IMF team to help NBR assess tax expenditures

A tax policy mission of the International Monetary Fund (IMF) yesterday began to work with the National Board of Revenue (NBR) to train taxmen to assess tax expenditures so that the government can eliminate less effective tax exemptions, broaden the tax base and increase revenue collection.

The development comes following a report of the review mission of the Washington-based lender. The report reviewed Bangladesh's performance against the criteria set as part of a $4.7 billion loan it approved for Bangladesh in January last year.

The IMF suggested the government raise tax revenues and rationalise expenditures as Bangladesh's tax-to-GDP ratio is one of the lowest in the world. The low tax revenue collection has constrained critical spending for longer-term economic development of the country, the IMF said earlier.

It recommended the government take tax revenue measures that yield an additional 0.5 percent of the GDP in FY2024.

As such, the government promised the IMF that it would eliminate less effective tax exemptions and simplify the tax rate structure to broaden the tax base and enhance voluntary taxpayer compliance.

It also sought the IMF's technical assistance in analysing existing tax expenditures.

The NBR earlier shared with the IMF that it would assess tax expenditure such as rebates, discounts, exemptions and reduced rates of taxes for corporate income tax, personal income tax and value added tax (VAT) as part of the budget for fiscal year (FY) 2024-25 and publish those before June 2024.

The NBR also said it would use the analysis to identify measures to rationalise tax expenditures, which will be adopted in the budgets for FY25 and FY26.

As such, the tax administration has formed a team to be trained to estimate tax expenditures such as rebates, discounts, exemptions and reduced rates of taxes for the next two years, including a projection for the next tax year, fiscal 2024-25.

The team, led by an additional tax commissioner, started training at a workshop conducted by an IMF tax policy mission. It will submit reports within April 30, according to a decision by the NBR.

At the same time, IMF training will assist the authorities assess tax and VAT expenditures and identify revenue-raising measures for FY25 and FY26.

In its first review report, the IMF said Bangladesh would publish an initial tax expenditure report covering personal and corporate income taxes and VAT with the FY25 budget and update it in following years in order to increase revenue collection to cover priority spending.

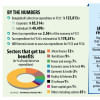

As part of the exercise to assess tax expenditure, the government, while placing the budget for FY24, said the total estimated amount of direct tax expenditure for the FY21 was Tk 125,813 crore.

Of the amount, the amount of tax subsidies given to corporates accounted for Tk 85,314 crore while Tk 40,499 crore was given at the individual level.

Overall, direct tax expenditure was 3.56 percent of total Gross Domestic Product for FY21. The NBR said the total amount of projected direct tax expenditure for FY24 will be Tk 178,241 crore.

"At the workshop with tax officials yesterday, the IMF mission inquired about the ways tax benefits or exemptions were provided to taxpayers, and the sectors that have been given such benefits. They also wanted to know whether we do a cost-benefit analysis before offering tax subsidies," said a senior official of the NBR.

"They also wanted to know why we could not collect more taxes although there is potential," he added.

At the workshop, the NBR presented its short-term and medium-term priorities for increased income tax collection. This includes expansion of the tax base, improvement in taxpayer services and plugging leaks.

The tax administration added that modernisation of tax infrastructure and increased inter-agency cooperation were other priorities.

However, it said the absence of evidence-based strategic action plans and integrated organisation-wide automation were major challenges to accelerating revenue collection alongside the narrow tax base and broad exemptions.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments