Growing inequality lays bare broader economic divide: CPD

The income inequality between the rich and the poor has surged to a level that the country is witnessing two economic systems, which go against the spirit of the Liberation War, said the Centre for Policy Dialogue (CPD).

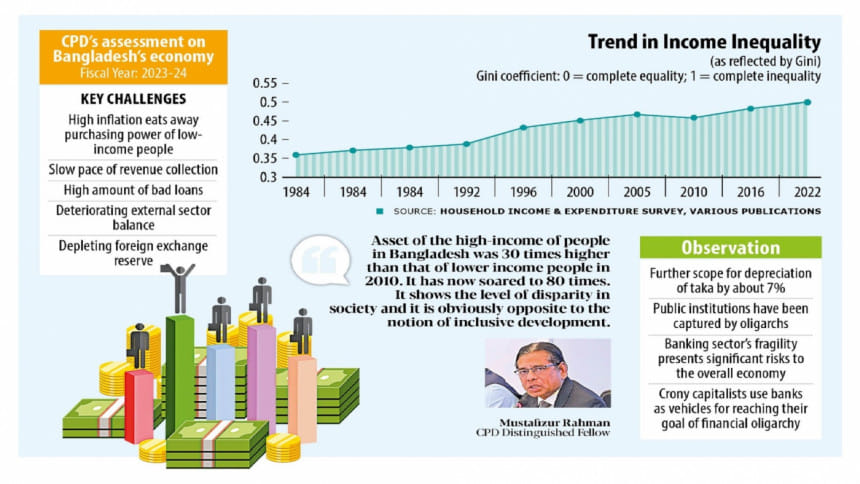

Prof Mustafizur Rahman, a distinguished fellow of the think-tank, said the assets of the high-income people of Bangladesh were 30 times the lower income group in the Household Income and Expenditure Survey of 2010.

"Now, it has soared to 80 times. It shows the level of disparity in society and it is obviously opposite to the notion of inclusive development."

He spoke during a media briefing organised to share the think-tank's observation on the state of Bangladesh's economy in the fiscal year of 2023-24 at its office in the capital.

Gini co-efficient, another tool to measure disparity in a society, is also on the rise, Prof Rahman said referring to the data of the Bangladesh Bureau of Statistics.

The Gini coefficient related to income rose to 0.499 in 2022, up from 0.482 in 2016 and 0.458 in 2010. Generally, a country is considered to have a high-income inequality if the Gini coefficient is 0.500 and above.

"The disparity undermines the spirit of the Liberation War," said Prof Rahman.

He suggested using the fiscal tool by imposing high taxes on high-income groups and distributing it among the poor in order to rein in inequality.

However, he said, the problem remains in the process. As a result, the tax-to-GDP ratio is still low and it is deteriorating.

"In fact, Bangladesh is among a small group of countries where direct tax is lower than that of indirect tax."

Khondaker Golam Moazzem, research director of the CPD, echoed Rahman, saying the economic sector needs reforms to reduce inequality.

"But we don't see any hope for reforms after the election because the type of participatory and competitive polls that can promise such reforms are not going to be held."

He warned inequality may even rise after the elections.

According to Moazzem, some of the regulators that needed reforms include the Bangladesh Bank, the Bangladesh Securities and Exchange Commission, the Bangladesh Competition Commission, finance, commerce, expatriates' welfare and overseas employment, and labour and employment ministries, the Bangladesh Export Processing Zones Authority, and the industrial police.

Fahmida Khatun, executive director of the CPD, thinks establishing good governance through reform measures will not be an easy task as the vested interest groups are strong and public institutions have been captured by the oligarchs.

During her presentation, Fahmida identified five areas where the government should give a major focus: public finance, inflation, the banking sector, the external sector and debt sustainability, and labour rights.

The CPD says annual development programme (ADP) utilisation remains sluggish perhaps due to the government's cost-cutting efforts.

It recommended prioritising the unfinished agenda and reducing expenditure in the short-term, recognising the frontier issues of taxation such as meaningfully taxing property, wealth and the expanding digital economy, curbing illicit financial outflows, and emphasising digitalisation of the entire revenue system.

Inflation

A major problem the economy has been facing lately is that prices for basic things are going up and the ongoing price increase has been influenced by domestic factors, including market distortion caused by a small number of dominant businesses and inadequate monitoring mechanisms, said the CPD.

The price of essentials such as rice, sugar and oil rose from 9 to 400 percent between 2019 and 2023.

The costs of goods and services as well as the price of food items are increasing, making it harder for the lower income families to make ends meet since salaries and wages are not rising at that pace, said Fahmida Khatun.

The think-tank suggested strengthening the role of the Bangladesh Competition Commission, particularly in the case of the essential consumer goods market.

"The commission should develop a database, regularly monitor the dominant market players' operations, examine the market control and manipulation (if any), and take proper measures," it said.

"The commission should adopt a strong stance against cartels and a zero-tolerance policy towards collusive practices. The Minimum Wage Board should consider increasing the minimum wages in all industries so that workers can at least afford basic foods."

It said the distribution of essential commodities sold through the open market system must be managed effectively and without corruption to ensure that eligible people can access the items at low prices.

Banking sector

Bangladesh's banking sector has consistently demonstrated vulnerability, primarily because of a lack of good governance and a dearth of reforms.

Its weaknesses have been consistently exposed through the higher loan default rates and sub-par performance across various indicators.

"Without reducing NPLs, the capital adequacy can't be improved since an elevated level of bad loans leads to increased provisioning requirements, resulting in capital shortfall," said Fahmida.

"A goal-specific, time-bound, unbiased and independent citizen's commission on banking should be set up to bring transparency, identify the root causes of the manifest problems, and suggest credible measures for improving the situation sustainably."

Continuing vulnerabilities in external sector

Key external sector performance correlates such as exchange rate stability, the volume of foreign exchange reserves, export performance, the availability of forex for the opening of letters of credit, and remittance flows all suggest that the worrisome developments experienced in the last financial year have continued in the ongoing financial year of 2023-24.

The balance of payments scenario continued to face serious difficulties in July-October of FY24. The improvement in the current account was driven primarily by a sharp decline in imports.

The CPD said falling imports will have adverse consequences for key macroeconomic performance indicators and the growth of the economy.

It said the negative financial account balance has contributed primarily to the falling forex reserves. "This needs to be reversed by attracting foreign direct investments."

Debt problem

Prof Rahman said the debt of Bangladesh is still not at a concerning level if compared to GDP.

"However, tension is growing as foreign exchange reserves are falling and the share of non-concessional loans is rising. The interest rate of foreign loans is also going up."

He said the ADP is fully loan-based, both local and foreign, which is uncommon in the world. "It is raising the loan burden for the country."

Prof Rahman said some countries couldn't upgrade themselves from the lower-middle-income country to the higher-middle-income country due to huge debt.

"This is called the middle-income trap or the debt trap. We are now heading towards the situation."

Prof Rahman urged the government not to take up loan-based mega projects in the short term.

"Moreover, the government should work to enhance the internal rate of return and the economic rate of return of the existing projects."

The CPD said the labour rights of Bangladesh has regained fresh attention as major trading partners such as the US and the EU continue to incorporate labour rights compliance as a key conditionality for trading and associated preferences.

Now, a coordinated and immediate approach is required, particularly targeting to start government-to-government negotiations, seeking time and assistance to minimise the possibilities of trade penalties, visa restrictions, sanctions, or removal of preferential trade measures, Fahmida said.

She called for ensuring a fair trial for the garment workers detained during the recent wage protest, withdrawing any false cases filed against them, and providing compensation to the families of the workers who were killed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments