Roadmap for banking reforms: Implementation is key

Although the roadmap drawn up to reform the banking industry of Bangladesh may seem attractive on the surface, there are questions regarding its efficacy in ensuring good governance in the scam-hit sector.

The Bangladesh Bank outlined 17 action plans under the roadmap released on February 4.

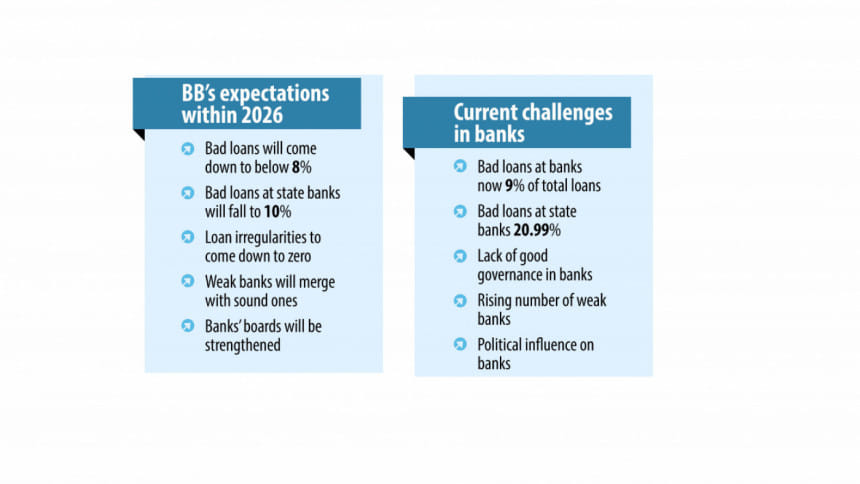

The initiative mainly aims to bring down the ratio of non-performing loans (NPLs) to below 8 percent and ensure good governance in the sector by June 2026.

The overall NPL ratio was 9 percent by the end of last year.

The state-run banks accounted for the bulk of the bad loans as 20.99 percent of their disbursed funds had soured by the end of 2023.

As such, the BB has included measures to reduce the NPL ratio of public banks to less than 10 percent within the deadline.

Although most of the action plans and policy reforms already exist while others were added in the Bank Company (Amendment) Act 2023, the governance in the sector is getting worse.

For example, the roadmap shows that the banking regulator will provide necessary instructions to prevent lenders from exceeding the single-borrower exposure limit.

However, the provision is not new as it has existed in the Bank Company Act for more than a decade. Still, exceeding the single-borrower exposure limit has become a regular practice in the banking industry.

Around 89 borrowers of four state-run banks, namely Sonali Bank, Janata Bank, Agrani Bank and Rupali Bank, had exceeded the limit as of June last year, as per a central bank report.

Under the current single-borrower exposure limit, banks are allowed to disburse loans equal to 25 percent of their total capital to an individual client.

Against this backdrop, economists and financial experts said that implementing the existing policies is more important than introducing new ones.

Salehuddin Ahmed, a former central bank governor, recently said regulatory bodies are failing to adequately punish those who do not follow banking laws.

As per the first policy change included in the roadmap, banks are allowed to write off loans that remain in the "bad and loss" category for two years while it was three years previously.

The central bank expects that NPLs will be reduced by Tk 43,300 crore because of the policy change.

However, the fact is that when banks write off bad loans, the figure is hidden from the balance sheet but the liabilities still remain.

Usually, loans are written off only when they are 100 percent provisioned and there are no realistic prospects of recovery. These loans are transferred to the off-balance sheet records.

And although the practice of writing off loans is accepted worldwide, some analysts call it a "window dressing".

He criticised the policy change, saying it would not help reduce the volume of defaulted loans.

The banking sector's defaulted loans climbed 20.7 percent to Tk 145,633 crore in 2023.

A provision in the roadmap allowing weak banks to merge with financially sound ones was welcomed by experts. They, however, focused on visible actions to this effect.

"The central bank should restructure the board and management of the weak banks and conduct a comprehensive audit before allowing mergers," said Ahsan H Mansur, executive director of the Policy Research Institute.

Under the roadmap, the central bank toughened the rules for appointing both shareholder directors and independent directors by fixing age and educational requirements. The regulator also raised the allowance of independent directors.

Former central bank governor Ahmed said the central bank must have enough strength to tackle political interference and pressure from influential groups to implement the roadmap.

In a press briefing in January, BB Governor Abdur Rouf Talukder said the central bank's activities have never been influenced by outside forces.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments