Debt burden gets heavier as Bangladesh runs low on capacity to repay

Bangladesh's debt service to revenue ratio is projected to cross the 100 percent mark for the first time owing to rising loans and lower tax and export receipts, highlighting the growing risk to the country's capacity to repay.

The debt service-to-revenue and grants ratio stood at 58.7 percent in the fiscal year of 2020-21 but it surged to 72 percent in FY22 and 71.8 percent in the last fiscal year of 2022-23, according to the International Monetary Fund (IMF).

It is projected to grow to 101.1 percent in the current financial year. Debt service is defined as the sum of interest and amortisation of medium and long-term, and short-term debt.

"The increasing debt service to revenue ratio highlights the urgency of mobilising tax revenue to support much-needed spending to achieve pro-poor, green growth recovery," the IMF said.

The higher ratio comes as the National Board of Revenue (NBR) missed its tax target for the 11th consecutive year in FY23, in the face of slowing growth of collections amidst economic slowdowns and ambitious goals set by the government.

Export earnings in terms of gross domestic product (GDP) stood at 10.7 percent in FY21 and 12.9 percent in FY22 and it is expected to reach 14 percent in FY24.

In Bangladesh, the risk of external debt distress and the overall risk of debt distress has remained low.

However, the persistently low revenue receipts have not only limited the government's ability to spend but are also posing a threat to the country's debt sustainability.

A spike in interest rates owing to the global monetary policy tightening and the sharp depreciation of the local currency have also deepened the risk.

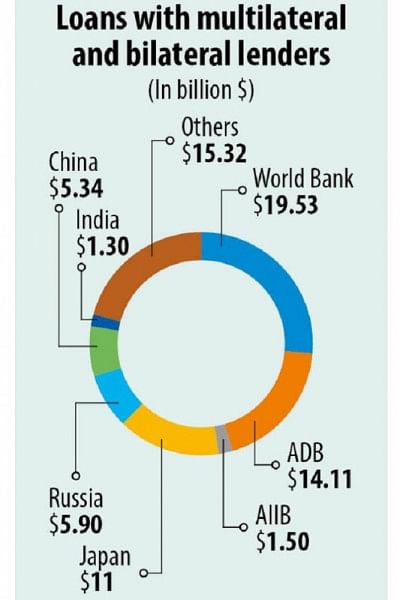

The government's total debt amounted to $166.65 billion in FY23. Of the volume, external debt stood at $74 billion, which is predominantly owed to multilateral and bilateral creditors, at $38.81 billion and $25.35 billion, respectively.

The government owes $19.53 billion to the World Bank, $14.11 billion to the Asian Development Bank, and $1.5 billion to the Asian Infrastructure Investment Bank.

Among the bilateral lenders, Japan is the biggest creditor with $11 billion in loans, followed by Russia $5.9 billion, China $5.34 billion, and India $1.3 billion.

Historically, Bangladesh's debt-to-GDP ratio hovered around 32.2 percent. But it shot up recently, reaching 35.6 percent in FY21. Of them, external debt was 15.1 percent.

The overall debt-to-GDP ratio went up to 39.8 percent in the last fiscal year, which included 17.7 percent of external debt.

An analysis of the World Bank-IMF projected that the overall debt will rise to 41.4 percent in FY24 and the external debt to 18.1 percent.

The IMF said all but one external debt indicators are below their corresponding thresholds under the most extreme shock, despite an initial increase due to large and ongoing taka depreciation.

The taka has lost its value by about 28 percent against the US dollar since January last year since foreign currency reserves started to decline at a faster rate as import bills outpaced earnings from both export and remittance sectors.

The IMF said Bangladesh's debt-carrying capacity is unchanged from the previous DSA of 2021. External and overall debt indicators are below their respective thresholds under the baseline.

Under a standard stress test, the present value of the debt-to-export ratio temporarily breaches the threshold of the external debt sustainability indicator. This short-duration breach of low magnitude is discounted via judgement.

The IMF said risks are tilted to the downside and include persistent inflation, increasing interest burden, revenue mobilisation constraints, slowdown in major trading partners, slow implementation of macro-critical structural reforms, amplified foreign exchange pressures, elevated non-performing loans, and climate-related events.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said one of the reasons for the recent increase in the debt service-to-revenue ratio was the depreciation of the taka and the increase in the interest rate of treasury bills.

"There is no other alternative but to increase the revenue generation so that the government retains the capacity to pay back loans."

He said existing loans have to be repaid and new funds should be borrowed. "If there is no disruption to this process, there will be no problem for Bangladesh."

Hussain said although the debt distress is low, Bangladesh faces risks from the external sector.

"If there is any adverse shock from the export sector, the debt sustainability may reach an unbearable level."

According to a document from the IMF, the government has agreed that rising interest rates, both external and domestic, will remain a critical challenge in the coming years, leading it to revise up the interest payment projections since the previous DSA.

The government has restated its commitment to public financial and debt management to improve the debt dynamics and ensure fiscal and debt sustainability. It also acknowledged the urgent need to accelerate domestic revenue mobilisation to meet financing needs, the paper said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments