This is one of the reasons for the slow realisation of investment. We are encouraging our investors to start the construction work immediately."

In 2015, the government decided to set up 100 economic zones across the country to attract both foreign and local investments to accelerate industrialisation, create one crore jobs and export an additional $40 billion worth of goods and services by 2030.

After eight years, the Beza has readied six economic zones while entrepreneurs have set up 12 enclaves.

In order to draw investments to the zones, the government has offered a 100 percent income tax exemption for 10 years on capital gains, dividends, royalties, and technical assistant fees and an 80 percent exemption on value-added tax on electricity, water and gas consumption.

Besides, export-oriented industries are allowed to sell 20 percent of their products in the burgeoning local market and foreign nationals working in the zones may remit 75 percent of their net salaries.

However, responses from foreign investors are lukewarm.

The state-run agency is, however, hopeful that investors will put in $3 billion within the next one year as more than 35 industrial units are under construction at the government-run economic zones.

Besides, Harun said, agreements are set to be inked to invest around $500 million at the Japanese special economic zone.

According to the Beza, Marico Bangladesh, a multinational company operating in the country for nearly decades, invested $6 million, Asian Paints Bangladesh invested $34 million, and Nippon & McDonald Steel Industries Ltd, a joint venture, made an investment of $15 million.

The agency has attracted foreign direct investments from Japan, China, India, Australia, Germany, the Netherlands, the US, the UK, Singapore, South Korea, and Norway, sources said.

The investment proposals have been made in the sectors such as automobile, chemical, pharmaceuticals, light engineering, hospital, plastic, edible oil, and food-processing.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, said overall facilitates are yet to be ready at public economic zones. "So, the exact investment has been low compared to the amount proposed."

He does not think that land development is the main factor.

"Rather, the economic zones need smooth utility supplies, availability of skilled workforce and proper one-stop services," Raihan said, adding that there are also legal issues that need to be addressed.

The economist also blamed bureaucratic complexities and a lack of smooth port services as factors that discourage local investments and FDIs.

Raihan, also a professor of economics at the University of Dhaka, emphasised open and cooperative regulatory bodies.

Khondaker Golam Moazzem, an industrial economist, said the investment realisation at the EZs is really disappointing.

The Beza has been trying to develop the economic zones for the last 10 years, but actual investment is yet to reach the expected level since both "hard and soft" infrastructures that are needed to ensure an investment-friendly environment have not been developed.

"Investments can't be attracted by providing land and utility services alone. There has to be a smooth supply of skilled workers and housing facilities for workers and staff."

Moazzem thinks the allotments of plots for the investors who have not made investments within the stipulated time could be scrapped and the land can be distributed among more capable entrepreneurs.

The research director of the Centre for Policy Dialogue called for finding out the actual reasons for the low investments and addressing the bottlenecks.

M Masrur Reaz, chairman of the Policy Exchange of Bangladesh, said investment realisation has not been happening in and outside of economic zones owing to the local currency volatility over the last 18 months.

The taka has lost its value by nearly 30 percent against the US dollar since January last year, central bank data showed.

The former economist of the International Finance Corporation said investors got cooperation when they received the allocation of land from the Beza.

"However, they faced challenges while availing permissions from various regulators to translate their investment plans into reality as well as for various services. As a result, investment realisation has remained low."

Beza's Harun hopes the actual investment will go up once factories that have been set up in the zones go into production as others will be encouraged to follow suit. The lower investment in the economic zones comes at a time when investment is falling globally.

For example, global flows of FDI fell by 12 percent to $1.3 trillion in 2022, according to the World Investment Report 2023 prepared by the United Nations Conference on Trade and Development.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments