IMF suggests greater flexibility in exchange rate to ease pressure on external account

Bangladesh should allow greater flexibility in its exchange rate to address issues in its external account, particularly the deficit in the financial account, said the International Monetary Fund (IMF) today.

"Once you implement this, you will see a greater sense of stability returning to the external account," said Krishna Srinivasan, the director of the Asia and Pacific department of the IMF, during a virtual briefing from Singapore.

He made the remarks in response to a question at the briefing on the regional economic outlook for Asia and the Pacific.

This suggestion from the Washington-based lender comes as the Bangladesh Bank has yet to allow market forces to fully determine the exchange rate, with two banking bodies periodically announcing the rates.

During the July-March period of the current fiscal year 2023-24, the current account balance, a major component of the Balance of Payment (BoP), was in surplus by $4.7 billion.

In contrast, the financial account, another key part of the BoP that includes foreign direct investments and short, medium, and long-term loans, suffered from an $8.3 billion deficit. This is nearly four times the deficit from the same period a year ago as shown by the Bangladesh Bank.

Srinivasan said that with reforms in the exchange rate and improvements in fiscal policy, Bangladesh should see a more sustained recovery from the crisis that every country in the region has faced due to multiple shocks.

He said that Bangladesh proactively approached the IMF for support for its home-grown programmmes, which have two components: addressing macroeconomic stability and tackling long-term structural issues related to climate change.

He said that there has been significant improvement in macro performance, with growth reaching 5.7 percent in 2024.

"There have been improvements in the monetary policy framework and fiscal performance. I think where Bangladesh was struggling was with the current account, which was just balanced, partly because there was restraint on imports."

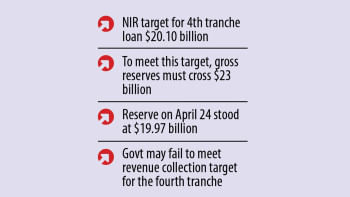

"The financial account was not performing very well. So, in some sense, you could see the depletion in the foreign exchange reserve, and the taka was coming under pressure."

"It is important that the next stage of the reform agenda is to allow greater flexibility in the exchange rate, which would help address the problem in external account."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments