External debt crosses $100b for first time

Bangladesh's external debt has crossed the $100 billion mark for the first time, indicating a challenging future amid foreign exchange shortage.

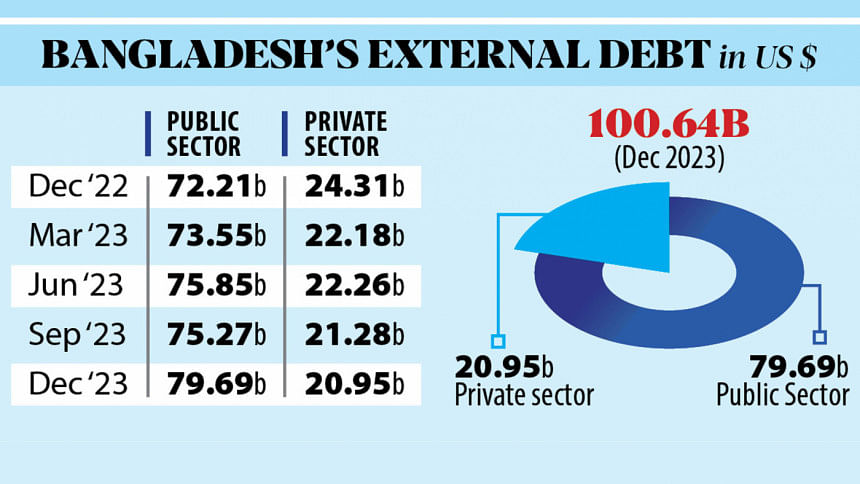

At the end of 2023, the overall external debt stood at $100.6 billion, up from $96.5 billion a year earlier, as per the latest data from the Bangladesh Bank.

Of the external debt, $79.69 billion was taken by the public sector and the rest by the private sector. About 85 percent of the loans are long-term and the rest are short-term.

The debt buildup, which is still within the threshold recommended by the International Monetary Fund (IMF), is becoming a headache for the country given the unfavourable developments on various economic fronts.

"This is concerning that the external debt is increasing," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

To tackle the situation, the supplier credit that is being taken from China and Russia must be stopped now, he said.

Supplier credit is an agreement in a commercial contract under which an exporter will supply goods or services to a foreign buyer on credit terms.

If external debt continues to rise, with it the repayment challenges will mount as the country's earning capacity is slowing, both in terms of revenue and foreign exchange, said Mansur, a former economist of the IMF.

Both external debt and debt servicing are growing, said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

In the first five months of the fiscal year, the government's spending on interest payments for foreign debt surged 136.7 percent year-on-year to $562 million.

"The latest batch of external debt is costly, so we have to be alert that there is no problem in debt servicing," Rahman said.

The returns against the foreign loans are coming in local currency and because of the devaluation of the local currency against the dollar, the cost of foreign debt will increase, he said.

The foreign loans that are piled up in the pipeline for projects will have to be used soon to avoid increasing the servicing costs, he added.

Meanwhile, the private sector's foreign loans have dropped about 14 percent to $20.95 billion.

Previously, the interest rate for foreign loans was 1 percent to 2 percent but it has now jumped to 8 percent to 9 percent, said a top official of the central bank.

"This is the main reason for the declining trend of private sector foreign loans," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments