Exports top $5b for fourth straight month

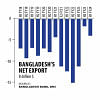

Bangladesh's merchandise exports stayed above $5 billion for the fourth consecutive month in March, giving much-needed breathing space to an economy struggling to keep its head above water amid the persisting foreign exchange crisis.

Exporters shipped goods worth $5.10 billion last month, an increase of 9.88 percent year-on-year, data from the Export Promotion Bureau (EPB) showed yesterday.

Exports stood at $5.30 billion in December, $5.72 billion in January and $5.18 billion in February and the healthy sales overseas came despite challenges on the global and local fronts.

The shipment crossed the $5-billion milestone for the first time in January last year.

The higher exports in the last four months came on the back of the moderate recovery of garment shipment, which accounts for about 85 percent of national exports, despite slowing demand in western economies because of the lingering impacts of the Russia-Ukraine war, the coronavirus pandemic, and the ongoing Middle East conflict.

Overall exports posted a 4.39 percent growth to $43.55 billion in the July-March period of the current financial year.

Garment shipment rose 5.53 percent to $37.20 billion during the nine-month period of 2023-24 compared to a year ago. Of the sum, $21.01 billion came from knitwear sales, which grew 9.79 percent, and $16.19 billion from the woven sector, which was up 0.47 percent.

"The garment export is expected to continue its current momentum in the coming months as international buyers are coming to Bangladesh with plenty of orders," said Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

The demand for clothing items is on the rise because western retailers and brands have run out of old stocks, he said.

"Bangladesh is also increasingly becoming an important source for value-added garment items."

A few factors like the uncertainty centring the general elections and the increase in the production cost following the upward adjustment of the minimum wage for garment workers emerged as major concerns for the biggest foreign currency-earning sector last year.

However, the BGMEA chief says those worries are now over and normalcy has been restored in the business.

Some other issues such as an inadequate supply of gas and power to the industrial sector, however, continue to hurt the industry while the rising bank interest rate is emerging as a new headache.

Hassan called for an end to harassment businesses experience while carrying out customs procedures and simplifying the bonded warehouse facility.

According to the EPB, the shipment of agricultural products like tea and vegetables grew 5.6 percent to $715.84 million in July-March of FY24. Plastic goods exports increased 18.16 percent to $182.8 million.

Cotton waste sales climbed 41.77 percent to $406.45 million, manmade filament export gained 12.98 percent to $246.29 million, and the shipment of specialised textiles rose 16.57 percent to $242.18 million.

Non-leather footwear export was up 7.67 percent to $385.73 million.

However, some potential sectors could not perform well. In July-March, Bangladesh's sales of frozen and live fish in the global markets fell 13.66 percent to $299.2 million.

Similarly, the shipment of leather and leather goods dipped 13.65 percent to $794.19 million and jute and jute goods export edged down 5.6 percent to $659.54 million. Home textile exports plunged 25.98 percent to $636.53 million.

Despite higher shipments in the past several months, it remains to be seen whether the country would be able to accelerate export growth from the less than 5 percent recorded in the first nine months of FY24.

Real merchandise export growth moderated to 8.7 percent in FY23, from 29.4 percent in FY22, driven by a contraction in home textiles, leather products, frozen food, engineering goods, and agricultural products.

Exports are expected to remain moderate as growth in the two largest export destinations—the EU and the US—is projected to be slower than expected, the World Bank said yesterday in a report on Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments