High bad loans a 'big threat' to financial sector: BB

High amount of non-performing loans (NPLs) is a 'big threat' to the advancement of the country's financial sector, Bangladesh Bank (BB) said in a report today.

The observation came at a time when the banking sector was burdened with a huge amount of bad loans largely because of lending irregularities, presence of wilful defaulters and lax enforcement of rules by the regulator.

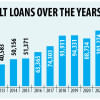

At the end of December 2023, Bangladesh's banking sector had Tk 145,600 crore as NPLs -- 9 percent of the total outstanding loans -- which analysts said is affecting the stability and profitability of banks, eroding confidence of people and blocking the flow of funds that would otherwise be used for economic growth of the country.

The amount of NPLs was Tk 120,650 crore or 8.23 percent of total outstanding loans at the end of December 2022, according to BB data.

The bad loans in banks piled up further in the three quarters to September 2023.

The amount dropped in the fourth quarter of last year although it remained higher year-on-year.

"High NPL requires banks to increase provisioning against the bad loans. This is mainly responsible for capital shortfall in banks," said the BB in quarterly review on money and exchange rate.

Without a reduction in NPLs, there will be no improvement in capital adequacy in the banking system, it said.

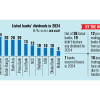

The central bank said state-owned banks have been failing to maintain a minimum capital adequacy ratio—at least 10 percent of their risk weighted assets as a cushion from losses—for the last 10 years.

Specialised banks have been staying undercapitalised, said the BB.

In the report, the central bank also termed Islamic banks' borrowing from Bangladesh Bank under special liquidity support, depreciation of taka, deficit in the country's external account and liquidity shortage as challenges for the banking and financial sector.

The BB report said high inflation discourages savers to perk deposit in banks because of negative real interest rate.

"It is apprehended that overall economic activities will suffer in the long term if these problems are not resolved quickly," said the report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments