Pubali Bank posts highest ever annual profit in 2023

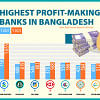

Pubali Bank PLC registered profits of Tk 695.12 crore in 2023, marking the company's highest annual earnings since its inception, thanks to higher interest income and treasury bond proceeds.

Profits of the private commercial bank grew 30 percent year-on-year last year, according to price sensitive information published by the company following its board meeting on Thursday.

As such, the bank reported consolidated earnings per share of Tk 6.76 for 2023 compared to Tk 5.49 for the preceding calendar year, the company said in a press release.

The net asset value per share rose to Tk 46.33 from Tk 41.96.

A top official of Pubali Bank said the interest income and treasury bond proceeds rose for mainly two reasons.

The first is that the central bank lifted the interest rate cap, so the interest income of the whole banking sector went up.

In July last year, the Bangladesh Bank moved away from the 9 percent interest rate ceiling on loans and implemented a market-based rate. Banks had followed the interest rate cap since April 2020 in line with the central bank's instructions.

"Moreover, the yield rate of treasury bonds has been on a rising trend for the past several months. So, it ensured higher income from treasury bonds," the official added.

The bank's board declared a 12.5 percent cash dividend and 12.5 percent stock dividend for 2023 in what was its highest dividend declarations in more than a decade.

Pubali Bank announced a 35 percent stock dividend in 2010. In 2022, the lender provided a 12.5 percent cash dividend.

The bank said the stock dividend has been recommended to strengthen the capital base for supporting future business growth and improving certain regulatory ratios.

It also said the stock dividend was recommended out of accumulated profit.

However, the dividend is not recommended from the capital reserve or revaluation reserve or any unrealised gain or out of profit earned prior to incorporation of the bank or through reducing paid-up capital or through doing anything so that the post dividend retained earnings become negative or a debit balance, it added.

The bank will hold an annual general meeting on June 5 to approve the dividend and audited financial statements and set the record date for May 12.

Pubali Bank stocks fell 3.10 percent to end the day at Tk 28.1 on Thursday.

Established as Eastern Mercantile Bank Ltd in 1959 in then East Pakistan, it was renamed Pubali Bank after the independence of Bangladesh.

Currently, Pubali Bank is one of the largest private commercial banks in Bangladesh, having 504 branches, 193 sub-branches, and 21 Islamic branches. Besides, it has the largest real-time centralised online banking network with 501 online branches.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments