Export falls to a six-month low

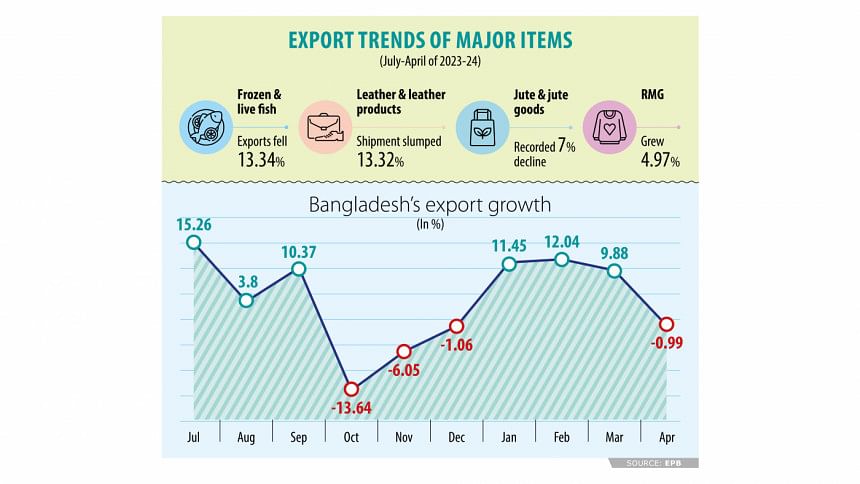

Bangladesh's exports dipped in April, the first decline in four months, because of slowing shipments of garments and some other major products, dealing a blow to an economy looking to recover from the lingering crisis.

The country shipped products worth $3.91 billion last month, down 0.99 percent from $3.95 billion a year ago, according to data released yesterday by the Export Promotion Bureau (EPB).

April's receipts were also the lowest in six months. However, shipments rose 3.93 percent year-on-year to $47.47 billion in July-April of the current financial year.

The slowdown in exports, the biggest source of foreign currencies for Bangladesh, came at a time when the economy is desperately trying to make a turnaround from the dragging dollar crisis and the widening deficit in the financial account, a key component of the balance of payments, which show the country's transactions with the rest of the world.

The exports of readymade garments, which account for about 85 percent of the total receipts, grew 4.97 percent year-on-year to $40.49 billion in the first 10 months of 2023-24 thanks to buoyancy in knitwear demand.

Knitwear sales rose 9.11 percent to $22.87 billion while woven garment exports remained almost flat growing at only 0.03 percent to $17.61 billion.

Shams Mahmud, managing director of Shasha Denims Ltd, a major garment exporter, blamed the chronic gas shortage for the lower exports.

"We are not getting an adequate supply of gas. Therefore, we are accepting reduced orders in order to maintain the lead time for shipment."

Owing to lower generation of gas locally, industries have long complained of inadequate energy supply. The supply situation has not improved owing to the government's limited capacity because of the fast-depletion of foreign currency reserves.

Mahmud, also the managing director of export-oriented Shasha Textiles, GA Garments, and Shasha Spinning, blamed the decline in global demand for apparel as well.

"The exports of garments by other countries have declined, not just in Bangladesh."

He said manufacturers face delays in releasing goods at ports. "This has increased the lead time."

Importing countries are also showing interest in nearshoring, said Mahmud, also a former president of the Dhaka Chamber of Commerce and Industry.

Nearshoring refers to outsourcing of business processes to an external company based in a nearby country or location. Since labour costs rising in many countries, companies are turning to nearshoring as an option to reduce high overheads, according to German logistics company DHL.

The exports of other key sectors -- leather and leather products, jute and jute goods, home textiles, frozen and live fish -- registered a fall, EPB data showed.

The shipment of leather and leather products, the second-largest exporter after RMG, dipped 13.3 percent year-on-year to $872 million in July-April of 2023-24.

Leather footwear, the prime export item in the segment, plunged 26 percent to $430 million.

Arifur Rahman Chowdhury, general manager of ABC Footwear Industries Ltd, said the sector does not enjoy the full benefit of importing raw materials at zero duty under the bonded warehouse facility though it has immense potential in the global market.

He alleged that footwear exporters face hassles while importing raw materials. "Customs offices are not cooperating with us," he said, adding that banks are not extending the support the sector requires.

For jute goods exporters, the problem has become double-edged.

The prices of raw jute have risen while the prices of yarn, the main export earner in the segment, have fallen in the global market, said Helal Ahmed, chief operating officer of Janata Jute Mills and Sadat Jute Industries Ltd, a top jute yarn and jute goods exporter.

This is due to a lukewarm demand for carpets, in which jute yarns are used, in the US, he said.

The economy of Turkey, the main importer of jute yarn from Bangladesh, is not doing well while the cost of borrowing has surged at home, he added.

A gradual tightening of the money supply by the central bank is now driving up the interest rate on loans, thereby ballooning the finance cost for businesses. For example, the weighted average interest rate on advances was 7.24 percent in January last year. It exceeded 13 percent in March this year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments