Bancassurance to help insurers break new ground

Bancassurance will open a new horizon for the insurance industry in Bangladesh as the collaborative arrangement will help insurers expand their coverage at low cost, according to industry people.

This is because bancassurance is an agreement under which banks will sell an insurer's products, allowing the latter to enjoy access to the bank's client base and thereby increase its sales.

Besides, the banks benefit by receiving additional income from the sales of the insurance products.

As such, a number of bancassurance agreements have been signed ever since Bangladesh Bank and the Insurance Development Regulatory Authority rolled out the related guidelines in December last year.

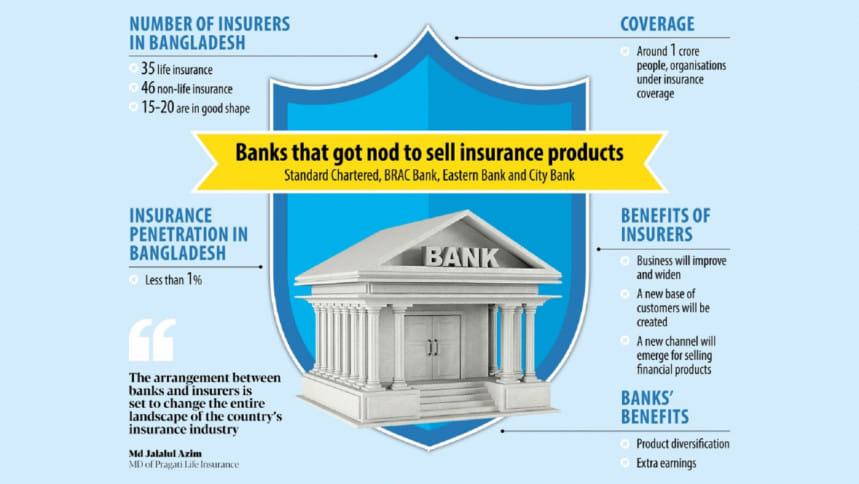

Md Jalalul Azim, managing director and CEO of Pragati Life Insurance, said the arrangement between banks and insurers is set to change the entire landscape of the country's insurance industry.

"It will help insurers reach a new customer base and thereby increase their coverage while also helping develop the overall industry and economy," he added.

While informing that Pragati Life recently signed bancassurance agreements with Mutual Trust Bank (MTB) and Dutch-Bangla Bank, Azim said it is tougher to sell insurance products through the traditional method.

"We have to set up offices with staff and multiple agents, for which we end up spending a lot on commission and other day-to-day expenses," he added.

Against this backdrop, Azim said the costs have decreased since the introduction of bancassurance as they now only need to pay commission to the banks.

Insurance penetration in Bangladesh remains exceedingly low at less than 1 percent as people lack trust in the industry given its poor claim settlement ratio.

However, there is where bancassurance can play a pivotal role as people will be more inclined to purchase insurance products that are backed by their trusted bank, he added.

M Khorshed Anowar, deputy managing director of Eastern Bank, said bancassurance also holds immense potential for the banking industry as they stand to benefit from the largely untapped insurance market.

Anowar explained that given the current economic climate in Bangladesh, local clients have more confidence in banks than insurers.

So, insurers can leverage this trust to increase sales by having banks market products on their behalf while the latter will benefit from sales commission.

While pointing out that Eastern Bank has inked bancassurance agreements with MetLife Bangladesh and Green Delta Life Insurance, he informed that customers can purchase both life and non-life insurance products through the bank's web portal.

Anowar also said that only the insurance providers will be liable for settling claims.

Md Shafquat Hossain, deputy managing director of MTB, said bancassurance is a completely new concept in the country and so, they have launched the service on a limited scale.

"We will collaborate with the insurers and our staff will be trained to assist customers in every way possible when purchasing an insurance product," he added.

Hossain informed that they have introduced an automated system that will deduct insurance premiums directly from the customer's account, thereby reducing the hassle in this regard.

"We have plans to fully digitalise the process and make bancassurance more accessible," he said.

Citing how bancassurance provides customers access to insurance products through banking channels, Hossain said the arrangement will help bring coverage to a wider range of customers.

"This will make insurance more accessible in both rural and urban areas as banks are predominantly viewed as trusted financial institutions," he added.

Other than Pragati, MTB has penned bancassurance deals with Guardian Life Insurance and Pioneer Insurance Company.

"MTB is entering agreements with leading insurance companies and so, customers' investment will be well protected," Hossain said.

"The liability of customers' payment shall be ensured by these reputed insurance companies," he added.

But despite having already signed bancassurance deals, MTB is yet to get approval from Bangladesh Bank or a licence from the Insurance Development and Regulatory Authority to market the products.

Mashfiqur Rahman, senior vice-president of the bancassurance department at Guardian Life Insurance, said the agreement will increase the current status of insurance companies in Bangladesh.

"But it will take time as nothing happens overnight," he added.

Rahman also informed that banks do not want to mislead their customers to mislead as so, they will only do business with insurers when the arrangement is secure.

He explained that banks are selecting their insurance partners based on their reputation in the industry.

Additionally, banks are still developing their knowledge and workforce on bancassurance.

As a part of their efforts, the banks are regularly holding meetings with insurance companies to know the policies and get hands-on experience on how the products are designed.

"Our objective should be to keep customers in confidence or else we will suffer in the long run. In that case, as a business, as an industry, we can no longer survive," Rahman said.

Shamima Nasrin, vice-president of Prime Insurance Company, said banks will be able to strike separate deals with three life insurers and as many non-life insurers under bancassurance.

"Bancassurance will be a discrete wing for banks. So, banks will recruit experts and knowledgeable officials from insurance companies, which will be a big boost for the sector as well," she added.

At present, there are about 81 insurance companies in the country, including 35 life insurers, with around 2 crore people either directly or indirectly involved with the sector.

Md Mesbaul Haque, executive director and spokesperson of Bangladesh Bank, confirmed that four banks have so far gotten approval.

They are Standard Chartered Bank Bangladesh, Eastern Bank, BRAC Bank and City Bank.

Mohammad Shahriar Siddiqui, director of the banking regulation and policy department at Bangladesh Bank, said they are very quick in reviewing applications.

"Every bank knows what to do to get the required permission from us as we have mentioned it all in our bancassurance guideline," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments