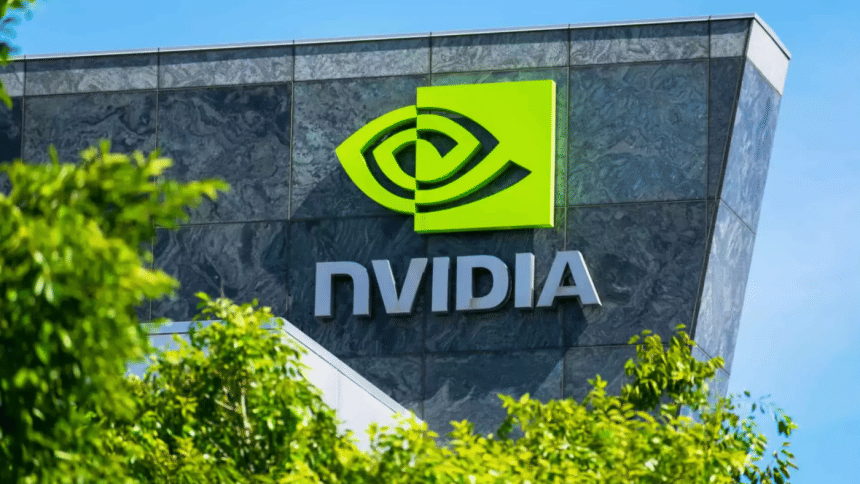

Nvidia dethrones Tesla as Wall Street's most traded stock

Chipmaker Nvidia is replacing Tesla as Wall Street's most traded stock by value, adding to its prominence after becoming the third-most valuable US company and showing more evidence of how central AI-related bets have become to investors.

Nvidia's outsized representation in day-to-day stock trading could leave investors more vulnerable should the chipmaker's revenue growth fail to meet investors' high expectations and puncture a Wall Street rally that has been fueled by euphoria about artificial intelligence.

The Santa Clara, California chipmaker's quarterly report late on Wednesday will be one of Wall Street's most watched events of the week. Some strategists believe anything short of a blowout report could reverse a rally that has sent Nvidia's stock soaring 40 percent in 2024.

Nvidia's stock dropped about 5 percent on Tuesday, reflecting investors' jitters ahead of the report.

About $30 billion worth of Nvidia shares changed hands daily on average over the past 30 sessions, pulling ahead of Elon Musk's electric car maker, which averaged $22 billion per day over the same period.

Tesla since 2020 had dominated daily US stock trading, according to LSEG data, with turnover -- a stock's share price multiplied by the number of shares exchanged -- peaking above $35 billion several times in recent years.

On Tuesday, combined trading in Nvidia and Super Micro Computer , another company benefiting from the boom in AI, accounted for 46 percent of all turnover of the 10 most traded US stocks, including Tesla, Meta Platforms , Apple , Amazon and Microsoft.

"There's an argument here that this is the dawn of a new era of trading, like the dawn of the internet, with Nvidia in the pole position," said Dennis Dick, a trader at Triple D Trading in Ontario, Canada.

But Dick also warned that sky-high turnover in AI-related stocks suggests retail investors and algorithmic traders are driving share prices higher based on momentum rather than fundamentals, such as expectations of future revenue growth.

Super Micro, which sells AI-related server components to Nvidia, has seen its value nearly triple to $43 billion so far in 2024. It fell about 5% on Tuesday following a 20 percent collapse from record highs on Friday after Wells Fargo started covering the stock with an equal weight rating, saying its valuation already discounts "solid upside".

Nvidia controls about 80 percent of the high-end AI chip market, and last week its market capitalization eclipsed, separately, Amazon's and Alphabet's to make it Wall Street's third-most valuable company, behind Microsoft and Apple.

Following Tuesday's selloff in Nvidia shares, Alphabet and Amazon's stock market values both pulled back ahead of the chipmaker. Nvidia's stock market value last stood at $1.7 trillion, compared to $540 billion a year ago.

Meanwhile, Tesla's stock has tumbled 23 percent so far in 2024 as it struggles with tepid demand for its electric cars and growing competition.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments