Costlier loans hand yet another blow to entrepreneurs

For the past two and a half years, entrepreneurs in Bangladesh have been facing numerous hurdles, beginning from a dollar shortage and a sharp rise in import costs for their escalated rates in global markets and the depreciation of the taka.

Electricity and gas tariffs have been adjusted upwards by the government as it looked to lessen the burden stemming from state subsidies amid lower revenue collections, raising the energy bills for businesses and industries.

The government has increased the prices of electricity in four phases since January last year. This has pushed up the electricity cost for industrial consumers and small and medium enterprises by 21 percent, according to the Centre for Policy Dialogue.

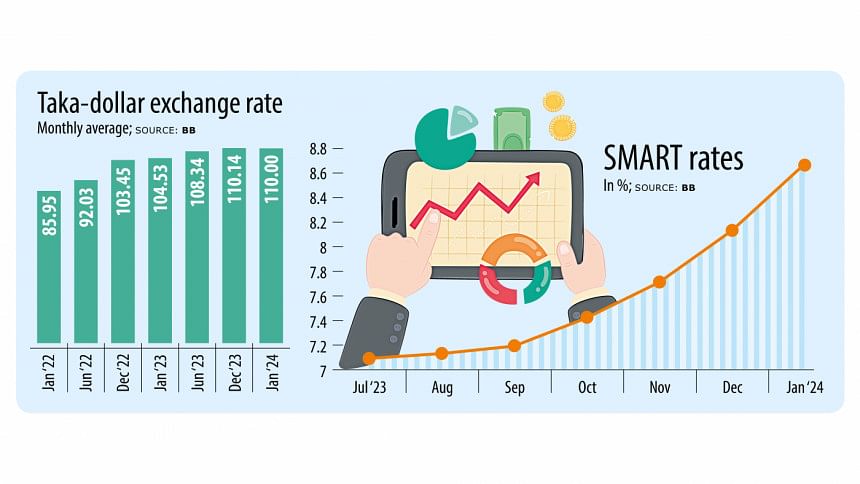

Despite the import contraction intensified by the dollar crunch, the taka lost its value by 5 percent against the US dollar in the one year to January 24. Over the last two years, it was weakened by 28 percent, Bangladesh Bank data showed.

A gradual tightening of the money supply by the central bank is now driving up the interest rate on loans, thereby ballooning the finance cost for businesses.

The weighted average interest rate on advances was 7.24 percent in January 2023. It exceeded 12 percent in January this year as the BB is allowing banks to add a 3.5 percent margin to its Six Months Moving Average Rate of Treasury bills (SMART), the benchmark rate.

In January, SMART was 8.68 percent.

"The repayment of loans has become a major issue," said Mir Nasir Hossain, managing director of Mir Akhter Hossain Ltd, one of the leading construction companies in Bangladesh.

He said businesses factor in all possible costs when they consider a project and go on to undertake the scheme based on indicators such as the return on investment.

"Here, the finance cost is not a small amount."

Businesses become upset when the finance cost surges by 30 percent to 40 percent, added Hossain, also a former president of the Federation of Bangladesh Chambers of Commerce and Industry.

He said businesses have not expected that the cost of dollars would rise substantially.

"The currency depreciation has caused the overall import cost to spiral. The increased bill for gas has added further pressure. However, we have not been able to fully absorb the rise in costs when it comes to adjusting prices."

The entrepreneur thinks the volatility relating to the interest rate also came as a surprise for the business community.

The central bank has maintained an interest rate cap on loans for more than three years before it was scrapped in July last year in order to bolster its fight against record inflation.

In the same month, it introduced SMART to gradually allow market forces to determine the lending rates. Since then, the interest rate has been increasing.

He thinks the higher cost of loans will affect employment generation and the economy.

Anwar-Ul Alam Chowdhury, president of the Bangladesh Chamber of Industries, said electricity and gas bills have risen.

"Against the backdrop, the soaring bank interest will put an additional strain on industries."

Persistently higher inflation since the middle of 2022 has caused a decline in domestic consumption, meaning lower sales for producers.

"Because of the higher expenses and lower sales, domestic industries are facing major challenges and many of them will find it difficult to survive if the current situation lingers," he said.

Chowdhury's Evince Group, which exports garments and has a presence in Bangladesh's retail sector, has seen its monthly gas bills rise to Tk 9 crore from Tk 5 crore.

Wages for workers have gone up by 35 percent.

"In return, what are my sales? What is my markup? Will industries survive If you pass on all the loads to us?"

He feared the amount of default loans would go up because of the spike in costs and the sluggish business environment.

Mohammed Amirul Haque, managing director of Premier Cement Mill PLC, says although industries have borrowed at a 9 percent interest rate, all term-loan borrowers would have to repay loans at the present interest rate.

This means, most of the businessmen who took loans at 9 percent would face a rate of 14 percent to 16 percent rate since the funds were secured at floating rates.

"The higher interest rate will elevate the cost of doing business and businesses will ultimately be forced to pass on the costs to consumers."

In the end, consumers, whose purchasing power has already eroded significantly, will suffer further and investors will not roll out new projects due to the high interest rate.

"You will see the impacts next year," said Md Arifur Rahman, chief executive officer at Assurance Developments Ltd.

Rising interest rates, the high cost of dollars and the higher registration cost have affected realtors, with the overall cost of property builders soaring by 30 percent to 40 percent.

"But we have not been able to raise the prices of flats to that extent," Rahman said.

Banks revise interest rates every three months, so realtors will see an increased repayment cost of loans, Rahman said.

"Since the interest cost is increasing, realtors that have taken up a high number of projects are seeing a buildup of liabilities. They will be in trouble."

However, Ahsan Khan Chowdhury, chairman and CEO of PRAN-RFL Group, one of the leading processed foods and plastic goods makers, said it is true that the current situation has been painful.

"But we will have to accept the play of demand and supply. The sustainable way is to let the demand and supply play its role."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments