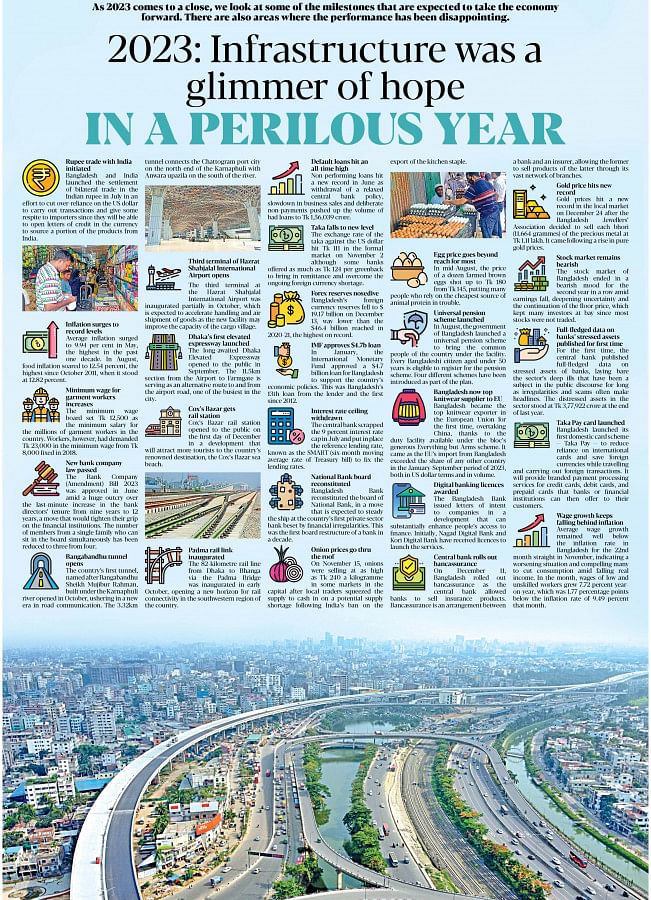

2023: Infrastructure was a glimmer of hope in a perilous year

As 2023 comes to a close, we look at some of the milestones that are expected to take the economy forward. There are also areas where the performance has been disappointing.

Rupee trade with India initiated

Bangladesh and India launched the settlement of bilateral trade in the Indian rupee in July in an effort to cut over-reliance on the US dollar to carry out transactions and give some respite to importers since they will be able to open letters of credit in the currency to source a portion of the products from India.

Inflation surges to record levels

Average inflation surged to 9.94 per cent in May, the highest in the past one decade. In August, food inflation soared to 12.54 percent, the highest since October 2011, when it stood at 12.82 percent.

Minimum wage for garment workers increases

The minimum wage board set Tk 12,500 as the minimum salary for the millions of garment workers in the country. Workers, however, had demanded Tk 23,000 in the minimum wage from Tk 8,000 fixed in 2018.

New bank company law passed

The Bank Company (Amendment) Bill 2023 was approved in June amid a huge outcry over the last-minute increase in the bank directors' tenure from nine years to 12 years, a move that would tighten their grip on the financial institutions. The number of members from a single family who can sit in the board simultaneously has been reduced to three from four.

Bangabandhu tunnel opens

The country's first tunnel, named after Bangabandhu Sheikh Mujibur Rahman, built under the Karnaphuli river opened in October, ushering in a new era in road communication. The 3.32km tunnel connects the Chattogram port city on the north end of the Karnaphuli with Anwara upazila on the south of the river.

Third terminal of Hazrat Shahjalal International Airport opens

The third terminal at the Hazrat Shahjalal International Airport was inaugurated partially in October, which is expected to accelerate handling and air shipment of goods as the new facility may improve the capacity of the cargo village.

Dhaka's first elevated expressway launched

The long-awaited Dhaka Elevated Expressway opened to the public in September. The 11.5km section from the Airport to Farmgate is serving as an alternative route to and from the airport road, one of the busiest in the city.

Cox's Bazar gets rail station

Cox's Bazar rail station opened to the public on the first day of December in a development that will attract more tourists to the country's renowned destination, the Cox's Bazar sea beach.

Padma rail link inaugurated

The 82-kilometre rail line from Dhaka to Bhanga via the Padma Bridge was inaugurated in early October, opening a new horizon for rail connectivity in the southwestern region of the country.

Default loans hit an all-time high

Non-performing loans hit a new record in June as withdrawal of a relaxed central bank policy, slowdown in business sales and deliberate non-payments pushed up the volume of bad loans to Tk 1,56,039 crore.

Taka falls to new level

The exchange rate of the taka against the US dollar hit Tk 111 in the formal market on November 2 although some banks offered as much as Tk 124 per greenback to bring in remittance and overcome the ongoing foreign currency shortage.

Forex reserves nosedive

Bangladesh's foreign currency reserves fell to $ 19.17 billion on December 13, way lower than the $46.4 billion reached in 2020-21, the highest on record.

IMF approves $4.7b loan

In January, the International Monetary Fund approved a $4.7 billion loan for Bangladesh to support the country's economic policies. This was Bangladesh's 13th loan from the lender and the first since 2012.

Interest rate ceiling withdrawn

The central bank scrapped the 9 percent interest rate cap in July and put in place the reference lending rate, known as the SMART (six-month moving average rate of Treasury bill) to fix the lending rates.

National Bank board reconstituted

Bangladesh Bank reconstituted the board of National Bank, in a move that is expected to steady the ship at the country's first private sector bank beset by financial irregularities. This was the first board restructure of a bank in a decade.

Onion prices go thru the roof

On November 15, onions were selling at as high as Tk 240 a kilogramme in some markets in the capital after local traders squeezed the supply to cash in on a potential supply shortage following India's ban on the export of the kitchen staple.

Egg price goes beyond reach for most

In mid-August, the price of a dozen farmed brown eggs shot up to Tk 180 from Tk 145, putting many people who rely on the cheapest source of animal protein in trouble.

Universal pension scheme launched

In August, the government of Bangladesh launched a universal pension scheme to bring the common people of the country under the facility. Every Bangladeshi citizen aged under 50 years is eligible to register for the pension scheme. Four different schemes have been introduced as part of the plan.

Bangladesh now top knitwear supplier to EU

Bangladesh became the top knitwear exporter in the European Union for the first time, overtaking China, thanks to the duty facility available under the bloc's generous Everything but Arms scheme. It came as the EU's import from Bangladesh exceeded the share of any other country in the January-September period of 2023, both in US dollar terms and in volume.

Digital banking licences awarded

The Bangladesh Bank issued letters of intent to companies in a development that can substantially enhance people's access to finance. Initially, Nagad Digital Bank and Kori Digital Bank have received licences to launch the services.

Central bank rolls out bancassurance

On December 11, Bangladesh rolled out bancassurance as the central bank allowed banks to sell insurance products. Bancassurance is an arrangement between a bank and an insurer, allowing the former to sell products of the latter through its vast network of branches.

Gold price hits new record

Gold prices hit a new record in the local market on December 24 after the Bangladesh Jewellers' Association decided to sell each bhori (11.664 grammes) of the precious metal at Tk 1.11 lakh. It came following a rise in pure gold prices.

Stock market remains bearish

The stock market of Bangladesh ended in a bearish mood for the second year in a row amid earnings fall, deepening uncertainty and the continuation of the floor price, which kept many investors at bay since most stocks were not traded.

Full-fledged data on banks' stressed assets published for first time

For the first time, the central bank published full-fledged data on stressed assets of banks, laying bare the sector's deep ills that have been a subject in the public discourse for long as irregularities and scams often make headlines. The distressed assets in the sector stood at Tk 3,77,922 crore at the end of last year.

Taka Pay card launched

Bangladesh launched its first domestic card scheme -- Taka Pay -- to reduce reliance on international cards and save foreign currencies while travelling and carrying out foreign transactions. It will provide branded payment processing services for credit cards, debit cards, and prepaid cards that banks or financial institutions can then offer to their customers.

Wage growth keeps falling behind inflation

Average wage growth remained well below the inflation rate in Bangladesh for the 22nd month straight in November, indicating a worsening situation and compelling many to cut consumption amid falling real income. In the month, wages of low and unskilled workers grew 7.72 percent year-on-year, which was 1.77 percentage points below the inflation rate of 9.49 percent that month.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments