Gun in NRBC Bank boardroom

NRB Commercial (NRBC) Bank has often made headlines for alleged money laundering, loan irregularities, over-expenditure and recruitment anomalies. In 2017, Bangladesh Bank had to intervene to dissolve the bank's board and remove its managing director Dewan Mujibur Rahman over a loan scandal involving Tk 700 crore. The then chairman Farasath Ali had to resign from the board. Both Mujibur and Farasath were banned from bank directorship for two years by the BB, and the board was subsequently restructured. The new board is headed by a chairman against whom allegations of irregularities were already rife, and the bank continues to be dogged by anomalies. A six-month investigation by The Daily Star based on hundreds of pages of documents reveals numerous irregularities and even gun toting inside the bank.

The first installment of this four-part series deals with alleged loan scandals and gun toting in the boardroom.

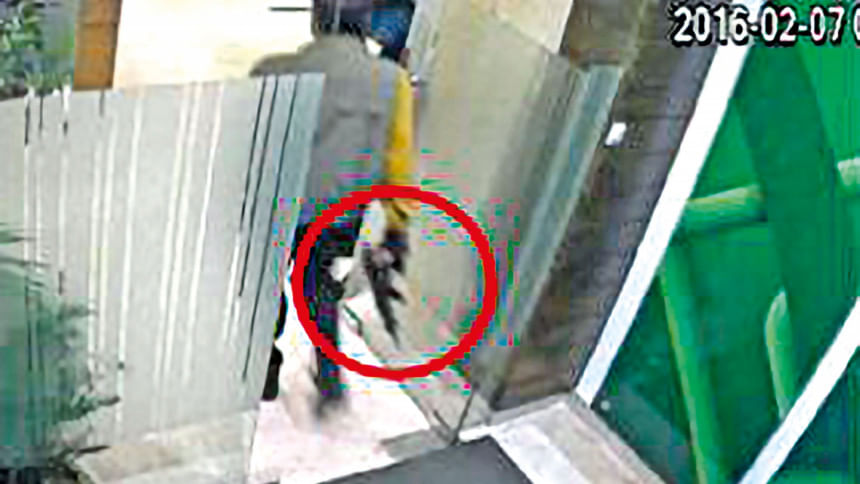

During the 40th board meeting of NRBC Bank on February 7, 2016, current Chairman Tamal Parvez and Director Adnan Imam entered the boardroom accompanied by a man carrying a large gun. Both Tamal and Adnan were board directors back then.

The gunman stayed in the boardroom until another director, Abu Bakr Chowdhury, asked him to leave, meeting minutes show.

Just at the previous board meeting, on December 20, 2015, Tamal, along with alternate director Abu Mohammad Saidur Rahman, allegedly assaulted the then board chairman Farashat Ali, the meeting minutes say.

At that point, the board was conducting an investigation into alleged money laundering from the bank amounting to Tk 64 crore and attempted money laundering worth Tk 165 crore by some of the board members.

The allegations involved three of their directors -- Tamal, Adnan, and Rafiqul Islam Mia Arzoo -- and sponsor shareholder AM Tushar Iqbal Rahman. There were 18 people on the board.

The board was also investigating alternate directors Saidur Rahman and AKM Mostafizur Rahman. Tushar is also Saidur Rahman's son.

Of these individuals, five currently serve on the board.

Over the last six months, The Daily Star has gone through hundreds of pages of the bank's meeting minutes, internal enquiry reports, bank statements and Supreme Court documents that reveal how these six, along with several others, formed an alliance to take fictitious loans in the name of companies tied to themselves or their friends and families, as well as for companies where they have business interests.

All six individuals named here have denied all the allegations, and said they were being framed as part of a conspiracy.

GUN TOTING

Displeased with the bank's investigation into the alleged scams, Tamal and Adnan brought the gun "to terrorise the board officials causing life threat," state the minutes of the 48th board meeting held on December 7, 2016.

"The purpose of violence and [brandishing] illegal heavy arms was to establish supremacy over the board to take and hide disguised/benami loans, disguised/benami contracts and other misdeeds of the accused directors and their associates," the minutes add.

Tamal denied all the allegations against him and defended bringing a gunman, saying the person was his licensed bodyguard.

Within two years of the gun-toting episode, Tamal was unanimously elected chairman of the bank's board on December 10, 2017, and has remained so since. At the same time, the board picked Rafiqul as the vice-chairman and Adnan as new chairman of the executive committee.

As per the 56th board meeting minutes, the findings by the internal enquiry committee against them were "resolved, set aside and cancelled" that year.

According to NRBC's website and Russian corporate registry, Tamal, originally from Barishal, was an expatriate having engagements in IT and real estate business and logistic consultancy in Russia.

Since his selection as the board chairman, Tamal's tenure has been peppered with allegations of disguised loans, illegal profiteering, violations of banking codes, and financial misappropriations, show the documents obtained by The Daily Star.

"The accusations made were false, concocted and distributed with an ulterior motive to defame me personally and to mislead the authorities."

For example, Lanta Services -- the same company that the previous board had investigated for allegedly being used by Tamal to take disguised loans -- was given credits worth crores of taka since he took the bank's helm.

Tamal is one of the founding sponsor directors of the bank established in 2013. In 2016, the bank's sponsor directors' capital was Tk 520 crore.

Of them, Tamal had a share capital worth Tk 20 crore, Tushar Tk 20 crore, Feroz Tk 20 crore, Rafikul Tk 20 crore and Adnan Tk 10 crore, according to meeting minutes.

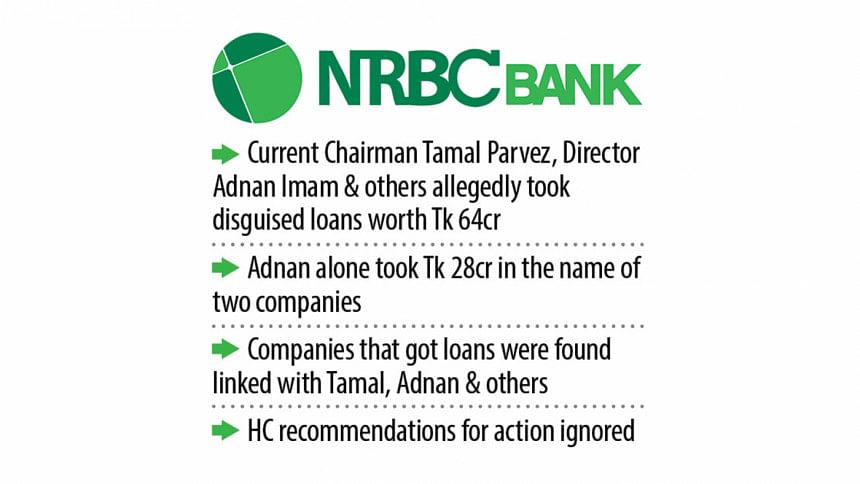

WHO TOOK WHAT?

In February 2016, the bank set up a committee and launched an investigation into a number of allegations, including the alleged money laundering by five directors and several others.

According to the 48th board meeting minutes, Tamal, Adnan, Rafiqul, Tushar, and Firoz took Tk 64 crore in disguised loans in the names of Pubali Construction, NES Trading, an NGO called Voluntary Organisation for Social Development (VOSD), Lanta Services and Ornita Agro. The loans were taken without the disclosure of the directors' affiliations with these companies.

In banking terms, these are called "related party loans", and according to Bangladesh Bank rules, in case of such loans, directors of borrower banks must declare their ties with the borrowing companies.

Of the Tk 64 crore, Adnan alone took two "disguised loans" of Tk 28 crore in the names of NES Trading (Tk 19 crore) and Pubali Construction (Tk 9 crore). He took another Tk 3 crore along with Mostafizur, Tushar and Firoz for a company called Ornita Agro, show the minutes of the 46th and 48th board meeting.

Ornita Agro was owned by Adnan and Mostafizur. After obtaining the Tk 3 crore loan from the NRBC, Ornita transferred an amount of Tk 3 crore to the bank account of IPE Capital in two tranches within two days, according to the bank's own enquiry report.

IPE Capital is Adnan Imam's family business where he is a director, their own stock exchange documents show.

NRBC's website lists Adnan as a UK citizen and a Commercially Important Person (CIP), having various businesses, including in real estate and private equity in London and Dhaka.

NES Trading is also owned by Adnan and his business partner and brother-in-law based in London, the bank's internal enquiry report said.

According to Adnan's own admission before the bank's enquiry committee, the owner of Pubali Construction is his employee, and that the Tk 9 crore loan for Pubali Construction was taken against the land of Adnan's father-in-law.

Tamal is also linked to Pubali Construction. He transferred at least Tk 87 lakh in two tranches to the account of Pubali Construction before the enquiry began, states the enquiry report.

On August 5, 2016, the then governor of Bangladesh Bank Fazle Kabir sent a letter to the then finance minister Abul Maal Abdul Muhith. The letter, obtained by The Daily Star, says that the BB had conducted a covert investigation and found that Adnan took disguised or "benami" loans worth Tk 3 crore using the name of Ornita Agro Industries.

Board members "observed with grave concern" that Rafikul, being the audit committee chairman, failed to prevent Adnan from swindling depositors' money, according to the minutes of 44th and 48th board meetings.

In a clear case of forgery, Adnan also submitted a bill of Tk 1 crore against the actual expenses of Tk 56 lakh for the interior work of the bank's Banani branch through his company, Adrita Trading, the 48th board meeting minutes recorded, citing board members.

VSDO, the NGO which was given Tk 30 crore loan, was founded by Mostafizur, a current director.

Tamal, the current chairman, took a disguised loan of Tk 3 crore in the name of Lanta Services, according to multiple meeting minutes.

The same day that Lanta was sanctioned the credit facility of Tk 3 crore, Tamal transferred Tk 1 crore to Lanta's account from his own, as lien, in the form of FDR.

Bank insiders say Tamal deposited the sum to facilitate the loan disbursement in favour of Lanta Services.

FROM BOARDROOM TO COURTROOM

Tamal, Adnan and Rafikul were removed from the board in April 2016 over these allegations, and the three took it to court.

A High Court bench led by Justice Md Rezaul Hasan reinstated them, but temporarily confiscated their shares and attached those to the bank. The court also said that they be kept out of board meetings that discussed the investigation against them.

The court made the decision to reinstate them only on the grounds that banking laws do not allow the board to relieve them. "However, this does not debar the bank or its board from taking proper action in accordance with the law."

The court ruled, "The petitioners [the accused directors] appear to have managed to slip through the fences [...] by contriving the path of taking disguised or benami loans."

The HC held that the board's enquiry report "shows the nexus of Adnan Imam with the loan of Pubali Construction and NES trading and his interest in these organisations."

It also said that there is prima facie proof of Tamal and Rafikul's link with Lanta, and there is a "seeable link of Tamal Parvez and his interest in Pubali Construction and NES Trading, and thus provide a basis that establishes on the preponderance of evidence that the petitioners had obtained disguised loans from the respondent bank and that they are the actual persons behind the veils of these two entities."

LOVE FOR LANTA

Three years after these findings by the bank's board and the ruling by the High Court, NRBC gave Lanta Services loans worth Tk 14 crore, according to multiple meeting minutes.

At a meeting on February 19, 2019, the board led by Tamal allowed Lanta a composite credit facility of Tk 4.5 crore.

Meeting minutes show there was no discussion about the fact that Tamal was investigated for being related to Lanta, and that the High Court had instructed the bank to take action against him for taking disguised loans.

The loan limit for Lanta was increased by Tk 2 crore to Tk 6.5 crore within two months. On April 18, 2020, the credit line was further scaled up to Tk 9.5 crore. Three meetings later, Lanta got another Tk 50 lakh in a "stimulus loan". In 2021, Lanta's Tk 9.5 crore loan limit was renewed.

The company was also given three car loans worth Tk 4.28 crore in just two years, documents show.

Since Tamal became the board chairman, Lanta Services' subsidiary company Lanta Fortuna Properties bagged the interior design work of the bank on multiple occasions, including a Tk 87 lakh contract in June 2019.

Both companies have the same managing director, Faisal Bin Alam, a bank client.

"He [the gunman] simply escorted me to the boardroom…. I was under threat from the board and I had even sought protection from Rab through a written application."

PILFERING PROVIDENT FUND

These two companies were also used for pilfering money from the provident fund of NRBC bank's junior tellers and assistant tellers, the junior most employees, show their bank statements.

The bank does not hire its contractual recruits itself. Instead, it uses a separate company called NRBC Management.

Founded in 2018, NRBC Management was owned by Tamal, Adnan, Rafikul and Mostafizur, among other people, until June 2022, documents show.

In a 2022 report by Bangladesh Bank's Financial Integrity & Customer Services Department, the central bank pointed out that obtaining third-party services from a company owned by the bank's management is a conflict of interest and a violation of the procurement policy.

Bank statements of NRBC Management's Provident Fund, Lanta Services, and NRBC Management show how the money went from the employees' provident fund to the NRBC Management's account, and then into Lanta Services', apparently using the recruitment company's bank account as a way to hide where the money was actually coming from.

There are many such transactions, but in one example, Tk 1 crore was transferred from the provident fund account to the account of NRBC Management on April 26, 2021. The same day, NRBC Management transferred Tk 60 lakh to Lanta Services.

This Tk 1 crore was returned by NRBC Management to the provident fund account nearly one and a half years later in October 2022.

But nowhere in the dozens of pages of bank statements in possession of this newspaper does it show Lanta returning the Tk 60 lakh it had taken from NRBC Management.

THE DENIAL

Tamal denied this, saying any bank statements in possession of The Daily Star are false or falsified.

In an interview at his Motijheel office, Tamal also defended bringing the gunman inside the boardroom, saying it was his licensed firearm and that the whole thing is being blown out of proportion.

"He [the gunman] simply escorted me to the boardroom…. I was under threat from the board and I had even sought protection from Rab through a written application," Tamal said.

However, during its proceedings, the High Court slammed Tamal for bringing the gunman, and said, "No personal gunman or personal bodyguard should be allowed to enter inside the bank."

Tamal also denied facilitating Lanta Services' loans.

"It is entirely possible that someone I personally know will have an account here. I was not the chairman of the bank when the overdraft facility was given, so I had no hand in who got the loans."

Adnan Imam denied having any business interest in Pubali Construction, Ornita Agro and NES Trading.

"The accusations made were false, concocted and distributed with an ulterior motive to defame me personally and to mislead the authorities," he said.

Both Tamal and Adnan said the HC judgement was based on false documents provided by vested quarters.

"The High Court in its judgement referred to the report prepared by the then chairman and his associates to frame me and other current directors of the bank. The reference in the judgement was neither a finding, nor an observation or obiter dictum, rather it was a direct reference to the so-called Comprehensive Enquiry Report. To put simply, the judge only read the allegations against me from the said false report made by the ex-chairman. It was not the judge's opinion," said Adnan.

But the HC verdict said it agreed with the findings of the NRBC bank's enquiry report because "no patent or latent irregularity or illegality or lack of competence has been found" in the entire proceedings of the probe committee.

When referred to the HC judgement, Tamal said, "The Appellate Division overturned the judgement…. This is a legal matter and whoever is in the chair can supply information according to his preference."

However, the Appellate Division did not overturn the HC Division verdict in full; it simply ruled that a portion of the HC judgement that took away his shares be set aside.

Mostafizur Rahman said that VOSD, the NGO he set up, is a non-profit and that the Tk 30 crore loan was taken in accordance with Bangladesh Bank's regulations.

These are "related party" loans, said Ahsan H Mansur, director of Policy Research Institute of Bangladesh.

"They needed to declare their relationships with the borrowing companies when such loans were sanctioned," the economist said.

Tushar Iqbal did not return our calls and text messages requesting his comment.

Saidur Rahman denied assaulting the former board chairman.

"They were pushing to sanction a loan for a company that did not have the credentials for it. Both Tamal and I demanded accountability on how our premiums were spent, and the chairman adjourned the meeting," he said.

Bangladesh Bank Executive Director and Spokesperson Md Mezbaul Haque said there have been multiple investigations into the NRBC and that actions are taken when required.

"We have not heard of any complaint about the chairman [Tamal] walking in with a gunman. If we had proof, we could have scrutinised the complaint," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments