BRAC Bank issues Tk 700 crore bond targeting small investors

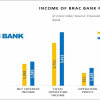

BRAC Bank has launched a subordinated bond worth Tk 700 crore to enhance its Tier II Capital base and it is now available for subscription by investors.

The bond will support the bank's capital adequacy requirements as it has earned significant balance sheet growth in recent years.

Any individual or institution can invest in the bond with a minimum investment threshold of Tk 10 lakh.

This seven-year tenor non-convertible, unsecured, fully redeemable, coupon-bearing, floating rate-based bond has already been approved by the Bangladesh Securities and Exchange Commission and Bangladesh Bank.

The coupon interest rate on the bond has been fixed as "Reference rate (Industry average of highest FDR rates) + 3 percent margin".

The coupon rate will be reset half yearly based on the latest reference rate.

As of December 2023, the coupon rate comes 10.97 percent.

The repayment of the principal amount will start from the third year that will cover 20 percent each year and the subscribers will be entitled to receive their coupon interest half-yearly.

Commenting on the investment scope of the bond, BRAC Bank Managing Director and CEO Selim RF Hussain said the minimum ticket size has been kept low to create investment opportunity for all, particularly for small investors and micro savers.

"We are offering 3 percent higher interest rate on bond than average FDR rate in the industry that will be exciting to the subscribers," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments