Non-bank loans turning sour hit record

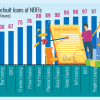

Defaulted loans at non-bank financial institutions (NBFIs) accounted for a record 30 percent of disbursed loans, indicating a fragile situation in the sector due to widespread loan irregularities and scams.

Soured loans at the 35 NBFIs in the country stood at Tk 21,658 crore at the end of September last year, rising by 9 percent from June the same year and 25 percent from a year ago.

The latest amount of bad loans accounted for 29.75 percent of total outstanding loans of NBFIs at the end of September 2023. The ratio was 27.6 percent at the end of June the same year, according to the latest data from the Bangladesh Bank.

The data comes at a time when international agencies and economists have raised concerns over vulnerabilities in Bangladesh's financial sector due to rising distressed assets, including non-performing loans, and a lack of corporate governance.

The country's economy is currently enduring a challenging time because of external pressure and a crisis in the forex market, which is why the NBFI sector, alongside other sectors, is going through a difficult period, said Mominul Islam, former managing director and CEO of IPDC Finance.

Islam, who is also former chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA), told The Daily Star that the central bank has strengthened its monitoring of NBFIs since last year, which helped unearth the actual amount of bad loans.

The banking regulator recently intervened in the board and management of some NBFIs such as Uttara Finance and Phoenix Finance due to loan irregularities and a lack of corporate governance.

However, bad loans jumped after the central bank last year withdrew the deferral facility extended during the Covid-19 pandemic for repaying loans.

Of the total Tk 21,658 crore worth bad loans in the sector, 10 NBFIs accounted for 67.48 percent or Tk 14,616 crore, showed BB data.

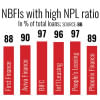

Bad loans of People's Leasing and Financial Services, which faced widespread loan irregularities and scams, stood at Tk 1,097 crore or 99.02 percent of its total disbursed loans.

The non-performing loans (NPLs) of International Leasing and Financial Services, another scam-hit NBFI, stood at Tk 3,917 crore or 95 percent of its outstanding loans.

Loans irregularities of those two NBFIs came to light in 2019 when depositors did not get back their money and then the fragile financial situation of some NBFIs was unearthed.

Till September last year, bad loans of BIFC stood at Tk 743 crore or 97 percent of its disbursed loans; GSP Finance's at Tk 721 crore or 92.37 percent; Fareast Finance's at Tk 879 crore or 94.41 percent and Aviva Finance's Tk 1,903 crore or 72 percent of its total loans, as per BB data.

Mominul Islam said some NBFIs had good financial health and were showing resilience amid the ongoing crisis, including IPDC Finance, whose bad loans stood at Tk 373 crore, which is only 5.39 percent of its total disbursed loans.

Echoing Islam, Md Golam Sarwar Bhuiyan, chairman of the BLFCA, said the ongoing economic situation posed a significant challenge to the NBFI sector.

Bad loans have increased after the withdrawal of the deferral facility introduced by the central bank, said Bhuiyan, also managing director and CEO of Industrial and Infrastructure Development Finance Company (IIDFC).

NPLs of IIDFC stood at Tk 611 crore at the end of September last year, which is 59 percent of its total disbursed loans.

Bhuiyan hoped that those defaulted loans would reduce in the December quarter, the data for which is yet to be released.

He added that most NBFIs were struggling at present to mobilise deposits because of a liquidity shortage in the banking sector.

The provision shortfall of ten NBFIs stood at Tk 2,020 crore till September last year due to high amount of bad loans.

Salehuddin Ahmed, a former Bangladesh Bank governor, recently told The Daily Star that the central bank was largely responsible for the ailing NBFIs.

He opined that the central bank's supervision of NBFIs was not up to the mark, as reflected by frequent reports of scams and loan irregularities in the sector in the last few years, he added.

The former BB governor went on to call for shutting down five to six weak NBFIs and merging another half a dozen.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments