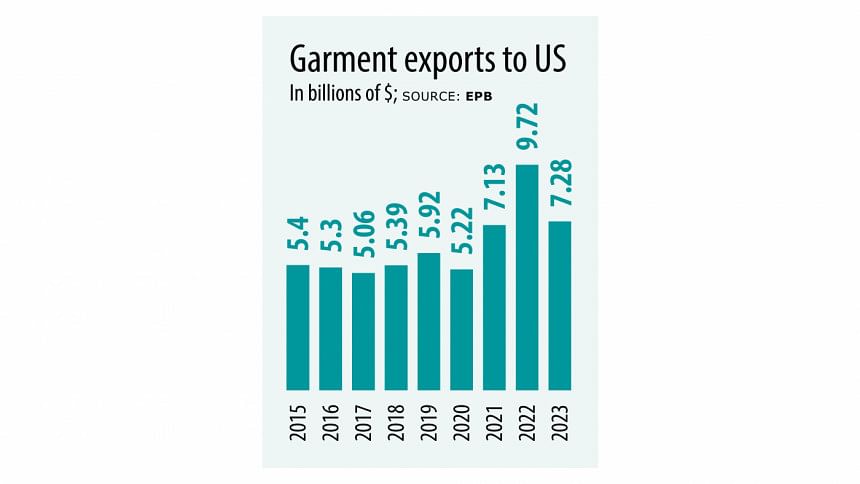

Garment exports to US continue to decline

Garment exports to the US, Bangladesh's single largest export destination, continued to decline over the past few months as American retailers and brands cut back on imports of apparel from all over the world.

In the January-March period of the current year, garment shipments to American markets declined by 17.68 percent to $1.75 billion, according to data from the Office of Textiles and Apparel (OTEXA), a body under the American Commerce Department.

In the January-February period, garment exports to the US declined by 19.24 percent to $1.18 billion, according to the data.

The collective shipment of textiles and garments slipped 17.37 percent to $1.81 billion in the January-March period of the current year, the data also showed.

Garment exports to the US have been declining over the past several months as American retailers and brands are importing less garments despite a gradual improvement in inflationary pressure to adjust with higher exports of garments in previous years.

For instance, garment exports from Bangladesh to the US rose more than 53 percent after the Covid-19 pandemic as retailers and brands imported more to meet pent-up demand in 2022.

But garment exports did not increase at same pace last year as American retailers and brands had plenty of old stock of unsold clothing items.

Retail sales began to revive in November last year during the beginning of the festive season while sales peaked in December last year during Christmas. The demand for apparel has been slowly reviving since then, with exports gradually approaching positive territory.

Moreover, many garment factories in Bangladesh have faced long closures due to the wage hike movement, which stretched from September to December last year. Production at many factories was disrupted severely as workers agitated, demanding a wage hike.

AK Azad, managing director of Ha-Meem Group, which exports 95 percent of its garment products to the US, said the demand for the apparel among low-end consumers in the US did not fully recover.

This especially affected Bangladesh because the country mainly exports low-end garment items to the US, Azad added.

Moreover, the interest rate in US banks is still high, which means consumers are busy making interest payments against loans, such as ones taken to purchase houses, he added.

Furthermore, the gas and power crisis in the garment industry has been severely affecting lead times.

As a result, manufacturers cannot ship goods as per commitments to buyers, said Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA).

The lack of a deep-sea port in the country has also been affecting lead times, Hatem added.

The National Retail Federation (NRF), the largest retailers' platform in the US, said retail sales grew at a steady pace in March.

"As inflation for goods levels off, March's data demonstrates steady spending by value-focused consumers who continue to benefit from a strong labour market and real wage gains," said NRF President and CEO Matthew Shay.

"In this highly competitive market, retailers are having to keep prices as low as possible to meet the demand of consumers looking to stretch their family budgets," Matthew added.

Total retail sales, excluding automobiles and gasoline, were up 0.36 percent seasonally adjusted month-on-month and up 2.72 percent unadjusted year-on-year in March, according to Retail Monitor.

That compared with increases of 0.4 percent month-on-month and 2.7 percent year-on-year in February, based on the first 28 days in February.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments