Equity funds from foreign investors dip

Bangladesh received 41 percent lower equity capital from foreign investors in fiscal year (FY) 2022-23 compared to a year ago as it faces challenges in stabilising the exchange rate amid shortage of foreign currencies and managing its external accounts comfortably.

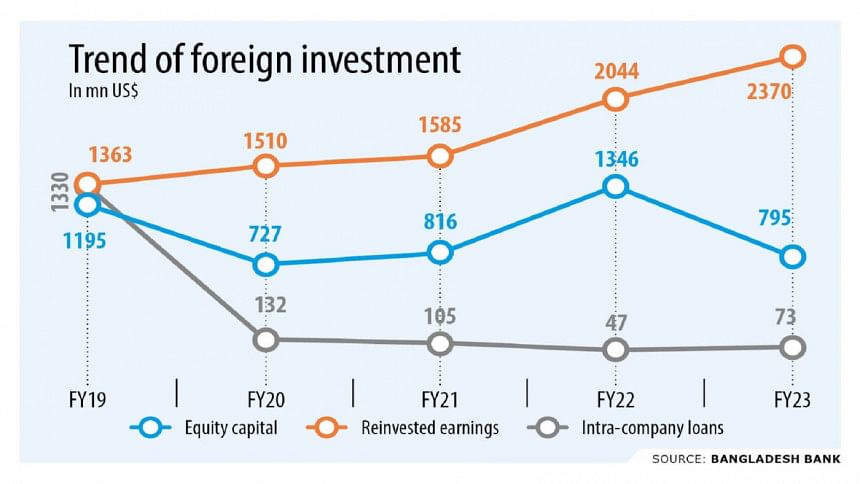

Bangladesh received US$795 million in the FY2022-23, down from $1,346 million a year ago, according to a Bangladesh Bank (BB) report released on Sunday.

With the dip in equity capital inflow from international investors, total net foreign direct investment declined nearly 6 percent year on year to $3,249 million even though foreign investors, who are already operating in Bangladesh, the second biggest economy in South Asia after India, registered spike.

Companies operating here reinvested $2,370 million in FY2022-23, which was a 16 percent increase year-on-year, according to the Foreign Direct Investment and External Debt, a half-yearly report by the central bank.

"Availability of dollar for repatriation of profits and dividends is being constrained. As a result, existing investors are reinvesting their profits," said M Masrur Reaz, chief executive officer of Policy Exchange Bangladesh, a private, independent advisory firm in Dhaka.

The nation, which once boasted $48 billion in gross foreign exchange reserves, recorded $25 billion on November 29 as inflows continued to fall short of outflows for imports and other payments.

The forex reserve fell further, hitting $19.4 billion as per the calculation method of the International Monetary Fund.

The taka lost around 30 percent of its value against the US dollar since July 2021 according to official estimates.

Unofficially, the rate of the taka's depreciation is higher, with the greenback trading at around Tk 120 each, which is higher than the official rate Tk 110.5 for imports. The central bank is yet to allow a floating exchange rate.

Reaz said the plunge in equity capital flow is a reflection of the ongoing macroeconomic challenges, although Bangladesh's long-term economic growth prospects remain solid.

"At a time when the local currency is facing depreciation and discouragement in imports, new investors will hesitate to invest," he said.

"Bringing back stability to the local currency and improving the availability of dollar will bring confidence."

BB data showed that inflow of equity capital was the lowest in FY23.

Besides, the amount of disinvestment such as capital repatriation, loans to parents, and repayments of intra-company loans to parents stood at $1,178 million during the year. The amount of disinvestment was nearly $1,200 million the previous year.

The decline in the flow of foreign investment, even after so many efforts, is a matter of concern, said Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue (CPD), citing establishment of economic zones and enactment of one-stop service law.

"Investors are getting land. But we are yet to ensure various other services that are needed to attract investors," he said. "So the only incentive does not work. Without an integrated approach, the expected amount of investment, which is needed to become a developed economy, will be tough to materialise."

Reaz said there are long-standing issues that still prevail in Bangladesh's investment climate.

"A lot more improvement is necessary to catch up with comparators, namely India, Vietnam and Indonesia," he said.

"There is a need for modernisaiton of age-old policies and improvement of efficiency and transparency of regulatory service delivery. We also need a significant improvement in trade facilitation."

Syed Ershad Ahmed, President of The American Chamber of Commerce in Bangladesh (AmCham), said the global economic slowdown and the Russia-Ukraine war were major reasons for the fall in the entry of equity capital.

"Maybe we could not do enough economic diplomacy. There are challenges in logistics. Lead times here are lengthier than in countries such as Vietnam," he said, also citing delays in customs clearance.

"We need to improve efficiency, automation and transparency in customs to attract increased flow of foreign investment," he said.

Mohsina Yasmin, executive member for investment promotion at the Bangladesh Investment Development Authority, said foreign investment proposals had reduced this year.

"It may be that the war is a reason. There has been no dramatic change in incentives and taxes for foreign investors. Rather, incentives have increased in some areas," she said, adding that the agency did not conduct any research to unearth the reasons behind falling foreign investment flow.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments