Padma Bank to turn institutional deposits into preference shares

In a rare move, Padma Bank PLC is going to convert institutional deposits into preference shares and provide them to customers seeking to withdraw funds, exposing how deeper its liquidity crisis is.

Preference shares, also commonly known as preferred stocks, are a special type of security that gives priority to its holders over those with ordinary shares when it comes to payments of any dividend by the company.

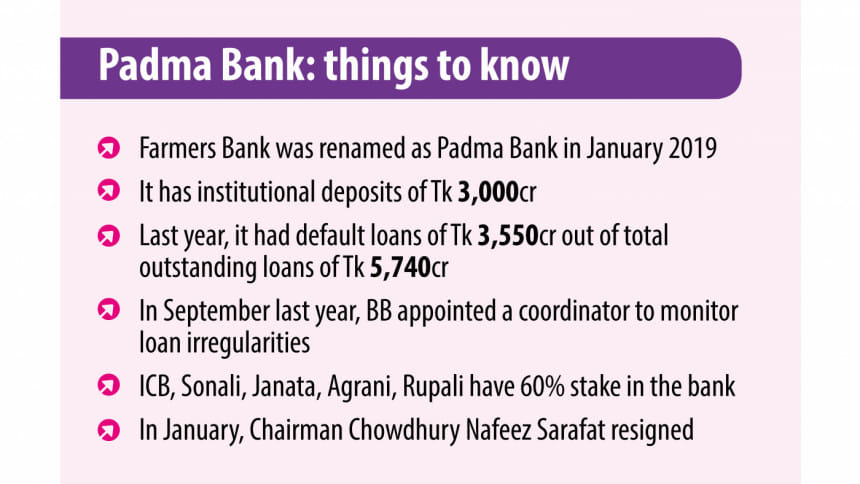

Padma Bank has institutional deposits of around Tk 3,000 crore, including funds of different government institutions and agencies and state-run banks.

The matter was approved by the board of directors of the bank in January.

"We are going to convert the [institutional] deposits into shares as per the instruction of the Bangladesh Bank," Tarek Reaz Khan, managing director and CEO of Padma Bank, told The Daily Star yesterday.

The Department of Off-Site Supervision of the central bank instructed to convert the deposits into shares based on the observations of the BB-appointed coordinator at the bank, he said.

"The conversion from deposits to shares is a long process and we have started working to this end."

Padma Bank, formerly Farmers Bank, turned into a hotbed of financial irregularities in less than three years past its inception in 2013. More than Tk 3,500 crore was siphoned out from the bank, according to the BB.

Allegations of corruption against Muhiuddin Khan Alamgir and Md Mahabubul Haque Chisty, the then board chairman and chairman of the audit committee respectively, became deafening and depositors, which included government agencies, started pulling out money.

The two were forced to resign in November 2017 and the government stepped in to rescue the bank in 2018.

State-owned Investment Corporation of Bangladesh, Sonali Bank, Janata Bank, Agrani Bank and Rupali Bank bought a 60 percent stake in the bank for Tk 715 crore.

In order to give a new beginning, Farmers Bank renamed as Padma Bank in January 2019. But the rebranding did not bring about any positive change. Rather, its financial health is worsening as days pass.

At the end of last year, the bank's outstanding loans amounted to Tk 5,740 crore, of which Tk 3,550 crore were bad loans.

In September last year, Padma Bank became one of the seven banks that saw the appointment of coordinators by the central bank to closely monitor the banks on detecting massive loans irregularities and scams.

Last month, Padma Bank Chairman Chowdhury Nafeez Sarafat resigned citing health issues, six years after taking over the charge of the board. Sonali Bank Managing Director Md Afzal Karim is serving as the acting chairman of the private commercial lender.

Zahid Hussain, a former lead economist of the World Bank, said he had not heard anything like the conversion of deposits into preference shares.

"It also has to be seen whether depositors have given their consent to the conversion. If no such consent is given, it will be a violation of contracts between depositors and banks. This is not consistent with the norms of the banking sector."

The economist also said this may set a bad precedent for the banking sector where banks may misuse funds and later turn the savings into preference shares.

"This will not only weaken the individual bank; it will also deal another blow to the confidence level of the banking sector."

Hussain also questions whether the BB has the authority to allow Padma Bank to turn deposits into preference shares.

An official of the Department of Off-Site Supervision said a bank can convert the deposits into preference shares if depositors want.

A board director of Padma Bank who is also an experienced banker said: "I have not seen anything like this in my life."

"I don't think that the move will bring about any success because depositors may not agree with it. Therefore, the initiative may be abandoned in the next board meeting," he told The Daily Star on the condition of anonymity.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments