Three firms spending Tk 1,000cr on first private submarine cable

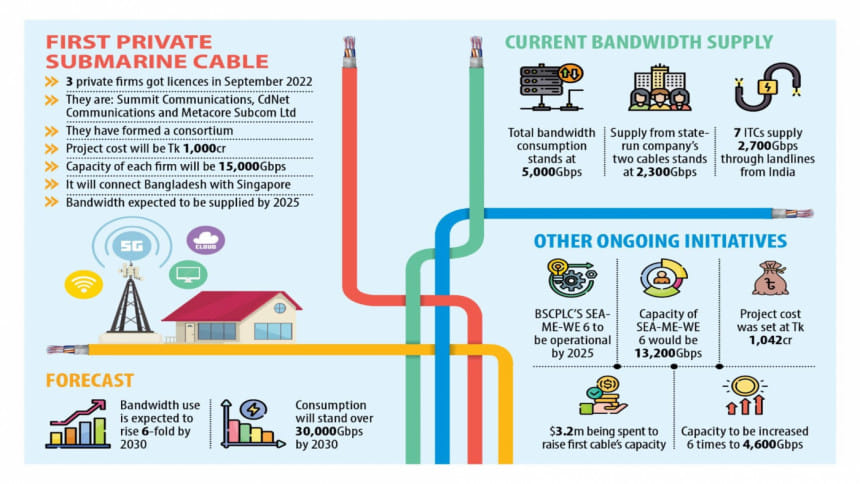

Three local companies are spending about Tk 1,000 crore for the first private submarine cable that will connect Bangladesh with the outside world for data transmission.

Three private licensees of submarine cable -- Summit Communications, CdNet Communications and Metacore Subcom Ltd -- have formed a consortium to install the cable, which will have the capacity to supply 45,000Gbps bandwidth.

The development is set to disrupt the monopoly held by the state-controlled wholesale bandwidth provider, Bangladesh Submarine Cables PLC (BSCPLC), and is expected to lower internet prices by increasing the supply of bandwidth.

"We, the three companies together, have already entered into an agreement with Singapore-based Campana," Mashiur Rahman, CEO of CdNet Communications, told The Daily Star.

The 3,000km undersea cable, originating from Singapore, will connect to Bangladesh's Cox's Bazar. The fibre laying process will be conducted in two phases, he added.

Campana will provide a connection to the Sigmar cable, a 1900-km long cable system connecting Singapore and Myanmar. The three companies will pay about $35 million and will get indefensible rights of use for 25 years.

For the second phase, the local consortium is finalising a deal with submarine cable provider HMN to lay fibre from Cox's Bazar to Myanmar. For that, the three companies have to spend about $45 million.

"The contract with HMN will be signed in December this year," said Rahman.

The cable will have three fibre pairs and will have a data transmission capacity of about 15,000Gbps through each pair.

The cable will connect Bangladesh with Telin-3, a data centre located at Tanjong Kling in Singapore.

Currently, total bandwidth usage stands at about 5,000Gbps and more than half of it -- about 2,700Gbps -- comes through international terrestrial cable (ITC) licences, which are used to import bandwidth from India across land.

The rest -- about 2,300Gbps -- is supplied by the BSCPLC, which connects the country with two submarine cables.

Bangladesh is a member of the South East Asia-Middle East-Western Europe 4 (SEA-ME-WE 4) consortium, the first undersea cable with which Bangladesh was connected in 2006. It supplies about 800Gbps bandwidth.

The BSCPLC supplies 1,500Gbps through the SEA-ME-WE 5, the connection for which was established in 2017.

The company is set to receive 13,200Gbps from a third undersea cable, SEA-ME-WE 6, by 2025.

Also, the BSCPLC is going to spend $3.2 million to raise the capacity of its first undersea cable by nearly six times to 4,600Gbps.

The project cost for SEA-ME-WE 6, the BSCPLC's third cable, was set at Tk 1,055 crore.

According to Rahman, the private cable will offer lower latency than that of the BSCPLC's as it will cover a considerably shorter distance.

Mirza Kamal Ahmed, managing director of the BSCPLC, said the third cable will not only connect Singapore but many other countries such as Saudi Arabia, Egypt, France and India.

"That is why it is costlier than the private one," he added.

In a development that broke the state monopoly in the wholesale bandwidth business, private firms obtained licences to establish, maintain and operate submarine cables in September last year amid a surge in internet use.

Before the Covid-19 pandemic, the BSCPLC dominated the bandwidth supply with its undersea cables. But the pandemic has pushed up internet usage several-fold, leading the ITC operators to bring more bandwidth from India.

Bangladesh first introduced ITC licences in 2011 to ensure bandwidth availability and redundancy, and to reduce the risk of internet blackouts due to maintenance of undersea cables or natural disasters.

Aminul Hakim, former president of the Internet Service Providers' Association of Bangladesh, said bandwidth supply through submarine cables was more suitable from a national interest perspective.

Investment in submarine cables is a one-time expense whereas ITC companies have to pay foreign currency for bandwidth every month.

"So, after the establishment of new government and private submarine cables, there is no logic to continue ITC licences," said Hakim, a director of Metacore Subcom.

According to industry people, the annual cost of ITC payments will surpass $30 million this year.

However, Abu Saeed Khan, a telecom expert, pointed to some red flags.

"Campana is not a financially viable company and it has yet to produce any success in its cable ventures. There is also an underlying political reason. Although it is based in Singapore, it is owned by Myanmar nationals. That worries me," he said.

"The three companies are riding on the same cable and they are putting all their eggs in one basket. That's not a very sensible solution. If anything untoward happens, all three parties will be down simultaneously, making it a high-risk venture," added Khan, a senior policy fellow at LIRNEasia.

Officials said they initially planned to opt for separate cables, but backtracked amid the US dollar shortage.

"Given the current dollar price, it will not be feasible," said Hakim. "Moreover, even if we opted for separate cables, we would have to follow the same route. Therefore, collaborating on a single cable or multiple cables would entail similar risks."

If all of the country's classrooms get connected to high-speed internet, the speed of digital growth continues, and 5G is rolled out, the broad projection is bandwidth consumption could rise to 34,000Gbps by 2025, according to estimates by Bangladesh Telecommunication Regulatory Commission (BTRC).

Mustafa Jabbar, telecom minister, recently said the use of internet bandwidth will shoot up by 600 percent in seven years to 30,000Gbps as people are ramping up internet use.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments