Inflation edges up despite monetary tightening. Why?

Bangladesh's inflation trend shows no signs of easing.

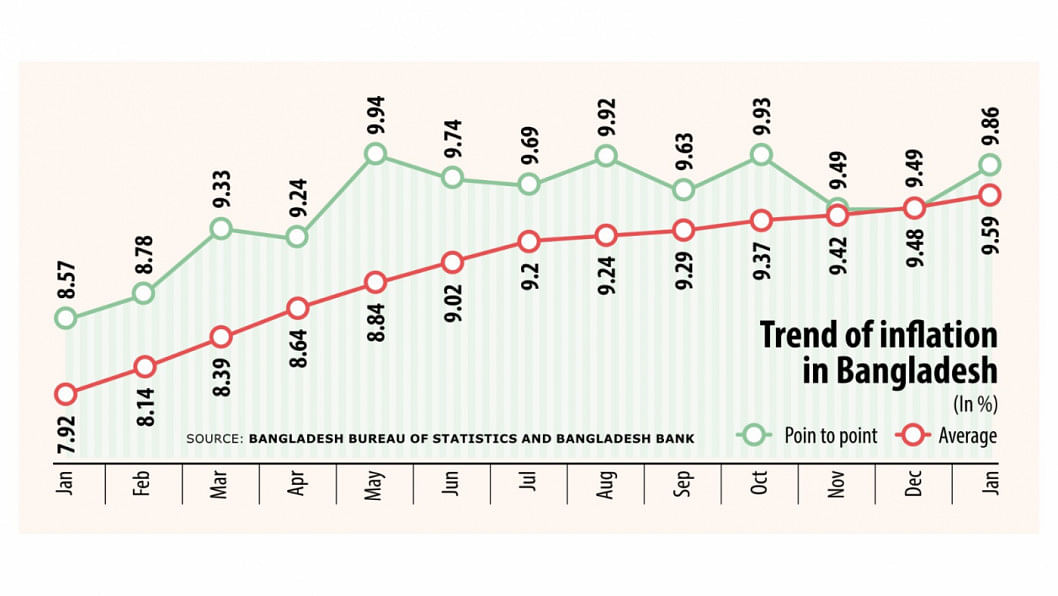

After falling marginally in December, consumer prices rose again in January to 9.86 percent driven by an increased cost of non-food items.

With the spike, annual average inflation crept up to 9.59 percent last month, way above the central bank's revised target of 7.5 percent for the financial year ending in June.

This upward movement already raised questions about the effectiveness of the monetary tightening, which has been taking place for the last several months to contain demand.

Since May 2022, the Bangladesh Bank hiked the policy rate or repo rate, at which it provides funds to banks and financial institutions, for the eighth straight month.

In January, the central bank increased the policy rate by 25 basis points to 8 percent in its efforts to make money costlier and curb excess demand in the economy.

The interest rate on loans rose too as shown by the upward trend in the Six Months Moving Average Rate of Treasury bills (SMART), the benchmark rate for banks to fix lending rates.

SMART advanced to 8.68 percent in January, a new high since the BB introduced it in July last year, moving away from a 9 percent lending rate cap, which was in place for more than three years. The shift aims at making the interest rate gradually market-based.

Globally, except for tensions centring the Red Sea and some hikes in freight for the rerouting of ships, overall prices have been falling.

In its latest World Economic Outlook, the International Monetary Fund (IMF) said global inflation was expected to fall from 8.8 percent in 2022 to 6.6 percent in 2023. It may ease further to 4.3 percent in 2024.

Bangladesh, a net importer, is supposed to benefit from the decline.

However, the data prepared by the Bangladesh Bureau of Statistics, showed that there is no sign of a cooling in prices, leaving further room for policymakers to find the loopholes and plug them in.

"We need to examine the source behind inflation and find out how much of demand is contributing to inflation and how much of it is coming from supply-side problems," said Mustafa K Mujeri, executive director at the Institute for Inclusive Finance and Development.

Also, a former chief economist at the BB, Mujeri said inflation does not decline just after the increase in policy rates.

"However, as the central bank is hiking policy rate and inflation is not reducing, there might be something in the supply side."

"Problems related to supply exist. Here, the interest rate hike will not work alone. Other measures involving commerce and food to ensure smooth supply have to be taken simultaneously. Without that, the effect on prices is unlikely."

He points out prices usually go up ahead of the fasting month of Ramadan as businesses increase prices for no reason.

"Under the circumstances, curbing inflation through the policy rate alone will not be fruitful. Supply-related problems need to be addressed."

Mujeri said piecemeal measures such as slapping fines on traders will not solve the problem as well.

He called for an integrated approach with short and medium-term measures involving related ministries to tackle higher inflation.

MA Taslim, a professor of economics at the Independent University, Bangladesh, said the way monetary policy was arranged, too much effect on inflation is unlikely.

A higher interest rate does not bring about too much impact other than for investments, he added.

In an article recently, Zahid Hussain, a former economist at the World Bank, wrote monetary tightening has not been long enough and tight enough.

Maximum lending rates have been allowed to increase by less than 350 basis points since last July, he said, adding that countries where monetary tightening seems to be working have done much larger tightening for longer.

Policymakers have raised rates by about 400 basis points on average in advanced economies since late 2021, and around 650 basis points in emerging market economies, Tobias Adrian, director of the IMF's monetary and capital markets department, wrote in October.

Besides, Zahid Hussain said, the foreign exchange shortage, exacerbated by policy uncertainty on Bangladesh Bank's stance on future exchange rates, has not eased.

"Consequent increases in parallel market rates have increased the cost of producing and importing goods."

Hussain said export restrictions in various forms in supplying countries, India in particular, often trigger such volatility.

Here, he said, market manipulation, popularly believed to be through "syndicates", may be operative at least some of the time.

"The same goes for opportunistic price gouging in response to export restrictions in supplying countries."

Inflation has been falling faster than expected in most regions of the globe with the unwinding of supply-side bottlenecks and restrictive monetary policy.

"Bangladesh has remained immune to these declines," said Hussain.

In its monetary policy for the second half of 2023-24, released last month, the BB noted the decline in global prices too.

However, it said, Bangladesh's economy has yet to experience an equal adjustment primarily due to domestic price rigidity, market imperfections marked by oligopolistic behaviours in certain commodities, and significant depreciation of the domestic currency, counteracting the potential advantages of reduced global prices.

To stem foreign exchange reserve losses and help restore external balance, the central bank allowed the taka to weaken by close to 20 percent in 2022-23.

The pass-through of a sharp depreciation of the local currency accounted for half of the inflation surge seen in Bangladesh in the last financial year, said the IMF in December.

The BB said the inflexible nature of internal price adjustments, coupled with the persistent depreciation of the domestic currency, might impede a decline in domestic inflation despite recent reductions in international market prices.

It said the inflationary strains and significant price surges observed in various essential goods during FY23 and the first half of FY24 are likely to contribute to sustained inflationary expectations in the second half of FY24.

Elevated land and construction materials prices have driven up asset prices, further exacerbating inflation risk, said the BB.

Fahmida Khatun, executive director at the Centre for Policy Dialogue, said no market works perfectly globally but the extent of imperfections is low in economies where governance is better.

"In Bangladesh's case, market distortion is high. In such cases, single policy measures can't be effective."

She called for harmonisation of monetary policy with fiscal policies and institutional measures.

"Unnecessary public expenditures have to be reduced and tax collections should be enhanced. Also, there is market manipulation by big players that should be tackled with tough measures."

Fahmida said if increased prices were a monetary- or demand-driven phenomenon alone, inflation was supposed to be falling as the BB has been hiking rates for the last several months.

She said the possibility of inflation easing in the coming months is unlikely because the government is expected to increase electricity tariffs further.

According to IMF's Tobias Adrian, central banks must remain determined in bringing inflation back to target because sustained economic growth and financial stability is not possible without price stability.

"If financial stability is threatened, policymakers should promptly use liquidity support facilities and other tools to mitigate acute stress and restore market confidence."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments