Next budget to see marginal hike as austerity measures linger

The government may cut the size of the budget for the ongoing fiscal year while the upcoming one is expected to see a marginal spike as the country's spending capacity has remained under stress.

The austerity stance, driven by the widening gap between incomes and expenses, is set to persist since the government continues to struggle to rein in inflation and reduce pressure on foreign currency reserves.

A meeting of the Fiscal Coordination Council, to be chaired by Finance Minister Abul Hassan Mahmood Ali, will discuss the draft outlays for the revised budget for 2023-24 and the new budget for 2024-25 today.

This will be the first meeting of the council since the new government took office after the January 7 parliamentary elections. Thus, it is the maiden meeting for the new finance minister on the budget and the overall macroeconomic situation.

The meeting will also make key decisions, including setting the new economic growth and inflation targets.

The next budget, which begins its journey on July 1, will focus on controlling elevated consumer prices, expanding social safety net programmes, and reducing subsidy expenditures in various sectors except for agriculture and food, said an official of the finance ministry.

In Bangladesh, inflation has stayed over 9.5 percent in the first eight months of 2023-24 after a 12-year high of 9.02 percent in the previous financial year, meaning many in the low-income nation are finding it difficult to keep their head above the water owing to the dragging cost of living crisis.

The FY24 budget will be slashed mainly for two reasons: revenue receipts have not gone up while the International Monetary Fund (IMF) recommended fiscal and monetary policies tightening under its $4.7 billion loan programme.

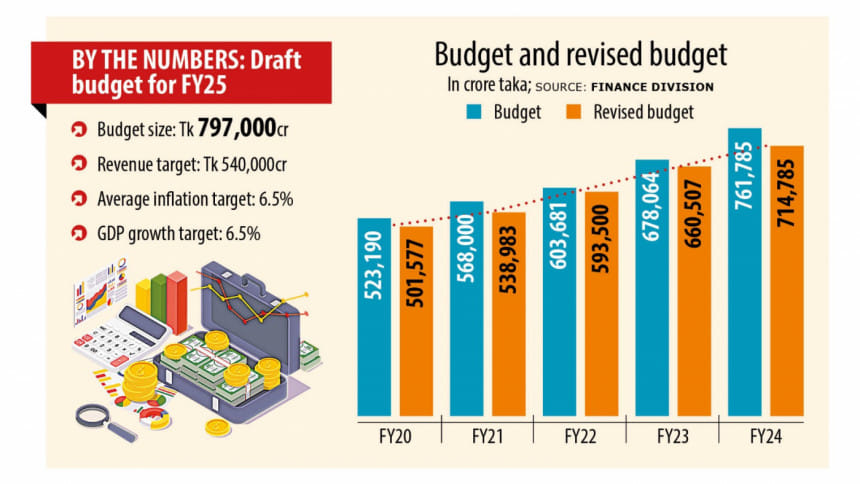

The government may cut the FY24 budget by 6.16 percent, or Tk 47,000 crore, to Tk 7,14,785 crore in the revised budget. The size of the original budget is Tk 7,61,785 crore.

Bangladesh managed to spend Tk 1,94,898 crore in the first six months of the fiscal year, which accounted for 25 percent of the total outlay.

The expenditure was Tk 1,84,525 crore during the same period of FY23, representing 27 percent of the allocation.

Amid slower progress, the government has already cut the annual development programme (ADP) by Tk 18,000 to Tk 2,45,000 crore. Besides, it will reduce the revenue budget by Tk 29,000 crore.

The revised revenue budget might see reduced expenditures, except for interest payments.

At present, the allocation for the interest payments against loans stands at Tk 94,376 crore. It may cross Tk 100,000 crore by the end of FY24 since 53 percent of the original allocation has already been spent because the cost of borrowing has gone up.

The government may reduce subsidies.

Currently, the allocation for the segment is Tk 84,002 crore. Of the sum, Tk 15,934 crore could be used in July-December, which is 19 percent of the allocated fund. On the other hand, the spending stood at 42 percent in the first half of FY23.

The finance ministry official said the subsidy expenditure will increase by the end of FY24 but the amount will not cross the initial target.

He said the next budget will not be much bigger than the outgoing one.

The size of the budget for FY25 could be set at Tk 7,97,000 crore, an increase of only 4.9 percent from the current fiscal year.

Historically, governments raised the size by 12 to 13 percent. The same trend was maintained in FY24 as well.

One of the objectives of the IMF programme is to limit the budget deficit to 5 percent to control higher inflation and ease forex pressure.

While revising the ADP, the government usually doesn't reduce the allocation from its own coffer. However, it cut the budget since the forex pressure shows no sign of diminishing.

The revised budget may trim the tax generation target for the National Board of Revenue by Tk 20,000 crore to Tk 410,000 crore. In the past 11 years, the agency has not been able to attain the collection goal set by the government.

The NBR raises about 87 percent of the revenues generated by the government.

The overall collection target is about Tk 5,00,000 crore in FY24 and it might be increased to Tk 5,40,000 crore in FY25. This means a revenue growth target of 4.5 percent would be fixed in FY25 whereas it is around 16 percent in the current budget.

The government's target is to bring down inflation to 6.5 percent in FY25 against 6 percent in FY24. The goal for the current fiscal year might be missed and the World Bank has already said inflation would stand at 9.6 percent in June.

It will target a gross domestic product (GDP) growth of 6.75 percent in FY25. The economic growth goal is expected to be revised downwards to 6.5 percent from 7.5 percent for FY24 since almost all macroeconomic indicators are under pressure.

In the last fiscal year, the GDP grew at 5.78 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments