Short on actions

Expectations were high from the Monetary Policy Statement for the second half of FY24.

They were high because we no longer have election as an excuse for delaying actions to reduce inflation, stabilise foreign exchange reserves, relax import controls, and alleviate financial sector vulnerability.

Bold measures were expected. The challenges are meticulously articulated in the MPS, but they fall short on all fronts in terms of measures concrete enough to yield some visible results within the current fiscal year.

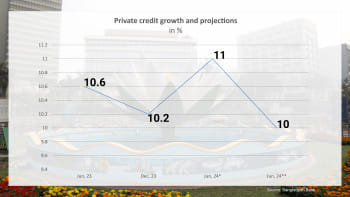

Note that BB has moved from monetary targeting to interest rate targeting since last July.

The policy rate along with the Interest Rate Corridor for the money market rates supported by the Standing Landing Facility (SLF) and the Standing Deposit Facility (SDF) constitute the operating framework for interest rate targeting.

BB has given mixed messages by adjusting the policy rate and the rate corridor.

They have increased the policy (repo) rate from 7.75 percent to 8 percent. This is the reason it has described the monetary policy as contractionary.

However, the contractionary stance is diluted by decreasing the SLF rate from 9.75 percent to 9.5 percent, thus making it cheaper from banks to borrow for SLF. This injects bit of an expansionary element into the policy stance.

The increase in the SDF rate from 5.75 percent to 6.5 percent is academic at a time when there is a liquidity crunch in the banking system.

Very few banks, if any, have excess liquidity. Why would the few, who may have such liquidity, put it into the SDF when the interbank money markets and short term government securities are paying much higher rates?

It is not clear what the BB is trying to achieve by reducing the width of the IRC.

The MPS has left the SMART based lending rate policy untouched.

There is therefore limited room for the increased policy rate to transmit into increases in bank lending rates which is what ultimately matters for having an impact on inflation.

The SMART based lending rate policy was supposedly an arrangement for transitioning to a fully market-based interest rate regime.

It is not clear what BB's plan is in this regard since they have not given any indication of an exit strategy.

The elephant in the room for monetary policy at this juncture is the exchange rate regime.

BB made an explicit commitment in the MPS for the first half of FY24 to switch to a market-based regime by September 2023 following the rate unification in July.

It did not make the switch and the rate unification was partially reversed by allowing the authorized dealers to offer a higher than export dollar rate for remittances.

BB appears to have changed its stance on the exchange rate. It is "contemplating" the implementation of a crawling peg exchange rate whose design is not yet done and the timeline unspecified.

Same goes for NPL resolution. The MPS recognises the problem very clearly and lists the legislative reforms undertaken to address it.

Yet, it is short on announcing a specific set of immediate measures to translate the legislative reforms into regulatory actions.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments