Credit card issuance creeps along

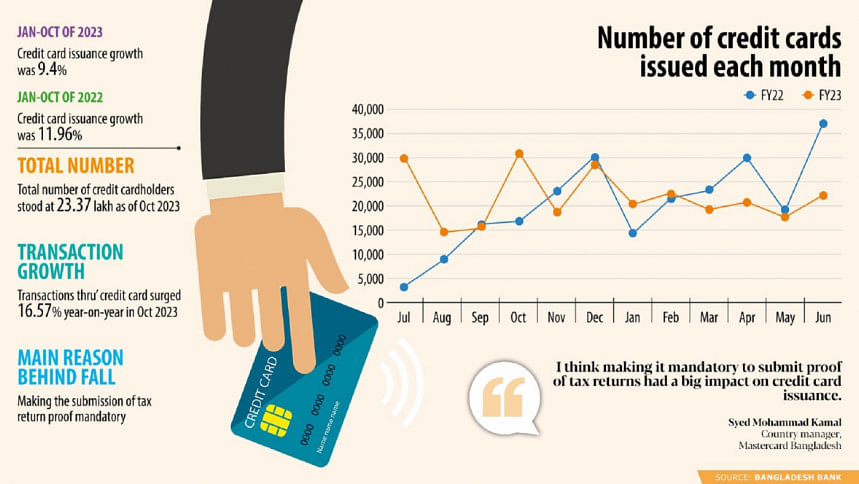

Credit card issuance by banks in Bangladesh witnessed slower growth in 2023 compared to the year prior, when the National Board of Revenue (NBR) tightened its regulations for securing the debt-based financial instrument.

In July 2022, the NBR made it mandatory for credit card applicants to submit proof of tax returns as a part of the government's push to widen the tax net.

This move led to a decline in credit card issuance, with the segment registering average growth of 11.96 percent in the first 10 months of 2022. That growth slowed to 9.4 percent during the same period in 2023.

In terms of the annual average, credit card issuance grew by 14.5 percent in 2022 while Bangladesh Bank is yet to disclose the final figures for last year.

"I think making it mandatory to submit proof of tax returns had a big impact on credit card issuance," said Syed Mohammad Kamal, country manager of Bangladesh at Mastercard.

Md Mahiul Islam, head of retail banking at BRAC Bank, echoed that sentiment.

He informed that it is only mandatory to provide proof of tax returns when availing loans greater than Tk 5 lakh or making deposits over Tk 10 lakh.

However, there is no such minimum threshold for the issuance of credit cards. So, the NBR should set a similar tax-free benchmark for credit cards, Islam said.

Besides, those whose incomes fall below the minimum requirement for paying income tax are unable to avail credit cards, resulting in issuance slowing, he added.

For example, housewives can no longer avail credit cards against their fixed deposit receipts regardless of the value of those funds as they have no taxable income that would require filing returns.

"Before the rule was introduced, we would issue around 7,500 credit cards each month. Now, 50 percent fewer customers are availing the facility," Islam said.

Md Abu Bokar Siddik, head of cards of Mutual Trust Bank Ltd, agreed that credit card issuance slowed after the NBR's move as the number of taxpayers is very limited.

To address the issue, he suggested the NBR revise the rule so that housewives and students are exempt from the clause.

However, despite reduced issuance, transactions through credit cards surged by 16.57 percent year-on-year to about Tk 2,865.66 crore in October 2023, according to central bank data.

Officials of the credit card segment at various banks said the hike in credit card transactions was mainly due to increased spending on daily essentials amid ongoing inflationary pressure.

This is because credit cards allow people to pay later for immediate necessities while also offering a host of other benefits, such as an interest-free repayment period of up to 45 days, and cashback facilities.

Rakibul Islam, an undergraduate at a university in Dhaka, said the NBR should relax the rule as many students like him use credit cards to help pay their tuition fees in times of financial crisis.

Additionally, credit cards are essential for students looking to go abroad for higher studies as they can be used to pay admission fees and other expenditures in foreign currency, he added.

The latest data from the Bangladesh Bank shows the total number of credit cardholders stood at 23.37 lakh as of October last year, up 0.92 percent month-on-month.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments