BB likely to discard SMART formula as interest rate surges

The Bangladesh Bank plans to ditch the SMART formula used currently to fix the interest rate on loans, in line with the prescription of the International Monetary Fund (IMF) that has proposed a market-based rate-setting system.

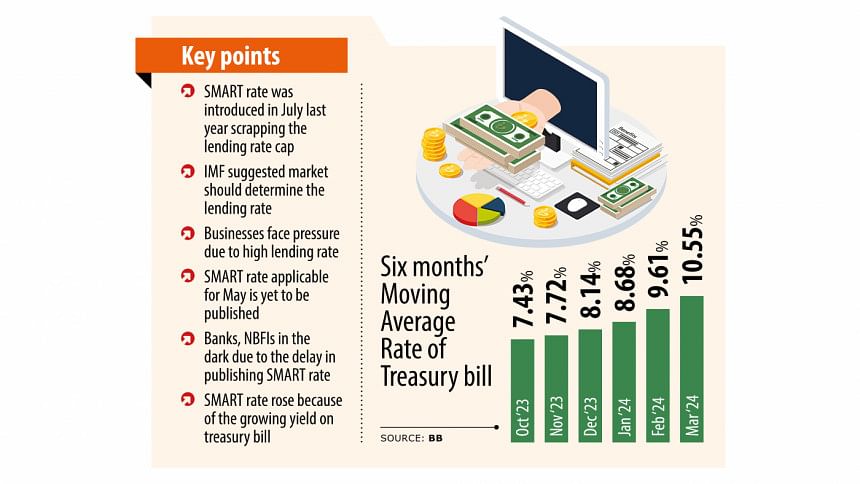

In July last year, the central bank withdrew the 9 percent lending rate cap and introduced the Six-months Moving Average Rate of Treasury bills (SMART).

Since then, the banking regulator has published the benchmark rate on the last working day of the month. This, however, did not happen on the last working day of April. As a result, banks and non-bank financial institutions (NBFIs) are in the dark and they might have to use the current reference rate to price loans.

The likely suspension of the rate-setting formula comes at a time when a mission of the IMF is in Dhaka to discuss the progress of the $4.7 billion loan programme. It has already met with the different stakeholders, including the BB.

The outcome of the mission will see whether Bangladesh will get the third tranche of the credit.

The SMART formula has been put in place since higher consumer prices showed no sign of cooling despite the unprecedented spike in the policy rate. This largely happened because of the cheaper funds owing to the interest rate ceiling and market mismanagement.

Even after the benchmark rate was rolled out and the lending ceiling was scrapped, inflation has stayed at an elevated level for nearly two years.

Local experts and the IMF think an interest rate cap still exists owing to the SMART, said a senior official of the central bank.

The observation has been made because banks are allowed to add as high as 3.75 percentage points to the SMART rate as the margin for lending. Similarly, the central bank has control over fixing the SMART rate.

According to experts, the interest rates of both Treasury bills and bonds are controlled by the central bank.

The BB frequently purchases the securities by bidding at a lower rate compared to commercial banks. However, private banks, other financial institutions, institutional investors and even individual investors are buying government bills and bonds because of higher yields, sending the sales of the tools higher.

Currently, the yield of the 91-day bills stands at 11.35 percent, the 182-day bills at 11.40 percent and the 364-day bills at 11.60 percent. This was up from 6.95 percent, 7.25 percent, and 8.30 percent respectively in June last year.

After the SMART was launched, the World Bank also said the introduction of a benchmark lending rate or reference rate for commercial banks could provide a transition path from rate caps toward market-determined rates.

The BB official said the IMF suggested the BB let the market determine the lending rate since the SMART was not a market-based interest rate.

On the other hand, there is fear among the business community that the rising interest rate could negatively impact the economy and businesses, he added.

Since the rollout of the benchmark rate, loans indeed have become costlier.

The SMART rate for March stood at 10.55 percent. Since banks can add 3.75 percent as margin, the highest lending rate stood at 14.3 percent in April. The SMART rate was at 7.13 percent.

Against the backdrop, the banking regulator has decided to phase out the SMART formula, several central bankers said.

A chief executive of a private commercial bank said there is a discussion on whether the BB will leave the lending rate to the market as there is pressure from the business community against for the formula.

Mustafa K Mujeri, a former chief economist of the BB, said that the central bank should find a way to allow the market to set the interest rate in order to give a long-term solution.

Sadiq Ahmed, vice-chairman of the Policy Research Institute of Bangladesh, thinks the lending rate will have to be flexible and the SMART rate should not be allowed to go up further.

"The market still is liquid. Therefore, it will take time to bring down inflation to the desired level."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments