Economy to post subdued growth for at least three years

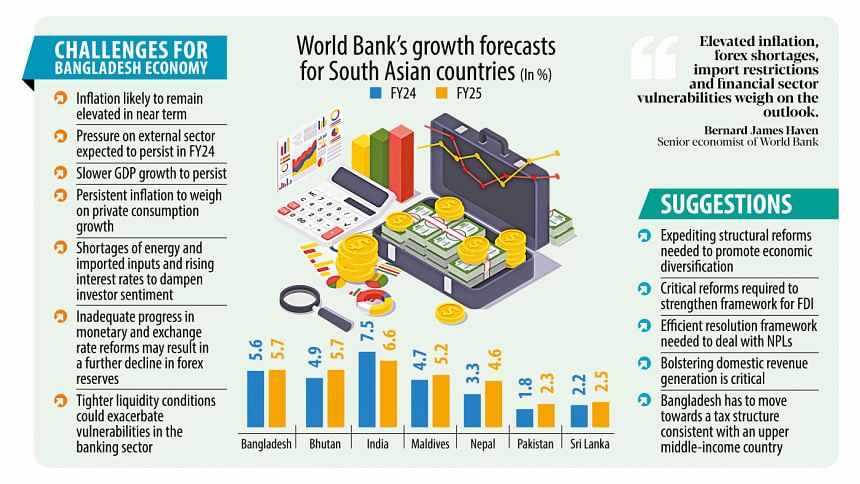

Bangladesh's economy is projected to grow at less than 6 percent for three consecutive years, including the current fiscal year, said the World Bank yesterday, a pace that is slower than the average expansion recorded in the pre-pandemic decade.

The Washington-based lender said the growth of gross domestic production (GDP)—the final value of goods and services produced in an economy for a certain period -- would remain subdued in the short-run with downside risks.

"Elevated inflation, forex shortages, import restrictions and financial sector vulnerabilities weigh on the outlook," said Bernard James Haven, a senior economist of the World Bank, while presenting the key observations on Bangladesh's economy.

"So, the World Bank is forecasting subdued growth. However, with the right policies, the growth can reaccelerate," he said at a press briefing at the WB's Dhaka office yesterday.

The multilateral lender said the economy would grow at 5.6 percent in 2023-24, lower than the South Asian average of 6 percent for 2024. Annual GDP growth averaged 6.6 percent in the decade before the pandemic struck the world in 2020.

Slower growth is projected to persist in 2024-25, it said, forecasting a marginal increase to 5.7 percent, driven by a modest recovery in private consumption supported by a moderation in inflation.

Once again, the forecast for Bangladesh would be lower than its projection of 6.1 percent for South Asia in 2025 though it would grow at the second-highest pace in the region.

India's economy is forecasted to grow at 7.5 percent.

The WB said Bangladesh's economy would improve in 2025-26 and register a 5.9 percent expansion.

Persistent inflation is expected to weigh on private consumption growth, and shortages of energy and imported inputs combined with rising interest rates and financial sector vulnerabilities are expected to dampen investor sentiment.

"Investment recovery will need support from improved implementation of large public investment projects," said the lender, adding that this will be reflected in higher industrial growth, even though services growth is expected to remain subdued.

The growth is forecast to increase gradually over the medium-term as monetary, exchange rate, financial and structural reforms are implemented.

However, there are risks too.

"Even though political uncertainty has diminished with a new cabinet taking oath after the national elections held in January 2024, downside risks to the outlook are significant," the WB said.

"Inadequate progress in monetary and exchange rate reforms may result in a further decline in foreign exchange reserves and persistent inflationary pressure."

Bangladesh's foreign exchange reserves have more than halved to $19.46 billion on March 27 compared to the level seen in August 2021.

The report cautioned that the delay in exchange rate reforms can perpetuate forex shortages and import restrictions.

Headline inflation is expected to remain elevated at 9.6 percent in 2023-24 before moderating to 8.6 percent in the next fiscal year.

"The continued depreciation of the taka and curbs on the imports of consumer and capital goods due to persistent foreign exchange shortages will add to inflationary pressures," the WB said.

The lender cited the contractionary monetary policy initiated by the Bangladesh Bank and said a sustained moderation in inflation and normalisation of imports will take place only gradually as the recent measures introduced by the central bank are expected to impact the real economy with a lag.

The inflation trajectory depends crucially on the extent of the transmission of the BB's contractionary monetary policy and the government's fiscal policy stance, it said.

Fiscal risks include a revenue shortfall, potential financial sector fiscal liabilities, and deficit monetisation, the WB said.

Going forward, the multilateral lender suggested expediting structural reforms to address the complex set of challenges on its path to achieving upper-middle-income country status by 2031.

"As Bangladesh approaches its graduation from the UN's least-developed country classification in 2026, it will encounter the challenge of a gradual loss of preferential market access."

In anticipation of the transition, it said, Bangladesh needs to adopt policies to boost trade competitiveness and broaden its participation in bilateral and multilateral free trade agreements.

The WB recommended reducing the excessive dependence on readymade garments by bolstering the technological and managerial capabilities of domestic firms to enable them to diversify into new areas.

Garment accounted for 84.6 percent of exports in FY23, with a declining share of engineering, agriculture, jute, frozen food, and leather goods in recent years.

"Bolstering domestic revenue generation is critical to finance diverse investment needs in the long term," the WB added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments